Coinspeaker

Bitcoin Bounces Off Key Level, Analyst Calls Current Price ‘No-Brainer’

Bitcoin

BTC

$63 231

24h volatility:

1.2%

Market cap:

$1.25 T

Vol. 24h:

$33.79 B

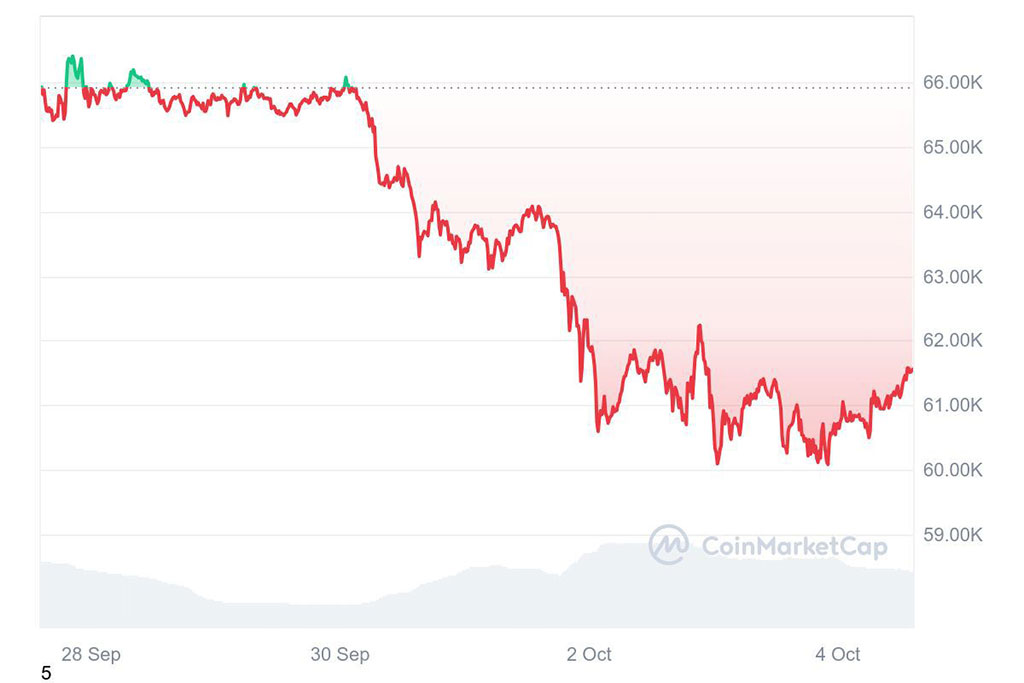

has fallen 6% since September 30, 2024, dropping to $61,000. Quinn Thompson, Chief Funding Officer at Lekker Capital, sees this as a first-rate shopping for alternative. He views the present value as an apparent probability for buyers to build up extra Bitcoin, citing modifications within the broader financial panorama.

Photograph: CoinMarketCap

On October 3, Thompson shared his evaluation on X (previously generally known as Twitter). He included a chart displaying Bitcoin’s value actions since March 5, 2024, when BTC reached a peak of $73,700. This chart highlighted Bitcoin’s volatility and the latest downward development, prompting Thompson to match it with previous market behaviors.

I don't often give very short-term views, however looks like a no brainer to be bidding this space with clear invalidation on the again of a 180 diploma shift within the macro backdrop from the relative to the three earlier comparable setups. https://t.co/NzqUSEvKbg pic.twitter.com/1PlviEyf5o

— Quinn Thompson (@qthomp) October 3, 2024

Thompson famous three earlier situations the place Bitcoin fell beneath its 200-day transferring common, a key metric for merchants assessing an asset’s mid-term energy. Nonetheless, within the present scenario, BTC rapidly recovered from this stage. Thompson interpreted this rebound as an indication of a serious shift within the broader financial panorama, suggesting that Bitcoin’s value is more likely to rise once more quickly.

Geopolitical Tensions Gas Bitcoin Bitcoin Promote-off

Thompson expressed confidence out there, suggesting it’s a transparent alternative to bid regardless of short-term fluctuations. He pointed to geopolitical tensions within the Center East, notably Iran’s navy actions towards Israel, which have shaken world markets. These occasions, together with broader financial issues, have led to a sell-off in threat property like Bitcoin.

Worries concerning the energy of the US financial system and the unsure outcomes of the November elections have fueled market volatility, weakening investor confidence. This shift has dampened the passion surrounding “Uptober”, a time period for October’s often optimistic efficiency within the crypto house. As markets retreat, social media mentions of “Uptober” have light.

Thompson’s view aligns with different analysts, similar to Santiment’s Maksim Balashevich, who famous that whereas optimism is dwindling, it might sign an opportunity for a short-term restoration. Nonetheless, Balashevich cautioned that it’s unclear whether or not the bigger downtrend has ended. This displays the blended opinions throughout the funding neighborhood on Bitcoin’s future.

🎃 Mentions of "Uptober" have declined considerably, portray an image that merchants have turn into rather more bearish on the thought of this month being an computerized cash printer for crypto. The dearth of optimism opens the door for (no less than) a short-term bounce. 📈 https://t.co/iACWMGPvSs

— Santiment (@santimentfeed) October 3, 2024

Bitcoin Dips Trace at October Surge

Traditionally, October has proven sturdy cryptocurrency efficiency, averaging over 20% positive aspects prior to now 11 years, according to CoinGlass. Nonetheless, most of those positive aspects sometimes happen within the second half of the month. In early October 2023, Bitcoin dropped 7%, hitting $26,650. But, inside two weeks, it surged practically 30%, closing the month at $34,500. This sample has led merchants to count on the same spike this October.

At present, Bitcoin’s 6% decline and indicators of restoration create a cautiously optimistic outlook for buyers. Quinn Thompson, a key voice, suggests shopping for through the dip, and historic traits again this view. Traders ought to weigh these components, contemplating each dangers and rewards in immediately’s market.

Because the cryptocurrency market evolves, world occasions, financial alerts, and technical evaluation will form methods. The following few weeks will likely be essential in figuring out if Bitcoin will repeat its typical October surge or observe a brand new path on this ever-changing monetary surroundings.

Bitcoin Bounces Off Key Level, Analyst Calls Current Price ‘No-Brainer’