Coinspeaker

Bitcoin’s 10% Crash Drops Active Wallets: Here’s Why Now Is Perfect Time to Buy BTC before 2025

With the crypto market liquidation reaching $1.1 billion in the last 24 hours, Bitcoin

BTC

$98 352

24h volatility:

3.2%

Market cap:

$1.95 T

Vol. 24h:

$81.69 B

and altcoins are falling rapidly. Bitcoin is down under $95K, and the total crypto market cap, excluding Bitcoin, is down by 18% this week to hit $1.27 trillion.

The ongoing short-term correction phase in the market has dropped the altcoin valuations by 22%, warning of a potential bear cycle. Will Bitcoin crash to $90K before 2025, and should you consider buying in this market?

Bitcoin Price Puts $90K as Potential Reversal Spot

In the 4-hour chart, the Bitcoin price trend shows an intense bearish correction at play. The BTC price has broken below the rising channel pattern in a step-wise correction with a lower low formation.

Furthermore, the downfall breaks below the 200 EMLI and the $95,000 support level. Currently, BTC is trading at $94,295, with a drop of 3.44% in the past 4 hours, creating a massive bearish engulfing candle.

The downfall crashes under the $94,400 support level and undermines the bullish dominance at this key level. Considering the downfall manages a closing below this support level, the bears are likely to continue the high-momentum run.

Based on the previous crucial price action levels, the crucial support levels for Bitcoin remain at $90,742 and $86,700. With the RSI line dropping into the oversold zone and the 20 and 100 EMA on the verge of giving a bearish crossover. Thus, the selling pressure is continuing to grow.

Hence, the BTC price will likely retest the $90,000 support level. However, with a shred of silver lining in the bear market, the number of active wallet data is projecting a chance to capture the best depth before 2025.

Here’s Why $90K Could Be the Best Buying Spot

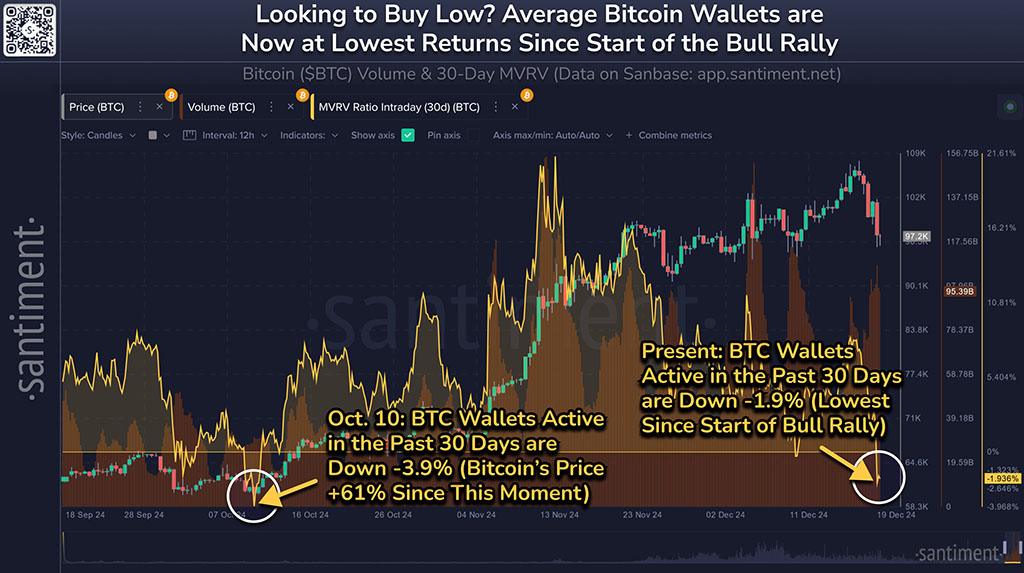

In a recent tweet by Santiment, the analytics firm shared a trading insight, suggesting looking beyond the prices when buying low or selling high. It suggests taking a look at the competing traders.

Bitcoin’s average returns, based on the wallets making at least 1 transfer over the past 30 days, have a -1.9% return. This is despite Bitcoin price reaching an all-time high just three days ago.

A negative MVRV, however, is often seen as a contrarian signal, hinting that the market may be undervalued. However, many traders are trapped at the top during the euphoric run.

There is no guarantee that we are at or near the exact local bottom. However, playing the probabilities with a dollar-cost average strategy could be an ideal way to enter the market during this phase of uncertainty.

Bitcoin’s 10% Crash Drops Active Wallets: Here’s Why Now Is Perfect Time to Buy BTC before 2025