Michael and his spouse have been pondering for some time about shifting from their dwelling in Surrey, the place they’ve lived for 25 years and raised their two sons. “We’re rattling round a bit, however there was no apparent catalyst for shifting — we hadn’t discovered wherever to go and all our mates are right here.” But final month, the 61-year-old retired businessman began chatting with property brokers to worth his six-bedroom home, set in 2.5 acres of land. He was quoted a determine of round £2.75mn.

“All of the speak of Labour inheritance tax within the Price range has made us suppose: let’s simply get on with it,” says Michael, who wished to talk below a pseudonym. “After all, we are able to’t promote earlier than October 30, however we need to transfer someplace smaller and go cash on to our sons whereas we are able to. The temper music positively appears to be turning towards older individuals proudly owning huge homes.”

UK property brokers have the best variety of properties on their books for a decade, with the variety of properties in the marketplace 12 per cent greater than it was in October final yr, in response to Rightmove.

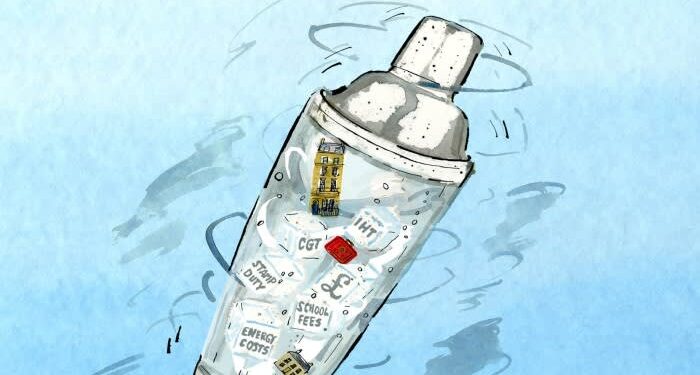

In addition to an increase within the variety of landlords and house owners of second properties promoting (prompted by fears over capital beneficial properties tax rises, which now look to be unfounded), various different elements — excessive vitality and mortgage prices, and even the plan to cost VAT on personal college charges — are spurring extra individuals into contemplating promoting bigger properties to maneuver someplace cheaper. With hypothesis mounting that the chancellor, Rachel Reeves, will announce sweeping adjustments to inheritance tax within the Price range subsequent week, this begs the query: may Labour’s tax insurance policies begin pushing extra individuals to downsize?

Since Labour received the election in July, property brokers say they’ve seen a notable improve in individuals enquiring about promoting their giant properties. “The change of presidency and potential adjustments in tax insurance policies, particularly round inheritance tax, have positively been the set off,” says Joanna Cocking, head of personal workplace at Hamptons property company. “Whereas usually individuals say they’re promoting as a result of the youngsters have left dwelling or the home is getting too huge for them to handle, the dialog just lately has been: ‘I don’t must personal an enormous asset like this and I’m involved about Labour’s plans’.”

This early trace of a change in perspective follows a interval that has seen falling numbers of individuals promoting to maneuver someplace smaller. There have been fewer than 100,000 downsizers within the yr to March 2024, lower than 10 per cent of the market, in response to Savills property company, though property gross sales throughout the board have been down in comparison with earlier years; in response to the Land Registry Home Worth Index, complete gross sales in England and Wales fell by 22 per cent in 2023.

Among the many deterrents to downsizing till now has been the issue of discovering a purchaser, provided that these upsizing have been going through excessive mortgage charges. “One of many greatest challenges for downsizers just lately has been not all the time getting the value they have been anticipating for his or her home,” says Jemma Scott, companion at The Shopping for Answer.

Nevertheless, since mortgage rates of interest have began coming down and home costs have drifted upwards, the urge for food for downsizing seems to have picked up. Jackson-Stops property company has seen a 21 per cent rise in downsizer candidates within the yr to October in comparison with the earlier yr, whereas Knight Frank says that, throughout the UK this yr, it has seen virtually 4 per cent of consumers citing downsizing as their purpose for shifting — this won’t sound like a lot, however it’s the highest degree for the reason that property company began recording the info a decade in the past (at which period it stood at 1.8 per cent).

“Because the housing market recovers, we might anticipate to see ranges of downsizing rise, significantly if we see older owners face a larger publicity to inheritance tax,” says Lucian Prepare dinner, head of analysis at Savills.

Over-fifties who personal their very own properties now maintain 78 per cent of all privately held housing wealth within the UK, whereas there are 1.3mn owners in England and Wales aged 65 and over dwelling in a four-bedroom home, which is prone to be too huge for his or her wants, in response to analysis by Savills. If this era moved, it might unlock properties for households.

Nevertheless, the boundaries to downsizing could be important. Savills says the over-sixties account for 44 per cent of all owners however solely 17 per cent of dwelling consumers, reflecting their reluctance to maneuver. Most clearly, “stamp obligation is a big transactional value that places off many,” says Richard Rogerson, chief govt of RFR Property.

And stamp obligation will rise subsequent yr. Reeves is anticipated to substantiate within the Price range that the “nil-rate” threshold for paying stamp obligation will fall from £250,000 to £125,000 in March — this implies the invoice for somebody shifting home will improve by as much as £2,500. Nevertheless, “provided that £2,500 isn’t big within the scheme of shopping for an costly property, we don’t anticipate it to have a lot of an affect [in this market],” says Aneisha Beveridge, head of analysis at Hamptons. “It’s on the decrease finish that arising with the additional money could be difficult.”

So what makes shifting worthwhile? To make the downsizing sums stack up after stamp obligation and shifting prices, a significant quantity of fairness must be launched, both by shifting to a decrease worth property or space. Savills says staying in the identical space and downsizing from a four-bedroom dwelling to a two-bedroom dwelling in England and Wales may unlock a median of £300,000, however the beneficial properties are a lot larger within the dearer south-east of England. For example, in Elmbridge, Surrey, a downsizer may launch virtually £675,000 of fairness (earlier than any shifting prices), however in Northumberland, the acquire is lower than £250,000.

However there’s a scarcity of appropriate properties for downsizers. The Mayhew Evaluation, printed in 2022, discovered that solely 7,000 properties are constructed for older individuals annually. It known as for 50,000 items to be constructed yearly with the intention to sustain with an over-65 inhabitants that’s set to extend from 11.2mn to 17.2mn by 2040.

“Usually, new developments focus extra on first-time consumers — and embrace incentives within the type of authorities schemes — or the household market,” says Lucy McIlroy, director of Winkworth property company’s Bathtub workplace. “Plus, retirement villages don’t attraction to everybody.”

Jean Milson, 75, is promoting the five-bedroom home in Canford Cliffs, Dorset, the place she has lived for nearly 50 years. “It’s a wrench as a result of the home nonetheless has reminders of my husband and kids and it’s in a lovely spot,” says Milson, who was widowed a decade in the past and has put her dwelling in the marketplace for £2.5mn. Milson had been pondering of downsizing for some time — it was concern of Labour’s inheritance tax insurance policies that lastly prompted her to promote.

Inheritance tax is levied on the worth of property and different belongings after demise. On paper, it’s paid by estates price greater than £325,000, though numerous guidelines and exemptions imply that many households can, in apply, go on belongings price £1mn to their kids tax-free.

Many properties exceed this. Property worth inflation over latest years signifies that, throughout Britain, the variety of properties price a minimum of £1mn has risen by 28 per cent since 2019. There are actually an estimated 670,100 properties valued at £1mn or extra, virtually half of that are in London with 155,085 within the south-east of England, in response to Savills.

The wealthiest households are sometimes capable of minimise their inheritance tax liabilities utilizing trusts and complicated property planning. Slightly below 4 per cent of estates paid inheritance tax in 2020-21. Nevertheless, speculation is now building that, with the intention to elevate more cash, the chancellor will goal the seven-year gifting rule, which sees belongings given to dependants turn into freed from inheritance tax after seven years, as long as the individual making the reward continues to be alive. Reeves is known to be contemplating extending that interval to 10 years. “This concern has actually targeted individuals’s minds to promote,” says Charlie Heaton, companion in shopping for company Heaton & Companions. “They need to have the ability to go as a lot as doable on to the following era.”

“Accelerating plans to downsize and reward a number of the fairness to descendants, to begin the clock ticking as quickly as doable, makes loads of sense,” says Heather Powell, companion and head of property on the accountancy agency Blick Rothenberg. “Encouraging individuals to downsize to unlock bigger properties for households may even be seen as a constructive transfer by the federal government,” she provides. “Thoughts you, I don’t suppose we are going to see any stamp obligation reduction for downsizers, which might actually encourage them to maneuver from properties which can be too huge for them.”

Amongst those that are selecting to downsize, there are indicators that there’s a broadening of profile. There was a rise in youthful individuals buying and selling down the ladder, in lots of situations as a consequence of excessive mortgage prices and vitality payments which have risen considerably up to now 5 years. Plus Labour’s plan so as to add 20 per cent VAT to high school charges.

Hamptons property company says 40 per cent of all its downsizers are considerably buying and selling down in worth by shifting to a house that’s much less than half the value of their earlier dwelling, up from 30 per cent in 2019. Extra downsizers additionally nonetheless have a mortgage — this yr, 55 per cent of downsizer strikes have been paid for in money, down from 62 per cent 5 years in the past. “All of this means that persons are downsizing at a youthful age as a result of they nonetheless have a mortgage and try to cut back the funds to a extra manageable degree,” says David Fell, senior analyst at Hamptons.

Sarah and her husband are promoting their five-bedroom dwelling in Wadhurst, East Sussex, to maneuver to a less expensive home in a village to the east and unlock about £200,000 to place in direction of prep college charges for his or her two kids. “The fairness we launch and the cash we hope to avoid wasting from not operating a bigger home, which we don’t really feel we want, will go in direction of personal college charges and a extra comfy life-style,” says Sarah, 39.

Fiona Penny, a property finder who works in Kent and East Sussex and helps Sarah, is more and more coming throughout individuals of their thirties and forties seeking to downsize. “They typically say that if issues have been totally different, they’d be seeking to purchase an even bigger dwelling now however mortgage and vitality prices are a lot greater than they have been and one thing’s acquired to offer in the event that they maintain the personal education.”

Nevertheless, some downsizers have managed to profit from hypothesis over Labour’s tax adjustments, profiting from rising numbers of second properties being put in the marketplace in (probably mistaken) anticipation that the Price range would improve capital beneficial properties tax on them.

Nigel Bishop, founding father of Recoco Property Search, just lately helped a pair promoting their four-bedroom London dwelling of 35 years to purchase in Falmouth, Cornwall. “That they had a price range of £1mn however couldn’t discover something appropriate till extra second properties began coming in the marketplace over the summer season,” says Bishop, who was capable of finding them a two-bedroom flat overlooking the shoreline.

With Labour’s proposed tax adjustments making extra individuals take into consideration shifting, may these ripples begin to construct to greater ranges of downsizing? “Coverage would possibly assist tilt these individuals who have been already considering downsizing into doing it,” says Neal Hudson, residential analyst and founding father of BuiltPlace.

Home & House Unlocked

Don’t miss our weekly publication, an inspiring, informative edit of the information and traits in international property, interiors, structure and gardens. Sign up here.

Nevertheless, Hudson provides, “Rising vitality prices over the previous few years could have made individuals take into consideration why they’re nonetheless rattling round in a big dwelling. Expectations for home costs are additionally essential. Over the previous few a long time owners have been rewarded handsomely for having a big home as a result of they’ve benefited from important home worth development. With home costs not anticipated to go up a lot within the coming years, there’s much less of an incentive to have your cash in property — so extra individuals may promote.”

Discover out about our newest tales first — observe @ft_houseandhome on Instagram