Asset managers haven’t at all times topped themselves in glory on the subject of sustainable investing.

At greatest, they’ve been accused by environmental campaigners of an indifference in the direction of utilizing their affect as buyers to avoid wasting the planet. And, at worst, they’ve been known as out for falsely advertising and marketing their funds as ‘inexperienced’ to faucet into the burgeoning demand for sustainable investing when, in fact, a lot of these merchandise had been stuffed stuffed with firms that pollute.

This grew to become such an issue that monetary regulators all over the world needed to step in to guard customers from being misled. In 2023, for instance, DWS, the funding arm of Deutsche Financial institution, was pressured to pay $25mn to the US Securities and Trade Fee in relation to “misstatements” over its environmental, social, and governance (ESG) funding processes.

A yr earlier, Goldman Sachs Asset Administration agreed to pay $4mn to the SEC to settle allegations of ESG violations.

On the identical time, funding managers have been quietly dropping the phrase “sustainable” from the names of their funds, in response to growing regulatory considerations about mis-selling.

In August, the European Securities and Markets Authority up to date its tips on ESG fund naming guidelines, setting a November 21 deadline for compliance. Beneath the brand new guidelines, funds with the time period ESG or sustainable of their identify should guarantee they’ve at the least 80 per cent of investments tied to environmental traits. Equal guidelines are set to reach within the UK in December.

Seventy-nine funds in Europe eliminated the phrase “sustainable” final yr, with one other 26 doing so in the course of the first eight months of 2024, in accordance with information from consultancy Broadridge. Many asset managers stated they did so as a consequence of a scarcity of regulatory readability.

Against this, in 2022, earlier than the elevated regulatory scrutiny and because the recognition of inexperienced merchandise was rising, 99 funds added the phrase.

“Some asset managers nonetheless stretch the reality to attempt to acquire the belief and enterprise of accountable buyers,” says Abhijay Sood, senior analysis supervisor at marketing campaign group ShareAction, which has been extremely important of the business’s method to inexperienced investing.

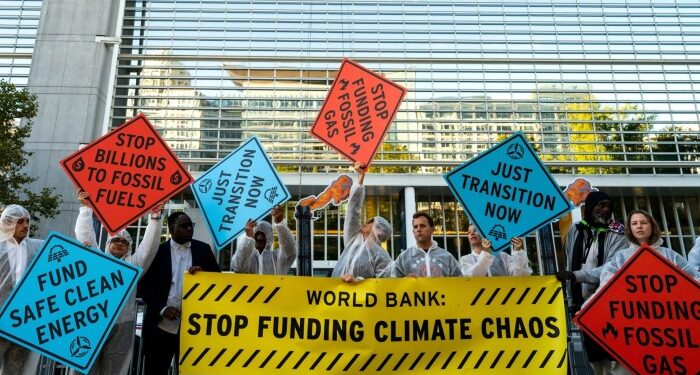

ShareAction printed a report in June final yr that discovered asset managers had inadequate targets to reduce emissions, had been persevering with to put money into firms increasing their oil and fuel manufacturing, and had been stalling the transfer to inexperienced, clear power by not investing sufficient in new low-carbon power alternatives.

The NGO, whose report was primarily based on a survey of 77 of the world’s largest asset managers, says it’s “alarming” to see so many failing to adapt their investments to sort out local weather change. It provides that the sector wants to make use of the “big energy” it wields by means of its investments to deliver a few “significant transition”.

Sood says: “General, asset managers’ local weather situation evaluation is unrealistic — failing to account for weakening carbon sinks, tipping factors or political instability. They typically undertaking {that a} world that’s 3C hotter is not going to meaningfully hurt their portfolios.”

The analysis supervisor provides that, for an business that “professes to reward particular person boldness”, asset managers are remarkably danger averse. “They don’t need to stand out as doing one thing uncommon and most don’t need to be seen as both local weather laggards or leaders,” he says.

In equity to asset managers, many have added their names to an business pledge, the Kunming-Montreal International Biodiversity Framework, to make a “constructive contribution” to biodiversity by means of actions and investments.

Dubbed a “Paris Settlement for nature” — a hat tip to the 2015 international local weather accord — the framework goals to, amongst different issues, defend a 3rd of the planet’s lands and seas by 2030. It changed the Aichi Biodiversity Targets set in 2010, beneath which simply 17 and 10 per cent of terrestrial and marine areas, respectively, had been beneath safety.

It isn’t legally binding, nonetheless, so critics have consequently been asking whether or not it simply creates one other approach for funding firms to “greenwash” their companies and declare they’re working exhausting when on biodiversity with out, in actual fact, doing a lot in any respect.

“Till 2022, there appeared to be much more momentum amongst asset managers to deal with local weather change,” says Sood. “Nonetheless, our evaluation reveals that the majority of this was signing commitments, demanding extra disclosure, and operating projections of the long run.”

“This low-hanging fruit began to expire on the identical time rate of interest hikes made sacrificing short-term acquire a lot more durable for asset managers to justify, derailing progress.”

In response to these allegations, the Funding Affiliation, a commerce group for asset managers within the UK, says the characterisation of an business that’s all “discuss and no motion” just isn’t matched by the truth of the financial transformation that’s going down.

Paul Scaping, public coverage specialist on the Funding Affiliation, says: “Within the UK, coal has been phased out and renewable electrical energy era ramped as much as take its place.

“The businesses and tasks that allow this transition by means of the availability chains, development and administration of infrastructure are incessantly supported by the allocation of capital by funding managers on behalf of their purchasers.”