Welcome to FT Asset Administration, our weekly e-newsletter on the movers and shakers behind a multitrillion-dollar world trade. This text is an on-site model of the e-newsletter. Subscribers can join here to get it delivered each Monday. Discover all of our newsletters here.

Does the format, content material and tone give you the results you want? Let me know: harriet.agnew@ft.com

One factor to begin: Farewell to John “Mac” McQuown, the true father of passive investing, who has died aged 90. It was McQuown’s “mixture of bullheadedness and brilliance” that proved the essential driver of the primary totally passive, index-tracking funding fund’s start in 1971, writes FT Alphaville.

And one other factor: HPS finds itself as one of the crucial sought-after belongings in one of the crucial sought-after markets. Don’t miss this in-depth tale of how a former Goldman Sachs banker constructed a $10bn personal credit score “whale” — and now might promote it to a sure giant US asset supervisor …

In in the present day’s e-newsletter:

-

BlackRock desires to speak about retirement. Local weather, not a lot

-

Tech increase forces US funds to dump shares to keep away from breach of tax guidelines

-

Traders clamour for funds that exclude China

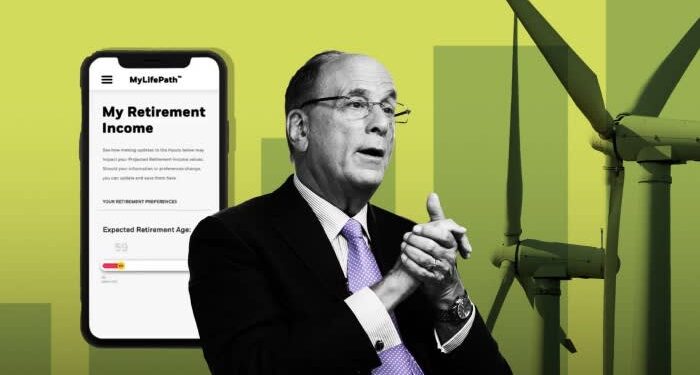

BlackRock adjustments the topic

Greater than two years after BlackRock ran right into a buzz noticed of criticism from US conservatives over its advocacy for sustainable investing, the world’s largest cash supervisor is trying to change the subject, writes Brooke Masters in New York.

Chief govt Larry Fink has not used the phrase “local weather” on an analyst name since January, and he talked about local weather, sustainability or the phrase inexperienced simply eight occasions — out of 11,000 phrases — in his carefully watched annual letter in March.

As of late, the $11.5tn asset supervisor is working arduous to focus on its pension and infrastructure choices. Fink headlined the March letter “time to rethink retirement” and used variations of the phrase “retire” 98 occasions. Again in 2020, he talked about retirement simply twice in his letter to shoppers, whereas sustainability and associated phrases appeared greater than 60 occasions.

BlackRock has been promoting its work on retirement in high-profile American political and monetary newsletters, together with campaigns this month in Semafor and the Monetary Instances’ sister publication Ignites.

The group has additionally been speaking extensively about its plans for World Infrastructure Companions, the choice asset supervisor that it bought for $12.5bn earlier this 12 months.

“It’s a sensible repositioning . . . an adaptation to a really US context,” stated Pierre-Yves Gauthier, founding father of analysis home AlphaValue.

BlackRock stated it was merely responding to what it heard from shoppers. The group reported file inflows and belongings below administration for the third quarter, and the share worth hit an all-time excessive earlier this month.

“We focus our world enterprise on the matters which are a very powerful to our shoppers and we evolve in anticipation of our shoppers’ wants. Over the previous 5 years, these have included sustainability, retirement and infrastructure, amongst others,” BlackRock stated, including that it had obtained practically $2tn in web new enterprise over that interval.

Tech increase forces US funds to dump shares to keep away from breach of tax guidelines

This 12 months’s lopsided inventory market rally has made it very difficult for lively fund managers reminiscent of Constancy and T Rowe Worth to outperform surging indices. It has additionally created one other problem: tax compliance.

In this article, my colleagues Nicholas Megaw and Will Schmitt in New York discover how giant funding funds are being compelled to dump shares to keep away from entering into hassle with the US tax authorities, because the rally has pushed them up in opposition to strict limits requiring them to take care of diversified portfolios.

The Inner Income Service requires that any “regulated funding firm” — which incorporates the overwhelming majority of mutual funds and trade traded funds — preserve the mixed weight of enormous holdings to lower than 50 per cent of their general portfolio. A big holding is something that accounts for greater than 5 per cent of belongings.

Traditionally, the restrict has primarily been a priority for specialist managers that run explicitly concentrated funds, however current features for the biggest US tech firms means stockpicking buyers that need to take even a barely obese place relative to an index in firms reminiscent of Nvidia and Microsoft are at risk of breaching the principles.

The pattern highlights the bizarre nature of the current market rally, which has pushed the S&P 500 and different indices to near-record ranges of focus. Simply 5 giant firms — Nvidia, Apple, Meta, Microsoft and Amazon — have contributed about 46 per cent of the year-to-date features for the S&P 500.

“It’s a really tough scenario for lively managers,” stated Jim Tierney, chief funding officer for concentrated US development at AllianceBernstein. “Usually having a place at 6 or 7 per cent of your portfolio is so far as most portfolio managers would need to push it for a enterprise you could have actual conviction in. The truth that would now be a impartial weight and even underweight, it’s an unprecedented scenario.”

Chart of the week

Traders are piling into rising market funds that exclude China regardless of a current blistering rally in Chinese language shares, amid issues over escalating tensions between Beijing and the west.

Funding corporations stated that shoppers more and more noticed the world’s second-biggest economic system as too giant or dangerous to handle alongside different creating economies reminiscent of India, resulting in one of many greatest shifts in rising markets investing in a long time.

Franklin Templeton grew to become the newest supervisor to launch a so-called ex-China rising markets car on Tuesday, including to a category of funds that has elevated belongings by 75 per cent this 12 months to greater than $26bn, in accordance with knowledge from Morningstar.

“When buyers are eager to keep away from a sure sector or area, the trade is completely happy to oblige,” stated Michael Discipline, European fairness strategist at Morningstar. “This has definitely been the case with funds which have excluded China from their make-up.”

China is classed because the world’s largest rising market, with its firms making up 1 / 4 of a benchmark MSCI index for developing-economy shares.

That weighting is down from a peak of greater than 40 per cent through the Covid pandemic. However it’s nonetheless thought of too giant by many buyers involved that it’s drowning out publicity to extra promising economies, or is saddling them with threat over tensions between China and the west.

This has led to “what is basically a brand new asset class” as buyers carve out Chinese language shares into separate allocations and construct portfolios that permit higher publicity to India, Taiwan and different markets, stated Naomi Waistell, a portfolio supervisor at Polar Capital, which additionally has an ex-China fund.

Ex-China fairness funds have obtained $10bn of web inflows to this point this 12 months, in accordance with JPMorgan — outstripping the full sum of money that has gone into broader rising market fairness funds. The variety of such funds globally has practically doubled to 70 up to now two years, in accordance with Morningstar knowledge.

5 unmissable tales this week

Franklin Templeton is battling the worst quarter for outflows in its historical past, as reputational injury and poor returns spurred tens of billions of {dollars} of withdrawals from its fixed-income enterprise Western Asset Administration.

Millennium Administration is contemplating launching its first fund because it was based greater than three a long time in the past in a bid to focus on much less liquid belongings, together with personal credit score.

Business property’s second of fact. Rates of interest have peaked and exercise in a number of sectors is choosing up. Is the storm now over for the battered industrial property sector, or is the worst yet to come?

The ultimate guide to carried curiosity: personal fairness’s tax break. The lower-taxed efficiency payment has helped buyout corporations’ executives amass private fortunes and is now going through a clampdown from the Labour occasion.

Conscious Tremendous, certainly one of Australia’s largest pension funds, and property group Delancey plan to invest up to £1bn in central London offices in a giant wager on a sector hit by excessive rates of interest and questions over post-pandemic demand.

And at last

Tim Burton grew up in Burbank, California, a homogenous suburban American neighbourhood so bland that it compelled him to flee. The Design Museum in London is the ultimate cease on the tour of a major exhibition of 500 drawings, work, images, sketchbooks, moving-image works, and sculptural installations. Immerse your self in Burton’s fantastical world.

Thanks for studying. When you have buddies or colleagues who would possibly get pleasure from this text, please ahead it to them. Sign up here

We’d love to listen to your suggestions and feedback about this text. E-mail me at harriet.agnew@ft.com