Key Notes

- Bitcoin trades at $113,227 on Saturday, August 2, down 5.78% amid a 5-day losing streak.

- Eric Trump urges traders to “₿uy the dips!” following a similar February call during market volatility.

- The 20-day moving average at $117,000 acts as key resistance for Bitcoin price rebound attempts to gain traction.

As market digests Eric Trump’s bullish “buy the dip” signal, can BTC price stage a rebound above the 20-day moving average at $117,000? The dip comes at a time when political and financial voices have re-entered the crypto discourse. Eric Trump, Executive Vice President of the Trump Organization, posted a renewed bullish call on Saturday, urging traders to “buy the dips!!!”, a sentiment he previously echoed on February 25 amid similar market anxiety.

At that time, Ethereum dropped to $1,400 following his post but rebounded sharply to over $3,900, coinciding with improving macro conditions and renewed institutional demand. Bitcoin price mirrored that trajectory, rallying to $122,838 in mid-July.

Notably, World Liberty Financial, a Trump-affiliated DeFi project, reportedly acquired 77,226 ETH at an average of $3,294, according to Lookonchain data from July 29.

More so, Eric Trump recently joined Bitcoin investor Metaplanet’s Board of Advisors in March 2025. The Japanese firm has now committed to a $3.7 billion Bitcoin investment through preferred shares, targeting 210000 BTC holdings by 2027, according to crypto exchange, Bitget’s latest report.

As BTC price struggles to defend the $113,000 support at press time, it remains to be seen if US President’s son, Eric Trump’s recent positive comments provide the timely market sentiment boost needed to avert further losses as tariff tensions swirl.

BTC Price Forecast: Will Bitcoin Reclaim $117K or Slide Toward $110K?

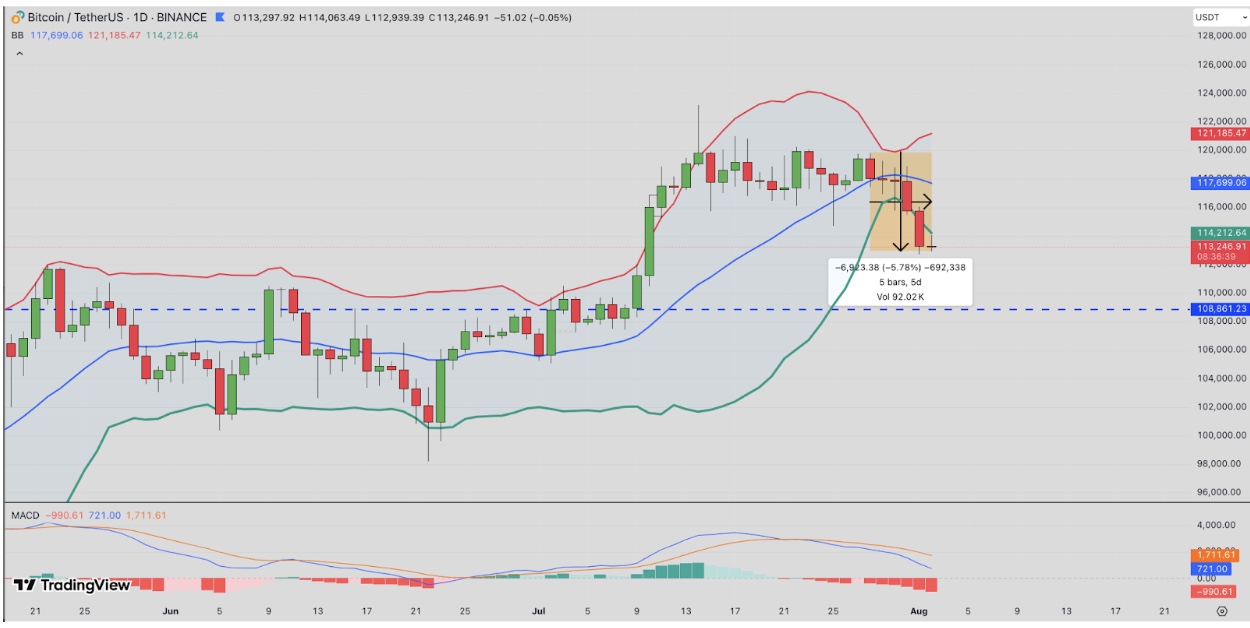

Technically, the outlook remains mixed. The recent 5-day decline has brought Bitcoin closer to the lower Bollinger Band near $112,000, signaling potential oversold conditions that could attract dip buyers. Volume on the pullback remains moderate, suggesting absence of high intensity panic-driven sell-offs.

A key resistance level to monitor is the 20-day moving average at $117,000, which also aligns with the Bollinger Band’s midline. Bitcoin price held on firmly around the support level for more than a week after a parabolic rally in early last month halted at the $122,838 all time high on July 14.

A breakout above $117,700 could reignite bullish sentiment and confirm that BTC has formed a short-term bottom at $113,000.

However, the MACD paints a more cautionary picture. With the MACD line at –991.82 and still below the signal line, momentum remains bearish. This suggests bulls will need a clear catalyst, possibly a significant recovery in market volumes to flip the short-term trend.

Bitcoin Price Forecast | Source: TradingView

On the downside, if the $113,000 BTC price support breaks, the next downside target lies near $108,861, a horizontal support level from early July. A breach below this would likely invite panic selling, potentially forcing a drawdown toward the $105,000 range.

Eric Trump’s bullish commentary could offer short-term psychological support, especially if echoed by large players or aligned with positive policy news. But such a bullish projection must align with significant increase in market volumes for a confirmation.

In the near term, if BTC price reclaiming of the $117,000 level would be the clearest signal that bulls are back in control. Until then, Bitcoin price remains at a crossroads, with $113,000 acting as the last line of defense against a deeper correction phase.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.