Coinspeaker

Bitcoin Stays Flat Ahead of CPI Data and Trump-Harris Debate

Bitcoin

BTC

$56 437

24h volatility:

2.9%

Market cap:

$1.12 T

Vol. 24h:

$33.49 B

has remained comparatively secure over the previous weekend, staying between $55,000 and $58,000. Regardless of the calm, merchants anticipate elevated market swings as this week comes with essential occasions together with key US financial information, significantly the Client Value Index (CPI) launched forward. Alongside this, the upcoming Trump-Harris debate is about to affect market sentiment.

The decrease buying and selling exercise in BTC adopted Friday’s US jobs report, which triggered the liquidation of over $220 million in lengthy positions. This sell-off weakened momentum, leaving merchants on edge as they watch for extra financial indicators.

Different main cryptocurrencies like Ethereum

ETH

$2 334

24h volatility:

1.7%

Market cap:

$281.79 B

Vol. 24h:

$15.30 B

, Solana

SOL

$132.8

24h volatility:

3.6%

Market cap:

$62.16 B

Vol. 24h:

$2.96 B

, and Tron

TRX

$0.15

24h volatility:

0.2%

Market cap:

$13.32 B

Vol. 24h:

$412.61 M

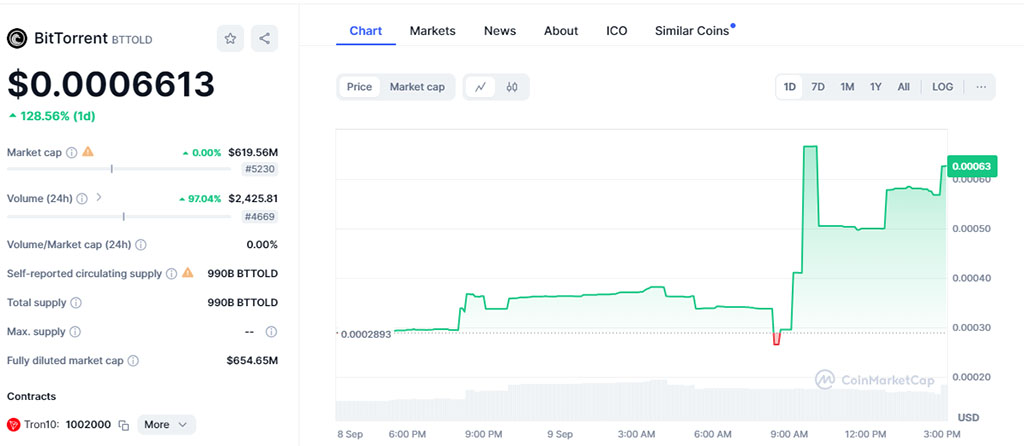

confirmed minor adjustments of about 0.6% within the final 24 hours. Nonetheless, mid-cap tokens, equivalent to BitTorrent (BTT), skilled a notable 128% rise.

Bitcoin’s Community Safety Bolsters Bullish Sentiment

Regardless of the market’s stagnation, specialists at Presto Analysis see Bitcoin as deeply undervalued. Analysts Peter Chung and Min Jung identified that the market is overlooking a key power of Bitcoin: its community safety.

Bitcoin’s hashrate, which measures the overall computing energy securing the community, reached an all-time excessive of 679 exahashes per second (EH/s) in September 2024. This surge displays elevated mining exercise, suggesting a strong basis for long-term progress.

Chung and Jung argue that the rising hashrate indicators a constructive outlook. The provision of spot ETFs has positioned Bitcoin in a stronger place than ever earlier than, making it appear undervalued of their view.

This uptick in miner exercise, which started in August, has typically been an indication of market bottoms for Bitcoin. As miners develop operations, it reveals their rising confidence in worth stability. Many analysts imagine this might be a catalyst for a major rise in Bitcoin’s worth.

CPI and Trump-Harris Debate Set to Shake Markets

Trying forward, Bitcoin merchants are carefully watching two main occasions this week: August’s CPI information launch on Tuesday and the Producer Value Index (PPI) figures on Wednesday. Each reviews will provide key insights into the state of U.S. inflation and are prone to affect Federal Reserve coverage within the coming months.

In the meantime, the primary Presidential debate between Donald Trump and Kamala Harris is including to market jitters. Trump, who goals to show the U.S. into a world crypto hub, would possibly make statements that might shake each the political and crypto landscapes.

Harris’s stance is much less outlined, however her group is reportedly exploring insurance policies that might increase the cryptocurrency sector. Consequently, the talk’s end result may have an effect on investor attitudes and introduce extra market swings.

Including to this, market professional Lucy Hu from Metalpha pointed to latest weaker US payroll information, which has triggered asset sell-offs since Friday. She famous that the crypto market is prone to stay unstable as the subsequent Federal Reserve assembly approaches.

Bitcoin Stays Flat Ahead of CPI Data and Trump-Harris Debate