Bitcoin open interest crashed by billions in one weekend, painting a bearish outlook for the flagship crypto and spells doom for BTC bulls. Despite this setback, crypto analysts have provided some optimism with their analysis, which hints at a bullish reversal soon enough.

Bitcoin’s Open Interest Crashes By $4.5 Billion Over The Weekend

Coinglass data shows that Bitcoin’s open interest crashed by $4.5 billion over the weekend, dropping from $65 billion to $61.5 billion. This came following the liquidations that occurred due to the BTC price crash. Further data from Coinglass shows that over $2 billion has been wiped out from the Bitcoin market in the last 24 hours.

Related Reading

Bitcoin bulls took the most hit, as $1.88 billion in long positions was liquidated during this period, leading to a crash in BTC’s open interest. This paints a bearish outlook for the flagship crypto and puts the bulls in danger as the bears look to be firmly in control. For context, Bitcoin dropped from above $100,000 to as low as $92,000 over the weekend.

This Bitcoin price crash occurred after US President Donald Trump announced a 25% tariff on imports from Mexico and Canada and a 10% tariff on goods from China. Mexico and Canada have retaliated by imposing tariffs on goods from the US, while China has also hinted about imposing a tariff on US goods.

Bitcoin’s open interest looks unlikely to recover in the short term as market participants could choose to stay out of the market due to economic uncertainty. This occurrence spells doom for Bitcoin bulls as the flagship crypto could drop lower if there are no buyers to defend BTC at these levels.

Some Positive For Bitcoin Amid Open Interest Crash

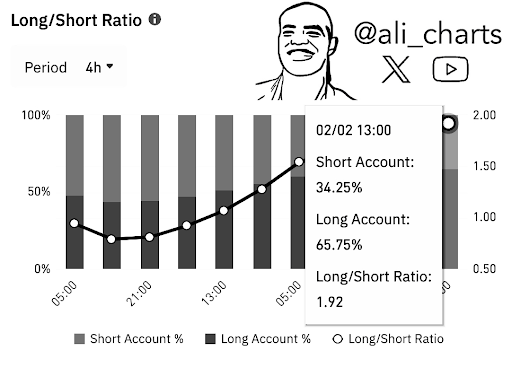

In an X post, crypto analyst Ali Martinez revealed that 65.75% of Binance traders with open Bitcoin futures positions are betting on the upside. This is bullish for the BTC price as these traders have a track record of being right most of the time. As such, the flagship crypto could rebound from its current price level.

In an X post, crypto analyst Titan of Crypto stated that the broader trend for the Bitcoin price is still upward. This came as he revealed that BTC is establishing a new range between $104,400 and $93,600. The crypto analyst remarked that the short-term direction remains uncertain until this range breaks. However, in the long term, Titan of Crypto is confident that the broader trend is still upward.

Related Reading

Meanwhile, renowned author and finance expert Robert Kiyosaki suggested that this wasn’t a time to panic as this was an opportunity to buy Bitcoin on sale before it rallies further to the upside.

At the time of writing, the Bitcoin price is trading at around $94,000, down over 6% in the last 24 hours, according to data from CoinMarketCap.

Featured image from iStock, chart from Tradingview.com