Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

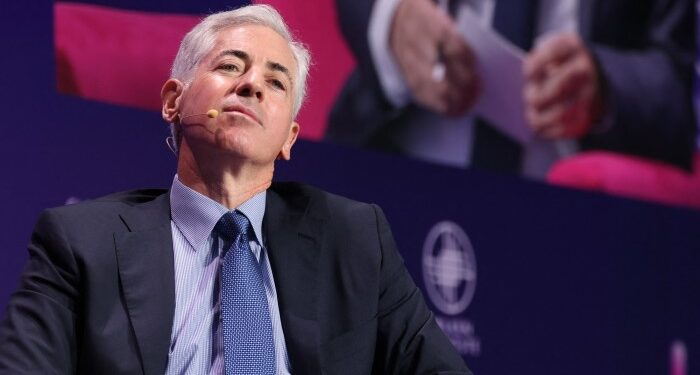

Bill Ackman has a message for the US taxpayer: don’t be so greedy. The hedge fund mogul is an investor in Fannie Mae, the government-sponsored mortgage finance titan that, along with twin Freddie Mac, was bailed out during the financial crisis. Now re-privatisation of the duo may be on the agenda, Ackman wants the government to sacrifice some of what’s due.

Fannie and Freddie’s job as private companies was to buy, insure and repackage mortgages, blessing them on the way with its once implicit government guarantee. When crisis hit, the government injected around $200bn of capital. But unusually, it allowed their common equity to keep trading. Speculators like Ackman made seemingly quixotic bets that Fannie and Freddie would be able to pay back the Treasury with plenty to spare for investors.

That proved at least partially right. The pair have reaped steady and large profits from the American home loan market. And the Treasury has collected $300bn in distributions and other payments. The Trump administration is now making overtures towards ending Fannie and Freddie’s two-decade “conservatorship”, which could mean some kind of initial public offering.

Ackman contends, in a characteristically lengthy PowerPoint presentation, that Fannie and Freddie could both be worth at least $35 a share after a pre-IPO clean-up, more than triple their share prices today. But he has a problem. The Treasury, for all its dividends and 80 per cent stake in the duo’s equity, also holds preferred shares that it could convert to yet more stock, which would leave private shareholders like Ackman with far less.

His answer, then, is for the government to declare its roughly $200bn of preferred stock repaid already. If it doesn’t, he reasons, the privatised Fannie and Freddie will trade at a poor valuation, since new investors would be reluctant to trust a company that had ridden roughshod over its previous shareholders. Ackman adds that a Treasury attempt to convert the preferred stock into regular equity could invite litigation.

As it is, freeing Fannie and Freddie from conservatorship comes with other complex questions. One is how much capital they should hold — Ackman suggests something lower than the amount demanded from banks — and another is how to reconfigure any implicit government guarantee. The White House has yet to pick from the wide variety of ideas doing the rounds. It’s not clear it should be in a rush to do anything at all.

Besides, the Treasury too has shareholders: namely, the American public. They were told for years that Fannie and Freddie would never need a bailout, as its managers made millions of dollars a year in pay in the years preceding the financial crisis. It’s true the taxpayer has made a handsome return already. But Ackman is asking the kind of favour he would be unlikely to grant were he on the other side of the negotiating table.