One beleaguered enterprise to start out: Tim Sheehy, the Republican set to show Montana and the US Senate crimson, has racked up $180mn of losses in his final 5 and a half years operating the Nasdaq-listed aerial firefighting firm Bridger Aerospace.

Welcome to Due Diligence, your briefing on dealmaking, personal fairness and company finance. This text is an on-site model of the e-newsletter. Premium subscribers can join here to get the e-newsletter delivered each Tuesday to Friday. Normal subscribers can improve to Premium here, or explore all FT newsletters. Get in contact with us anytime: Due.Diligence@ft.com

In immediately’s e-newsletter:

-

How excessive will taxes on carried curiosity go?

-

The way forward for Naspers and Prosus

-

EQT gears up for $10tn consolidation wave

The battle for carried curiosity

The UK’s 3,000-strong membership of senior personal fairness dealmakers who earn carried curiosity are hoping that chancellor Rachel Reeves will put an finish to their struggling on Wednesday.

Buyout executives have endured 4 months of anticipation for the reason that launch of Labour’s election manifesto, which argued the trade was the one one “the place performance-related pay is handled as capital good points”, quite than revenue, which is taxed at a better fee.

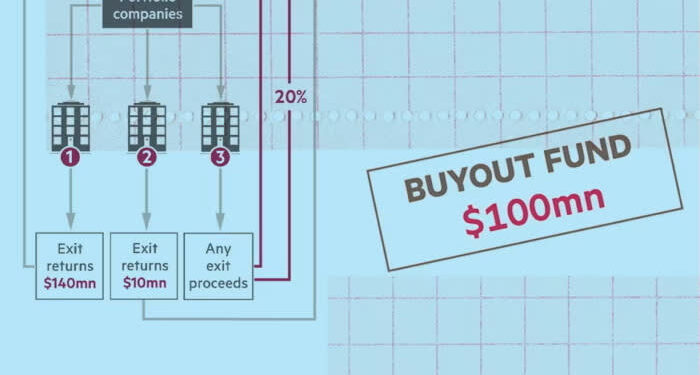

Carried curiosity — the share of earnings executives get to maintain on profitable offers — is complicated. That’s why DD’s Alexandra Heal took it upon herself to put in writing an in-depth explainer breaking it all down, with visuals by the FT’s Cleve Jones.

After an intense lobbying campaign, buyout executives are actually hoping the tax fee on carry will improve by just a few share factors from its present 28 per cent fee, as an alternative of the much-feared high revenue fee of 45 per cent.

“Having come out with the statements they made earlier than the election, the Labour authorities should do one thing however I believe they’ve realised that their thought of taxing carry as remuneration will not be so simple as it sounded,” Yash Rupal, head of UK tax at legislation agency Simpson Thacher & Bartlett, informed DD.

If Rupal’s prediction comes true, a well-resourced lobbying effort from the British Non-public Fairness & Enterprise Capital Affiliation may have been largely accountable.

They weren’t alone. Regulation agency Macfarlanes printed an evaluation displaying the quantity of tax paid by personal fairness managers. The outcomes had been supposed to indicate {that a} harsh crackdown might spark an exodus.

However one rival PE lawyer argued that strategy had “backfired” by drawing consideration to the massive sums of cash earned by carried curiosity.

Reeves is strolling a political tightrope. The left-leaning authorities is intent on displaying it cares about inequality, whereas it’s additionally determined for personal funding within the UK.

The stakes are excessive, with high PE executives raking in thousands and thousands of kilos by the scheme.

Even within the remaining hour, new analysis is coming in: a research out this morning exhibits the highest 100 carry recipients within the UK racked up a mean of £90mn every over the seven years to 2023.

Naspers’ new chief plots future past Tencent

The prospect of a $100mn payday may be massively motivating.

That’s the reward Fabricio Bloisi, the brand new head of South Africa’s Naspers group and its Amsterdam-listed funding arm Prosus, stands to make if he efficiently brings the latter’s market worth up considerably by mid-2028.

(He’ll be paid the $100mn in Naspers and Prosus shares if a $168bn market worth is maintained for a 12 months.)

Bloisi informed the FT that he plans to overhaul company tradition and remuneration to satisfy to satisfy the formidable four-year goal. For a way of simply how difficult that is perhaps: the corporate’s market worth is presently hovering round $105bn.

Prosus is the largest shareholder in Chinese language web large Tencent, however for years has been residing in its shadow. The group’s shares have traded at a reduction to its $115bn stake within the Chinese language firm — valuing the remainder of its different international holdings at principally nothing.

“I’m right here to do the subsequent Tencent,” Bloisi mentioned.

Prosus has already been on the prowl. It spent the previous a number of months finding out a takeover bid for Supply Hero, the German meals supply app, two folks with direct data of the matter informed DD.

Prosus owns a 29 per cent stake within the firm alongside iFood and India’s Swiggy, and is already acquainted with the sector. In 2019 it tried a hostile bid for the UK’s Simply Eat earlier than it merged with Takeaway.

However a rally in Supply Hero’s shares to a market worth of almost €12bn and the corporate’s efforts to spin out its profitable Center East arm have cooled Prosus’s plans.

Bloisi declined to touch upon dealmaking, however mentioned that he sought to make sure Prosus’s meals supply corporations “co-operate extra collectively” as he sees the phase rising for years to return. Supply Hero additionally declined to remark.

A part of Bloisi’s imaginative and prescient is that workers must take extra dangers. He needs to create a better threat, greater reward entrepreneurial spirit at Prosus. And to perform that, pay will probably be carefully linked to outcomes.

“Prosus was not constructing the longer term because it might, and that’s what’s going to occur,” he mentioned.

EQT will get prepared for a consolidation wave

Swedish personal fairness group EQT and the highly effective industrialist household, the Wallenbergs, go way back.

In the course of the period of KKR’s notorious takeover of RJR Nabisco, the Wallenbergs despatched a younger Swedish government to the US to see how Wall Avenue labored.

He returned with a pitch. Why not create a European personal fairness agency? The highly effective household agreed to again the enterprise.

Three many years later, EQT has secured the title of Europe’s largest publicly traded buyout group, with €246bn in belongings beneath administration.

After going public in 2019 as a part of a method to make use of its public inventory as a foreign money for dealmaking, the group is now gearing up for what it sees because the sector’s subsequent chapter.

EQT is predicting the $10tn personal capital trade may have a wave of consolidation within the coming years, as smaller corporations or these going through succession challenges promote to bigger rivals.

Chief government Christian Sinding informed DD’s Antoine Gara that the group is finding out so-called secondaries corporations that purchase personal fairness fund stakes, growth-oriented funding corporations and people with a distinct segment focus in healthcare.

EQT has expanded by offers earlier than. In 2021, the group purchased Exeter Property Group, a big supervisor of commercial warehouses. Then a 12 months later, it acquired Barings Non-public Fairness Asia for €6.8bn, securing an even bigger presence in Asia.

In the meantime, the Wallenbergs — which nonetheless have a minority stake within the personal fairness group and are behind main corporations comparable to Ericsson, ABB, AstraZeneca and Saab — have begun making ready for their very own transition.

The household is on the brink of hand power to the sixth generation because it considers 30 kin for its succession planning. And for the primary time, ladies are within the combine.

Job strikes

-

Linklaters has employed David Lucking, John Hwang, Derek Poon and Dan Guyder to hitch the agency’s finance group as companions in New York from A&O Shearman.

-

Manchester United has fired supervisor Erik ten Hag after a poor begin to the season. The dismissal comes lower than a 12 months after UK billionaire Sir Jim Ratcliffe acquired a 27 per cent stake within the membership.

-

Olympus head Stefan Kaufmann has been pushed out over allegations he bought unlawful medication, in a stunning exit for one among Japan’s few overseas chief executives. Yasuo Takeuchi, the Japanese medical machine maker’s chair, will fill the position as the corporate weighs its choices.

-

Simpson Thacher has named Dave Azarkh and Alexandra Kaplan as co-heads of the agency’s international funding banking observe.

Sensible reads

Firm lifers Nike introduced again Elliott Hill from retirement to be its chief government final month, and with him a lifetime of expertise — he began out on the shoemaker as an intern. Whereas firm lifers can enhance morale, they will additionally carry risks, the FT writes.

Feared fund Elliott Administration is the busiest hedge fund left within the more and more sparse world of shareholder activism, Bloomberg reviews. And it’s not letting up.

Difficult M&A Deal negotiations are tough in the perfect of occasions, Lex writes. Navigating distressed debt hedge funds takes the ache to another level.

Information round-up

Boeing launches $19bn share sale to bolster finances and avoid downgrade (FT)

Volkswagen plans to close at least 3 German plants and cut thousands of jobs (FT)

BT explores sale of Radianz unit as part of overhaul (FT)

Wise chief executive fined £350,000 over ‘tax issues’ (FT)

EssilorLuxottica backs Del Vecchio as hacking probe escalates (FT)

Douglas Elliman board pushed for CEO Howard Lorber’s exit amid culture concerns (WSJ)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please ship suggestions to due.diligence@ft.com