As the holidays approach, we’re taking a look ahead to 2026 and a look at how the housing market is faring right now.

First, the Realtor.com® November Housing Trends Report showed that buyers gained some ground as home prices flattened and active listings and new listings both continued to grow. The housing market is moving more slowly than at the same time last year, and buyers are likely to find more price cuts on for-sale homes.

Weekly trends in housing data have been similar to these monthly readings. One difference is in the trend for newly listed homes, which has been a bit more sluggish in recent weeks. This gauge of seller enthusiasm is one I will keep my eye on.

As buyers gain ground, our November Hottest Markets Report shows familiar Northeast and Midwest areas with the most competitive real estate conditions. But among the 40 largest markets, we see a departure: San Francisco emerged as a top mover, indicating a more seller-friendly shift in this market.

The mortgage rate lock-in effect continues to shape homeowner decisions about selling and buying. Our new report shows just how much. Nationwide, the typical current homeowner would see a nearly $1,000 increase or a 73% surge in costs to buy a typical home at today’s mortgage rate.

This week’s mortgage rate rose 3 basis points from last week, but at just less than 6.25%, it remains on the lower end of its 2025 range. You may recall that the typical 30-year fixed rate started the year at roughly 7% and didn’t fall below 6.5% until September, so this improvement is still relatively recent.

At the December Fed meeting, we saw another Fed rate cut. The Fed’s policy rate is now within the range of some estimates of the neutral rate. As a result, some participants may want to see stronger evidence of a slowing economy before supporting further rate cuts, as seen in an uptick in the number of voters who preferred not to cut the rate.

When monetary policy is in a transition phase and the Fed’s two policy goals (full employment and price stability) are in tension, it’s not surprising to see different perspectives on appropriate policy, as we see now. Looking ahead, I expect we’ll see just a couple of Fed rate cuts, spaced out over several months in 2026.

It’s worth remembering that the Fed does not set mortgage rates. What’s ahead for mortgage rates? Our 2026 Housing Forecast anticipates that they’ll continue to hover around their current 6.25% range, down from the 2025 annual average. I discussed this and the Realtor.com outlook alongside chief economists of the National Association of Realtors® and the National Association of Home Builders at the annual NAR Forecast Summit. Watch the video replay for a great overview of the key real estate trends to watch.

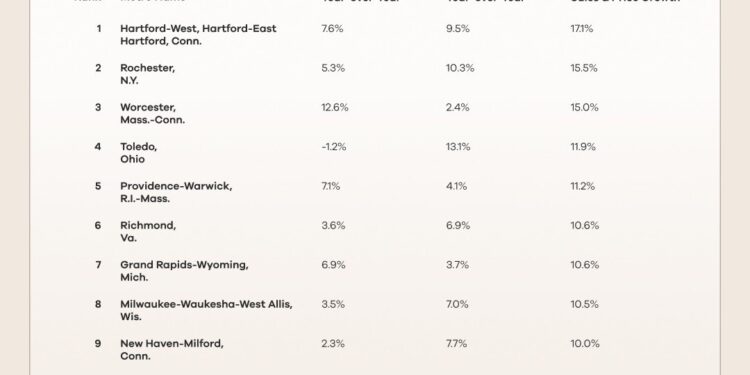

Finally, our 2026 housing predictions enable us to identify the metro areas that are poised to see the greatest growth in home transaction activity, driven by a combination of home sales and home price growth.

Our Top Markets for 2026 are overwhelmingly located in the Northeast and Midwest, where relative affordability gives buyers a refuge from higher housing costs, but limited new construction hampers supply and drives prices higher. Buyers in these markets are older and well-qualified, helping them to better navigate a steadying housing market.