Coinspeaker

Bitcoin Could Drop 20% Following M2 Money Supply Correlation

Bitcoin’s

BTC

$95 475

24h volatility:

2.5%

Market cap:

$1.89 T

Vol. 24h:

$81.25 B

potential for reaching new value peaks faces a major impediment, with analysts predicting a 20% or higher decline if its established hyperlink with the worldwide M2 money supply persists. The M2 cash provide, encompassing money and short-term deposits, has served as a key indicator of Bitcoin’s value traits traditionally. Joe Consorti, head of development at Theya Bitcoin, predicts a value pullback to $70,000 if this sample continues.

Supply: Joe Consorti

Consorti issued a cautionary assertion on social media platform X, highlighting the outstanding accuracy of this correlation. He expressed uncertainty over whether or not Bitcoin would comply with the M2 provide’s trajectory all the best way down or discover assist earlier than reaching that time. Since September 2023, Bitcoin has demonstrated a 70-day delay in mirroring the worldwide M2 cash provide motion.

Bitcoin Developments Mirror World M2 Shifts

Bitcoin’s worth has traditionally risen with the worldwide M2 cash provide, significantly throughout inflationary intervals. Increasing M2 typically alerts inflation, prompting buyers to think about Bitcoin as a hedge in opposition to rising costs. Comparable patterns emerged throughout earlier bull runs. Nonetheless, analyst Joe Consorti anticipates a 20-25% drop in Bitcoin’s worth, attributing this prediction to ongoing traits that might doubtlessly drive important declines.

On November 25, 2024, Consorti highlighted Bitcoin’s tendency to comply with M2 actions with a 70-day delay. He noticed this correlation constantly since mid-2023, underscoring its significance for market evaluation. He warned of the potential for corrections if the pattern persists, noting the historic reliability of this relationship.

“I don’t need to alarm anybody, but when it continues, Bitcoin could possibly be in for a 20-25% correction,” Consorti warned.

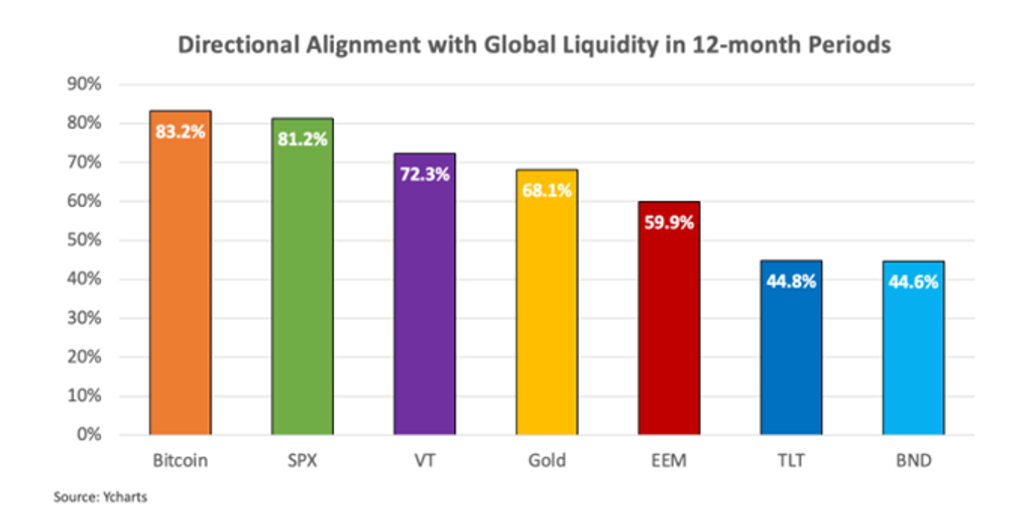

Contrasting views exist amongst consultants. Macroeconomist Lyn Alden noted in a September 2024 report that Bitcoin aligns with international liquidity traits 83% of the time over a 12-month interval, shifting alongside M2. Regardless of this commentary, some commentators stay skeptical. Analyst David Quintieri dismissed such correlations, emphasizing Bitcoin’s excessive volatility, which he argued undermines its connection to any metric.

Supply: Lyn Alden

“Bitcoin is just too unstable to trace it in opposition to something. All of those are simply distractions. You could possibly do it with the inventory market, and it’s extra sensible,” mentioned David.

In the meantime, Glassnode’s lead analyst, James Test, supplied a special perspective, explaining that a lot of the latest decline in M2 was resulting from greenback energy, successfully “devaluing” the M2 of different international locations.

Bitcoin Defies Developments amid US Tariff Considerations

Analysts specific issues about exterior influences, resembling potential US tariff modifications, affecting Bitcoin. On November 22, crypto analyst Sam KB highlighted a notable anomaly in market conduct. Traditionally, Bitcoin rallies have aligned with peaks in M2 cash provide. Nonetheless, through the present cycle, regardless of M2 reaching its lowest degree, Bitcoin continues to surge.

“Regardless of M2 being at its lowest level this cycle, Bitcoin has continued to rally, leaving many to query the disconnect between the 2. “M2 is almost on the lowest level this cycle… however BTC is rallying. What am I lacking?” he wrote.

Including to the uncertainty, President-elect Donald Trump’s plans to impose tariffs on imported items may additional strengthen the US greenback. Hedge fund supervisor Scott Bessent addressed this subject in a Bloomberg interview on November 5, declaring that “Tariffs trigger a stronger greenback,” which may result in challenges for Bitcoin.

Bitcoin Could Drop 20% Following M2 Money Supply Correlation