The world has consistently faced the threat of another financial crisis. If the global crisis from 16 years ago has imparted any wisdom, it is that a single unnoticed flaw can cause the whole system to collapse. That is why it is crucial to have a metric capable of evaluating the resilience and effectiveness of a system when subjected to extreme or unforeseen circumstances.

This is what Wall Street refers to as a stress test.

In layman’s words, a stress test is a simulation in which unfavorable conditions, such as market collapses or liquidity shortages, are used to determine how specific institutions or the entire financial system respond and perform. It is extremely beneficial to detect risks, assess capital adequacy, and make required adjustments/enhancements.

A conventional static stress test, commonly employed by financial institutions and regulatory bodies, primarily relies on a combination of spreadsheet models and risk management software. The process starts with the current balance sheet as a key input, which includes assets such as loans, securities, cash, and liabilities like deposits and debts. Subsequently, predefined adverse scenarios are introduced. These scenarios may include macroeconomic shocks, such as increases in interest rates, rising unemployment, or contractions in GDP. The system then computes the impact of these factors, producing outputs like capital ratios, liquidity shortfalls, and loss projections. All of this is intended to demonstrate the institutions’ resilience.

It does not evolve or adapt in response to real-time data and changing conditions. In short, it views the financial system as a frozen snapshot.

The limitation becomes clear: a static stress test is becoming increasingly obsolete and insufficient in a world where dangers are evolving and emerging at an unprecedented rate.

Nevertheless, it should not mean that we should abandon static stress tests altogether. They still serve as foundational tools that help financial institutions prepare for risks and act as benchmarks across entities. But relying entirely on static tests is like flying with an outdated map — you might reach a certain altitude, but you will miss uncharted terrain that can bring you down.

The way forward is to infuse static stress tests with AI-driven dynamic capabilities. AI is more than just a buzzword or hype, so let’s look at how AI may improve the stress test.

Scenarios are the heart of stress testing because they define the conditions under which the system or firms are evaluated. In static tests, scenarios used to be predefined fixed assumptions such as: interest rates rise by 200 basis points or GDP drops by 3%. Single assumptions like that do not capture the complexities and unpredictability of real-world crises.

A combination of assumptions, such as GDP dropping followed by a rise in unemployment, can be defined manually, but it is a very tedious task. And this is where AI-based dynamic scenario generation can be a game changer. It goes beyond static and manual input. It uses data science techniques to design adaptive scenarios that reflect evolving risks.

AI can learn from historical patterns. Past crises are rich with lessons that can reveal how combinations of factors amplify each other. Using machine learning, systems can identify hidden relationships between variables, such as how a rise in unemployment typically impacts loan defaults. Thus, realistic, diverse, and adaptive stress test scenarios rooted in historical precedent can be generated.

Another key strength of AI is its ability to generate rare catastrophic events that humans might not expect. Using Monte Carlo techniques, AI can randomly simulate thousands of scenarios and identify the worst-case combinations. This will surely enhance the quality of stress tests and yield more insightful results.

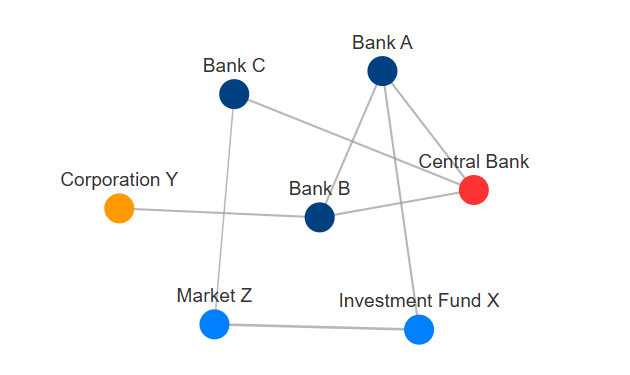

One of the critical limitations of traditional stress tests is the inability to spot interconnected risks among institutions, markets, and financial systems. In reality, systems are deeply intertwined; what happens to one sector can ripple and create cascading effects on others. Amplification often occurs. A liquidity crisis in one bank can spread panic to investors, causing stock sell-offs. That’s why it is important to identify and visualize how risks propagate.

AI can perform systemic risk mapping using advanced technology and data science. Network analysis and graph theory can be used to identify interconnections and critical nodes. If Bank A has large credit exposures to Bank B and Bank C, AI can predict how a liquidity crisis at Bank A could spread stress to each creditor, depending on certain parameters. Combined with Agent-based Modeling, further simulations can be done to see how Bank B and Bank C react to what happens in Bank A.

With AI’s ability, systemic risks can be made “visible.” This is a critical capability for regulators, policymakers, and institutions seeking to limit the impact of the next contagion.

Sometimes prediction is not enough. “Liquidity shortfall of 15% under scenario A” or “Default probability of 40%” does not mean much. Policymakers need to understand what factors drive the results or even how much each factor contributes. All of this is aimed at addressing the inquiries surrounding the question, “Is the output reliable for making important decisions?”

This is where explainable AI (XAI) plays a crucial role. It helps to decompose the AI model logic into human-readable insights, bridging the gap between complex algorithms and actionable decisions.

XAI’s core function lies in breaking down the AI output into clear, interpretable parts. It identifies the drivers of risk by using a combination of advanced techniques, none of which require the end user to be a data scientist.

Tools like SHAP (SHapley Additive Explanations) and LIME (Local Interpretable Model-Agnostic Explanations) are at the forefront of this process. SHAP, for instance, borrows concepts from game theory, assigning each input variable a “score” based on how much it contributed to the prediction relative to others. If a bank’s liquidity shortfall is predicted, SHAP might reveal that 50% of the issue stems from declining interbank lending, while a spike in bond yields adds another 20%.

At a systemic level, XAI can also reveal hidden patterns within massive datasets. Using sensitivity analysis, the way a model reacts to changes in input variables can be tested. For example, a mere 1% increase in unemployment could lead to a significant rise in forecasted default rates, allowing decision-makers to better grasp the delicacy of specific conditions. Such minor insights, magnified through thousands of simulations, can assist institutions in strengthening their balance sheets to better withstand potential vulnerabilities.

As AI models grow more sophisticated, XAI will play an even bigger role. It will help policymakers build confidence, knowing that the decision-making mechanism is supported by reliable tools. The shift in perception could be pivotal, as clarity and trust are true keys to resilience.