Coinspeaker

$3.42 Billion in Bitcoin and Ethereum Options Expiry Hint Market Volatility Ahead

Simply because the cryptocurrency market is heading for a weekly expiry, Bitcoin value

BTC

$98 402

24h volatility:

0.1%

Market cap:

$1.94 T

Vol. 24h:

$59.14 B

has rallied to its new all-time excessive of $99,502 with its market cap at $1.95 trillion. A complete of $2.86 billion in Bitcoin choices will expire as we speak hinting at crypto market volatility forward.

The substantial expiration occasion might set off short-term value volatility, particularly as markets eagerly anticipate Bitcoin reaching the $100,000 milestone.

A Look into the Bitcoin Choices Expiry Information

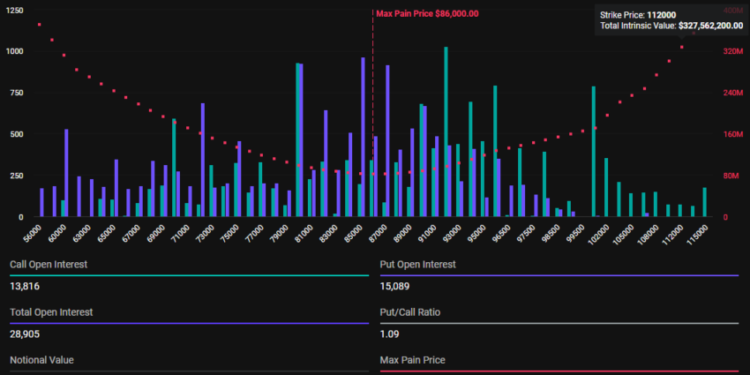

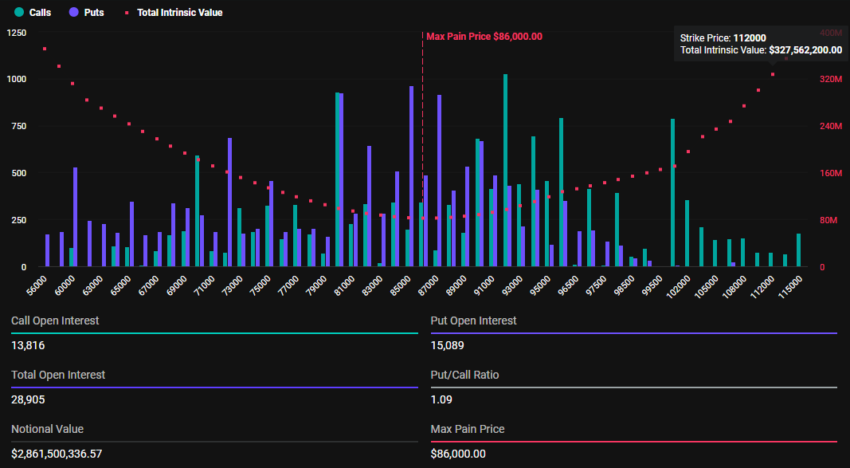

Information from Deribit reveals that 28,905 Bitcoin choices contracts are set to run out on Friday, that includes a put-to-call ratio of 1.09 and a most ache level of $86,000.

The put-to-call ratio, which measures market sentiment, presently stands above 1, signaling bearish sentiment regardless of current development fueled by Bitcoin whales and long-term holders.

-

Courtesy: Deribit

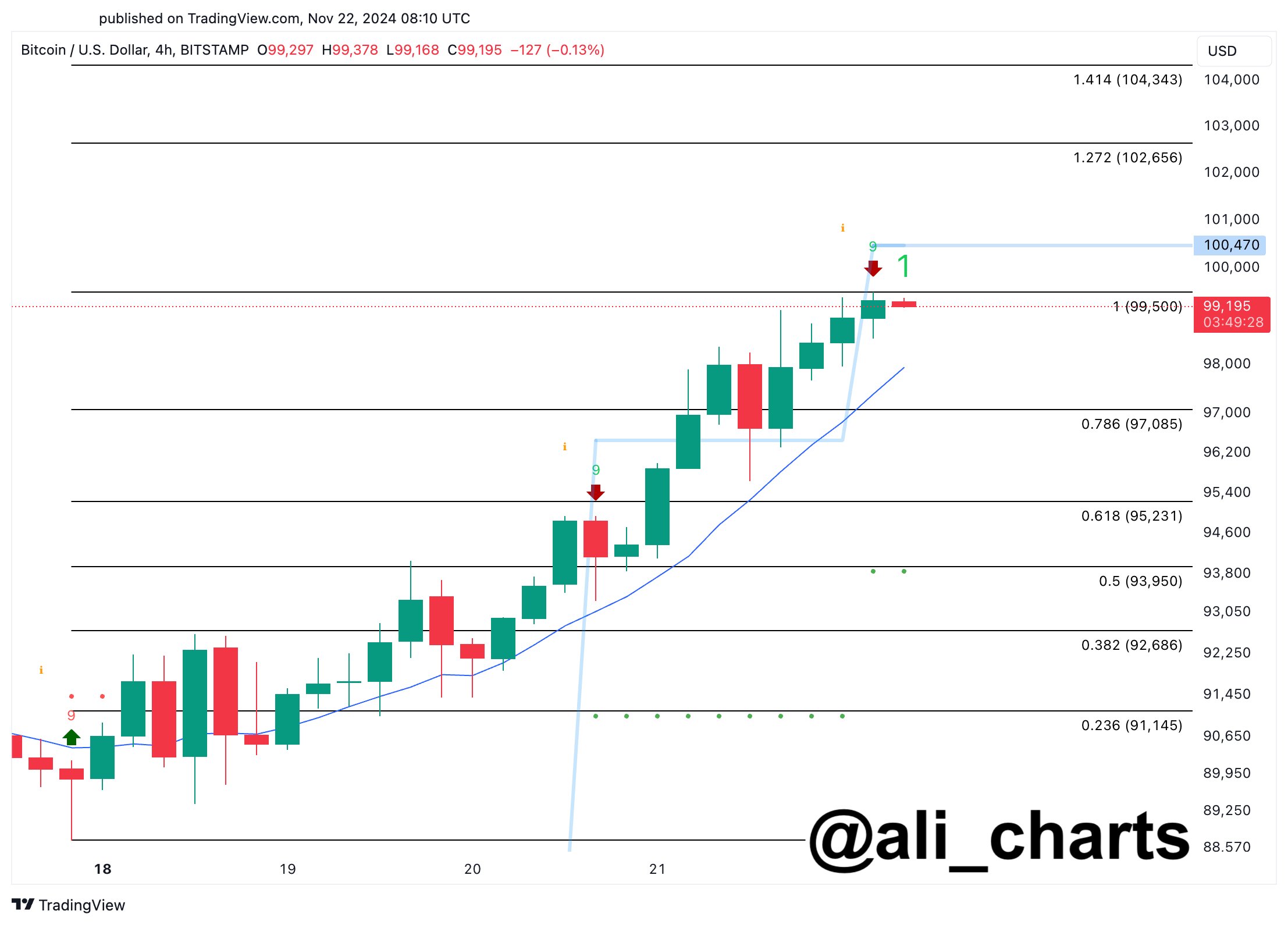

Whereas everyone seems to be anticipating a Bitcoin value breakout above $100K, there might be a short correction forward earlier than it lastly occurs. In response to crypto analyst Ali Martinez, the TD Sequential indicator has flashed a promote sign on Bitcoin’s 4-hour chart, suggesting a possible correction towards $97,085.

-

Courtesy: Ali Charts

Nevertheless, if Bitcoin manages a candlestick shut above $100,470, it might invalidate the bearish sample. In such a situation, BTC might climb to targets of $102,656 or $104,343, famous Martinez.

Ethereum Choices Expiry and Analyst Predictions

A complete of 164,687 Ethereum choices contracts are set to run out as we speak, with a put-to-call ratio of 0.66 and a most ache level of $3,050. The decrease put-to-call ratio displays a usually bullish sentiment within the ETH market.

As of press time, Ethereum is buying and selling at $3,389. Analysts at Greeks.reside counsel Ethereum

ETH

$3 394

24h volatility:

0.6%

Market cap:

$407.45 B

Vol. 24h:

$30.44 B

might see continued upward momentum according to the bullish put-to-call ratio, whereas Bitcoin seems poised for a possible correction. They added:

“With about 8% of positions expiring this week, the massive rally in Ethereum has led to a major improve in ETH main time period choices IV [implied volatility], whereas BTC main time period choices IV has remained comparatively steady. The market sentiment stays extraordinarily optimistic at this level”.

Analysts spotlight that regardless of Bitcoin’s threat of a correction, the broader market rally might forestall a major pullback. This might be because of the substantial capital inflows into ETFs, notably BlackRock’s newly launched IBIT choices. Yesterday, BlackRock’s IBIT clocked $5 billion in buying and selling volumes.

Additionally, the entire inflows into spot Bitcoin ETFs yesterday crossed over $1 billion with IBIT alone contributing greater than $600 million.

$3.42 Billion in Bitcoin and Ethereum Options Expiry Hint Market Volatility Ahead