Key Notes

- The hedge fund submitted its Q2 Form 13F on the final deadline day, revealing unexpectedly large Bitcoin exposure through multiple IBIT entries.

- Bitcoin recently crashed from $124,500 all-time high to $116,800, triggering over $1 billion in market-wide liquidations before recovering.

- BlackRock’s IBIT remains the largest Bitcoin ETF with $88 billion AUM, while institutional flows suggest potential altseason beginning.

Brevan Howard, often described as one of the largest “macro hedge funds” in the world, disclosed a stake of $2.30 billion in BlackRock‘s iShares Bitcoin Trust ETF on August 15, reportedly accounting for over 20% of its portfolio. The disclosure comes while BTC tanks in price, retracing back to $117,000 after making a new all-time high above $124,500.

Notably, the multi-billion-dollar hedge fund waited until the last day to submit its 2025 Q2 Form 13F to the Securities and Exchange Commission (SEC) of the United States, containing the surprisingly high allocation in BlackRock’s Bitcoin ETF. Form 13F is a quarterly report for institutional investment managers that exercise investment discretion over $100 million and must be presented within a maximum of 45 days after the end of each calendar quarter—which ended on June 30.

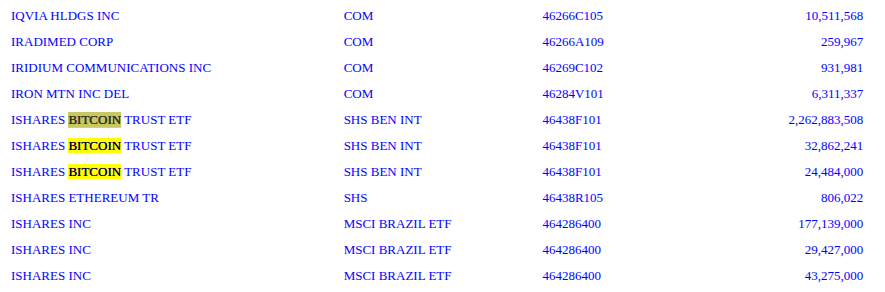

The filings reveal three separate entries for the iShares Bitcoin Trust ETF (IBIT) totaling $2.26 billion, $32.86 million, and $24.48 million. Additionally, the documents show an $800,000 allocation in the iShares Ethereum Trust ETF (ETHA).

Brevan Howard SEC FORM 13F INFORMATION TABLE | Source: SEC Archive

According to a post by LuxAlgo on X, this position represents 21.84% of Brevan Howard’s portfolio, followed closely by BlackRock Trust Fund II (IVVB), with 17.91%.

$20B Hedge Fund Brevan Howard has over 20% of their portfolio in spot Bitcoin ETFs.

Are you paying attention? $BTC 👀 pic.twitter.com/H8wVNLcJPD

— LuxAlgo (@LuxAlgo) August 15, 2025

Bitcoin Price Analysis and ETF Performance

As of this writing, Bitcoin

BTC

$117 816

24h volatility:

0.8%

Market cap:

$2.35 T

Vol. 24h:

$38.75 B

is trading at $177,400, slightly recovering after a crash down to $116,800. This crash affected the entire crypto market, triggering over $1 billion in liquidations, as CoinSpeaker reported. Before the recent move down, BTC had reached a new all-time high against the dollar of $124,500.

Bitcoin (BTC) 1D Price Chart vs. US Dollar (USD) | Source: TradingView

Interestingly, BlackRock’s Bitcoin ETF, IBIT, is the largest institutional product for the leading cryptocurrency, currently with over $88 billion AUM. BlackRock’s Ethereum ETF, ETHA, is also ETH’s largest ETF, with over $15 billion AUM.

Analysts have been talking about signals that an altseason has started in the cryptocurrency market, including a massive inflow for Ethereum ETFs on August 11, registering over $1 billion against Bitcoin ETFs’ nearly $200 million, suggesting institutions could be rebalancing their portfolios.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.