Federal Housing Finance Agency Director Bill Pulte appears to be backing away from the idea of improving housing affordability with 50-year mortgages, after the idea faced conservative backlash.

“We have other priorities,” Pulte told reporters on Friday when asked if the White House is still pursuing his 50-year mortgage plan.

Instead, Pulte touted President Donald Trump‘s new proposal to ban institutional ownership of single-family homes, and said the president is reviewing a wide range of solutions to the housing crisis.

“We are looking at everything. We presented the president with anywhere between 30 to 50 different options” to improve affordability, Pulte told CNBC. “It will be up to the president to decide which, if any, of those he wants to do.”

Pulte was the mastermind of the disastrous 50-year mortgage proposal, which, according to Politico, he presented to Trump during an impromptu meeting at Trump’s Palm Beach Golf Club in November.

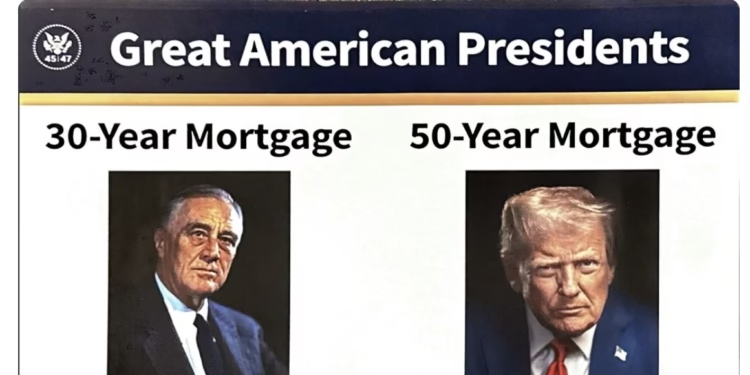

Moments after Pulte presented the plan on a large posterboard comparing Trump to President Franklin D. Roosevelt, Trump posted an image of Pulte’s placard on Truth Social, sparking furious backlash that reportedly blindsided top aides.

While a 50-year term might lower monthly mortgage payments slightly, lifetime interest payments on the typical home would nearly double. As well, the extreme length of the loan seemed to deliver a visceral shock even to conservatives who staunchly support Trump.

“This just means your house will be owned by the bank until you die, and after. We don’t need 50-year mortgages,” conservative commentator Matt Walsh said at the time.

Housing economists were also skeptical of the plan, pointing out that homeowners would build equity at a painfully slow pace, with the majority of each payment going toward interest for the first 37 years.

Following Pulte’s latest comments, Realtor.com® senior economist Joel Berner says the White House’s pivot away from 50-year mortgages is no great loss to homebuyers, calling the saga a “nothingburger.”

“It was a bad idea, and it went away. Nobody wanted to build equity that slowly and pay so much interest to the bank,” says Berner. “Renting continues to get more affordable, so people don’t have to feel so desperate as to jump into a bad deal.”

Meanwhile, Trump has signaled that housing affordability will be a major domestic focus for his administration in 2026, saying that he plans to announce a slate of new initiatives next week.

In recent days, Trump has said he wants to ban large investors from buying single-family homes and announced plans for Fannie Mae and Freddie Mac to backstop mortgage rates by purchasing $200 billion in mortgage bonds.

The administration is also considering the idea of “portable mortgages,” which would allow homeowners to take their old mortgage rate with them when they move, according to Pulte, who oversees Fannie and Freddie.

The White House is reportedly crafting an extensive executive order on housing affordability that will be revealed in the coming weeks. The provisions of the order remain unclear, and it’s unknown what role Congress would play in the administration’s final plan.