Coinspeaker

Bitcoin Miners Begin 2025 with Robust Growth, Says JPMorgan

Bitcoin mining companies began 2025 on a strong note, with 12 of 14 stocks monitored by JPMorgan, outperforming the cryptocurrency in the year’s first two weeks. JPMorgan’s research reveals optimism, with performance metrics reflecting a robust mining sector.

Global network hashrate, a key indicator of mining computational power, rose 2% month-to-date, averaging 793 exahashes per second (EH/s). This marks a 51% increase from January 2024, showing intensified competition and heightened mining difficulty. Despite growing challenges, miners sustained a nearly stable hashprice, with only a marginal dip of less than 1% since December.

JPMorgan analysts Reginald Smith and Charles Pearce noted miners earned approximately $54,900 in daily block reward revenue per EH/s in early January, reflecting a modest 2% drop from December. Industry sentiment, however, remains upbeat as companies adapt to a shifting market.

US Miners Gains $4.5B in Just Two Weeks

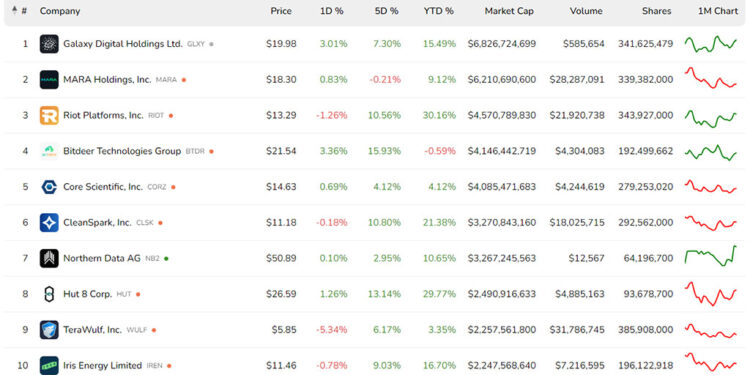

Market performance has also been robust, with the total market capitalization of the 14 US-listed miners covered by JPMorgan rising by 16%, or $4.5 billion, in the first two weeks of 2025. Among the standout performers, Riot Platforms (NASDAQ: RIOT) posted a 32% gain, while Bit Origin Ltd (NASDAQ: BTOG) followed the reverse track, logging over a 30% decline.

Source: Bitcoin Mining Stock

Apart from Riot Platforms, Cathedra Bitcoin (TSXV: CBIT) achieved a 25% year-to-date surge, According to Bitcoin Mining Stock, Bit Digital Inc (NASDAQ: BTBT) and Digihost Technology Inc (NASDAQ: DGHI) followed closely, recording gains of 23.90% and 23.33%, respectively. Meanwhile, CleanSpark Inc (NASDAQ: CLSK) recorded 21.38% year-to-date gains.

While some miners saw setbacks, overall, the broader sector remains on an upward trajectory. Data shows that the combined market capitalization of 31 publicly traded bitcoin mining firms currently stands at $44.09 billion, with 26 of these companies witnessing positive stock movement against the US dollar.

Bitcoin 144% Year-on-Year Growth Fuels Optimism

Bitcoin

BTC

$100 235

24h volatility:

3.7%

Market cap:

$1.97 T

Vol. 24h:

$87.38 B

has continued its steady climb, recording a 61% increase since the April 2024 halving event, a 51% rise since the US presidential election in November, and a stunning 144% growth year-on-year. These trends reflect a buoyant ecosystem where miners and investors alike are reaping rewards.

Publicly listed miners have also demonstrated significant strategic planning, collectively holding record reserves of over 92,473 BTC as of December 2024, according to TheMinerMag. Simultaneously, some firms are branching into high-performance computing and artificial intelligence hosting, signaling a diversification trend to strengthen long-term revenue streams.

Source: The Miner Mag

Despite an overall positive outlook, miners face hurdles tied to Bitcoin’s price remaining below the highly anticipated $100,000 threshold. Nonetheless, their upward stock momentum indicates confidence in the industry’s resilience. Core Scientific (Nasdaq: CORZ), for instance, experienced only a marginal decline of 0.06%, with an estimated revenue of $97,790,600.