Securing funds to build from the ground up requires planning beyond traditional lending, and that is where construction financing becomes essential. Whether you’re developing a home or a commercial property, understanding how a construction loan works helps you anticipate cash needs, lender expectations and approval hurdles. With the right preparation, borrowers can reduce risk, speed approvals and move confidently from initial concept through completion before engaging contractors, finalizing designs or requesting funds from lenders early in the process.

What Is Construction Financing?

Construction financing refers to short-term funding used to cover the costs of building or significantly renovating a property. Unlike permanent mortgages, funds are released in stages as work progresses. This structure allows lenders to monitor risk, verify progress and ensure borrowed capital directly supports approved construction activities rather than unrelated expenses or uncontrolled project changes during active construction periods only.

- Borrower submits preliminary plans, cost estimates and qualifications to a lender, who evaluates feasibility, credit strength and project viability before issuing a conditional construction financing approval and outlining loan terms.

- After approval, detailed construction documents are finalized, including budgets, schedules and contracts, allowing lenders to confirm scope, risk controls and draw structures before releasing initial funds for project startup activities.

- Funds are disbursed in controlled draws tied to inspections and milestones, ensuring completed work matches plans, costs align with forecasts and loan exposure remains proportional to verified construction progress onsite.

- Once construction finishes, final inspections confirm completion, remaining funds are released and the construction loan typically converts into permanent financing or is repaid through long-term refinancing arrangements with approved lenders.

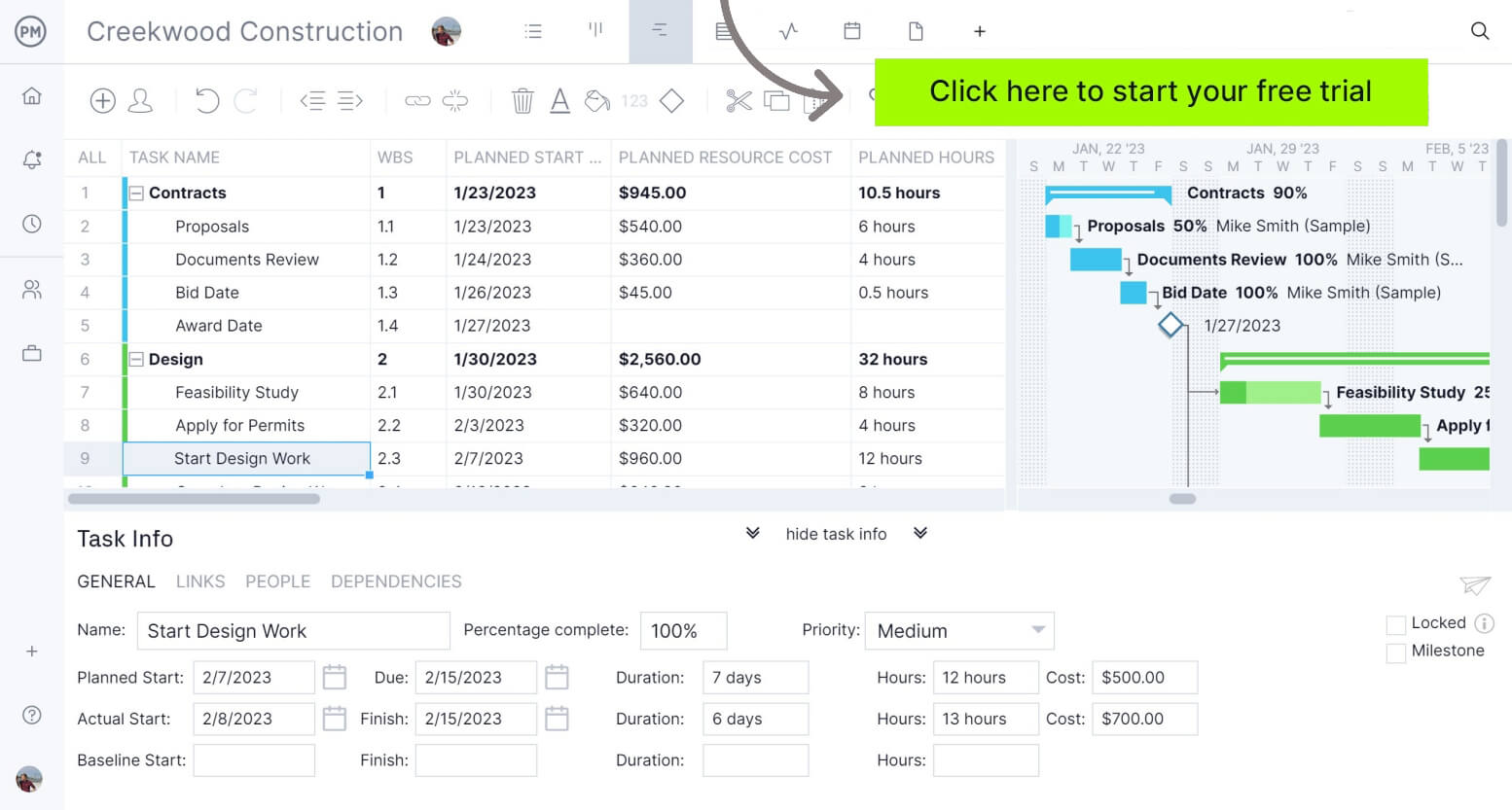

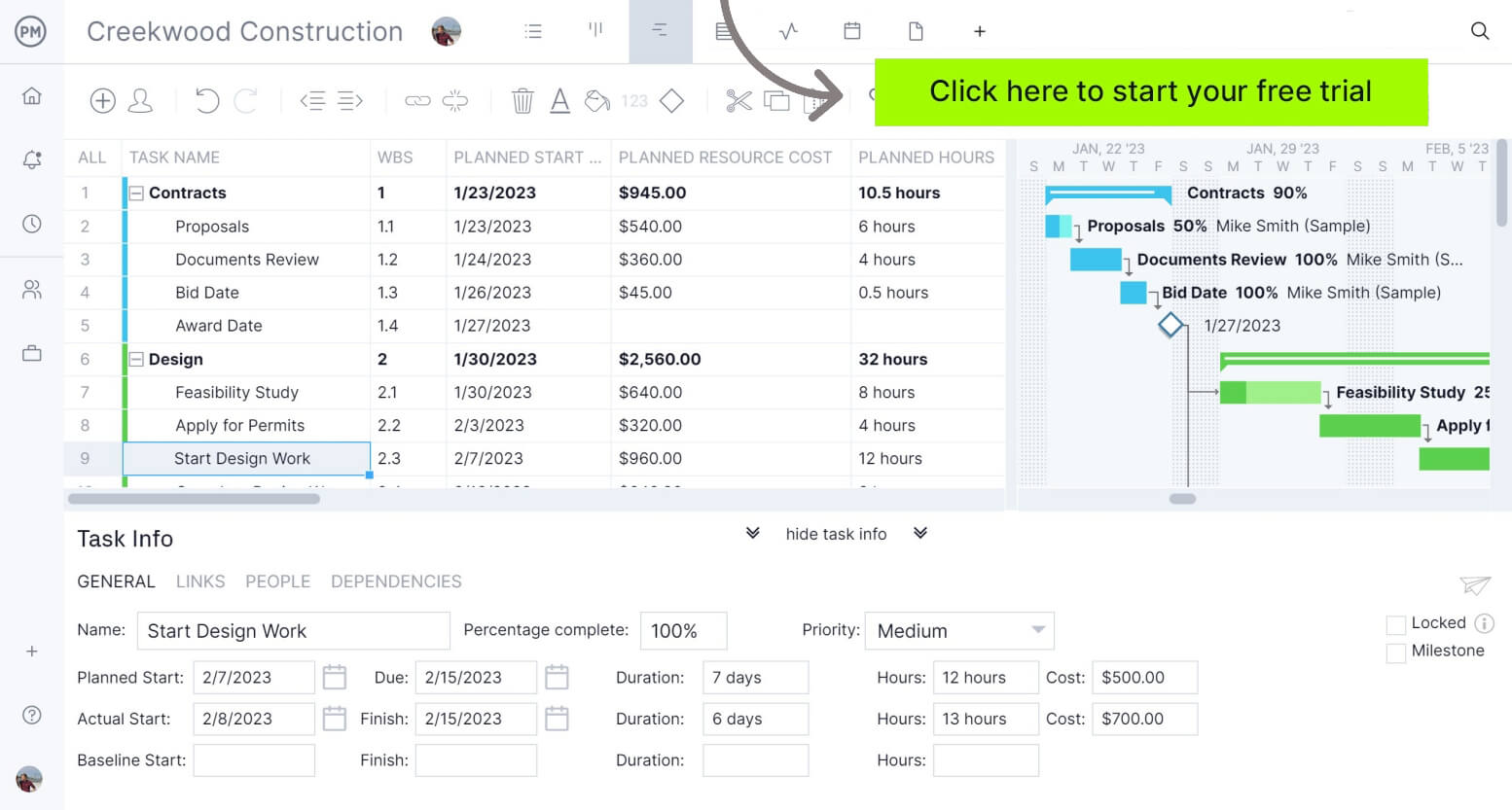

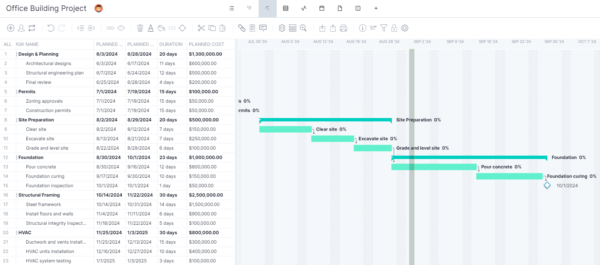

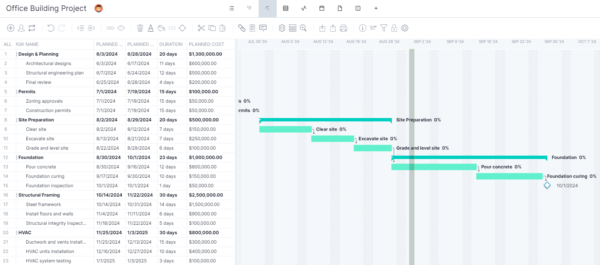

ProjectManager has built-in resource management tools that allow construction teams to set up and manage project budgets from the start. Use the Gantt chart, for example, to track planned versus actual costs for labor, equipment, materials and more. It acts as a living financial plan that helps ensure your project stays on budget and highlights overspending before it becomes critical. Get started with a free 30-day trial.

Who Provides Construction Financing?

Construction financing is offered by a range of lenders, each with different risk tolerances, approval criteria and project preferences. Knowing who provides construction loans helps borrowers target the right institutions, align expectations early and avoid applying to lenders that are not a good fit.

Traditional Banks

Commercial and retail banks are among the most common sources of construction financing. They offer competitive interest rates but apply strict underwriting standards, requiring strong credit, detailed documentation and proven contractors to minimize risk during the construction phase.

Credit Unions

Credit unions provide construction loans with a more relationship-driven approach. While loan products may be limited, they often offer flexible terms, lower fees and personalized service, particularly for residential projects and borrowers with established membership histories.

Private and Hard Money Lenders

Private lenders focus on asset value and project potential rather than borrower credit alone. They fund construction loans quickly but charge higher interest rates and shorter terms, making them suitable for time-sensitive projects or borrowers excluded from traditional lending.

Government-Backed Loan Programs

Programs backed by government agencies support construction financing for qualified borrowers. These lenders follow specific guidelines, offer lower down payments and expanded eligibility, and are commonly used for owner-occupied residential construction projects meeting program standards.

Get your free

Construction Budget Template

Use this free Construction Budget Template to manage your projects better.

What Is a Construction Loan?

A construction loan is a short-term loan designed to finance the building phase of a project. Instead of providing a lump sum, lenders release funds in stages based on progress inspections. Interest is typically charged only on drawn amounts, and the loan is repaid or refinanced once construction is complete and transitions into permanent financing when the lender approves it.

Types of Construction Financing

Not all construction projects require the same financing structure, and lenders offer multiple options to match risk, scale and borrower experience. Understanding these construction financing types helps borrowers choose funding, anticipate requirements and avoid structures creating delays or refinancing problems.

Stand-Alone Construction Loans

A stand-alone construction loan provides funding solely for the build phase and must be repaid or refinanced after completion. It does not automatically convert into a permanent mortgage. Borrowers secure separate long-term financing later, making approval standards, timelines and interest rates distinct from combined construction-to-permanent loan products offered by lenders.

This loan works best when borrowers expect improved credit, plan to sell the property after completion or want flexibility to shop financing later without being locked into a single lender.

Construction-to-Permanent Loans

Construction-to-permanent loans combine short-term construction financing with long-term mortgage financing in a single loan. Funds are drawn during construction, then automatically convert to a permanent mortgage after completion. This structure simplifies approval, locks interest terms early and eliminates the need for separate refinancing once the project is finished successfully overall.

It suits borrowers seeking predictability, fewer closings and lower refinancing risk, especially homeowners planning to occupy the property long term and wanting stable payments immediately after construction ends fully completed.

Related: 39 Construction Documents (Templates Included)

Owner-Builder Construction Loans

Owner-builder construction loans finance projects where the borrower acts as their own general contractor. Lenders assess experience, licensing and project controls more strictly due to higher risk. These loans fund labor, materials and subcontractors while requiring detailed oversight, documentation and inspections to ensure construction quality, cost control and timely completion.

This option fits experienced builders constructing their own property, willing to manage trades directly and accept stricter lender scrutiny in exchange for greater control over costs and execution responsibilities involved.

FHA Construction Loans

FHA construction loans are government-backed loans insured by the Federal Housing Administration that finance construction and permanent housing together. They follow FHA guidelines, allow lower down payments and flexible credit requirements, but require approved contractors, strict inspections and compliance with federal property standards throughout the building process for all projects.

They are best for owner-occupants with limited cash, moderate credit profiles and residential projects that meet FHA standards while prioritizing affordability and long-term homeownership stability goals and eligibility requirements fully.

VA Construction Loans

Reserved for eligible veterans, active-duty service members and certain spouses, VA construction loans are government-backed loans that finance residential construction with favorable terms. They often require no down payment, limit closing costs and follow strict appraisal, inspection and builder approval standards set by the Department of Veterans Affairs.

This option works best for qualified borrowers building a primary residence who want reduced upfront costs and long-term affordability without the burden of private mortgage insurance requirements.

Hard Money Construction Loans

Hard money construction loans are asset-based loans issued by private lenders rather than banks. Approval focuses primarily on property value and project potential instead of borrower credit. These loans carry higher interest rates, shorter terms and faster funding timelines to accommodate higher lending risk.

They are typically used when speed matters, credit is limited or traditional lenders decline the project, such as short-term developments, fix-and-flip builds or time-sensitive opportunities.

How to Obtain a Construction Loan

Before approaching lenders, borrowers need more than a strong idea and available land. Construction loans are approved through a structured process that evaluates financial strength, project clarity and execution risk, making preparation just as important as the loan terms themselves.

1. Assess Your Construction Financing Needs

Every construction project has unique funding requirements based on size, complexity and delivery method. Start by determining whether financing must cover land acquisition, soft costs and contingencies, or strictly construction expenses. Clarifying total funding needs early helps prevent underborrowing, mismatched loan structures and approval delays later in the process.

2. Check Your Financial Readiness

Lenders closely examine personal and business finances to gauge repayment risk. Credit history, income stability, liquidity and existing debt obligations all influence approval. Reviewing financial readiness in advance allows borrowers to correct issues, increase reserves or adjust project scope before formally applying for a construction loan.

3. Prepare Construction Plans and Specifications

Detailed construction plans demonstrate that the project is fully thought through and buildable. Lenders rely on drawings and specifications to assess feasibility, cost accuracy and inspection benchmarks. Incomplete or conceptual plans increase perceived risk and often delay approvals or result in reduced loan amounts.

4. Make a Construction Project Budget

Accurate budgeting turns a concept into a financeable project. Lenders expect a detailed budget that accounts for hard costs, soft costs and contingencies, not rough estimates. A well-structured construction project budget shows cost awareness, supports draw schedules and reduces concerns about overruns that could stall progress or jeopardize repayment.

5. Create a Construction Schedule

Timing plays a major role in lender risk assessment. A realistic construction schedule outlines phases, milestones and inspection points that align with funding draws. By demonstrating how work will progress over time, borrowers help lenders validate feasibility, anticipate cash needs and monitor whether the project stays on track.

6. Gather Required Project Documentation

Construction loan lenders care about project management documentation because it proves the project is clearly defined, controlled and realistic. These documents reduce uncertainty, demonstrate professional planning and show how risks, costs and responsibilities will be managed. Strong documentation lowers lender risk and increases confidence that funds will be used properly.

- Scope of work: A scope of work defines exactly what construction activities, materials and deliverables are included or excluded from the project. Lenders rely on it to prevent scope creep, clarify responsibilities and ensure the loan amount aligns with a clearly defined work scope.

- Technical drawings: Technical drawings translate the project scope into detailed visual plans covering architecture, structure and systems. Lenders use them to validate feasibility, confirm costs and timelines, assess complexity and ensure the proposed construction meets codes, standards and permitting requirements accurately and consistently.

- Bill of quantities: A bill of quantities itemizes materials, labor and quantities required to complete the project. It gives lenders transparency into cost assumptions, supports budget accuracy, helps validate draw schedules and reduces the risk of underestimated or missing construction costs overall exposure.

- Risk management plan: A risk management plan identifies potential construction risks such as delays, cost overruns and supply issues, along with mitigation strategies. Lenders value it because it shows foresight, preparedness and a clear approach to minimizing disruptions that could impact loan repayment.

- Cash flow forecast: Cash flow forecast maps when construction costs will be incurred and when loan funds will be drawn throughout the project. Lenders use it to align disbursements with progress, ensure liquidity, manage draw risk and confirm the borrower can meet obligations.

- Licenses and permits: Licenses and permits document shows that the project is legally authorized and compliant with local regulations. Lenders require it to avoid legal delays, stoppages or fines that could halt construction, disrupt schedules and threaten timely completion and loan repayment risk.

- Insurance certificates: Insurance certificates confirm that appropriate coverage is in place for property damage, liability and worker injuries. Lenders rely on them to protect collateral, limit exposure to claims and ensure unforeseen incidents do not jeopardize project completion or loan recovery security.

- Procurement plan: Procurement plan outlines how and when materials, equipment and subcontractors will be sourced. Lenders use it to assess supply chain risk, lead times and cost certainty, reducing the likelihood of delays, shortages or price volatility affecting the project schedule delivery.

7. Submit a Construction Loan Application

Once documentation is complete, the application formalizes the lender review process. This step combines financial records, project plans and legal disclosures into a single evaluation package. Clear, consistent information improves underwriting efficiency, shortens approval timelines and minimizes follow-up requests that could delay funding.

Free Construction Project Management Templates

We’ve created dozens of construction project management templates for Excel, Word and Google Sheets you can download for free.

Construction Scope of Work Template

Designed to bring clarity early, this construction scope of work template helps project managers outline project tasks, timelines, resource requirements and estimated costs, reducing ambiguity and setting clear expectations for all stakeholders involved.

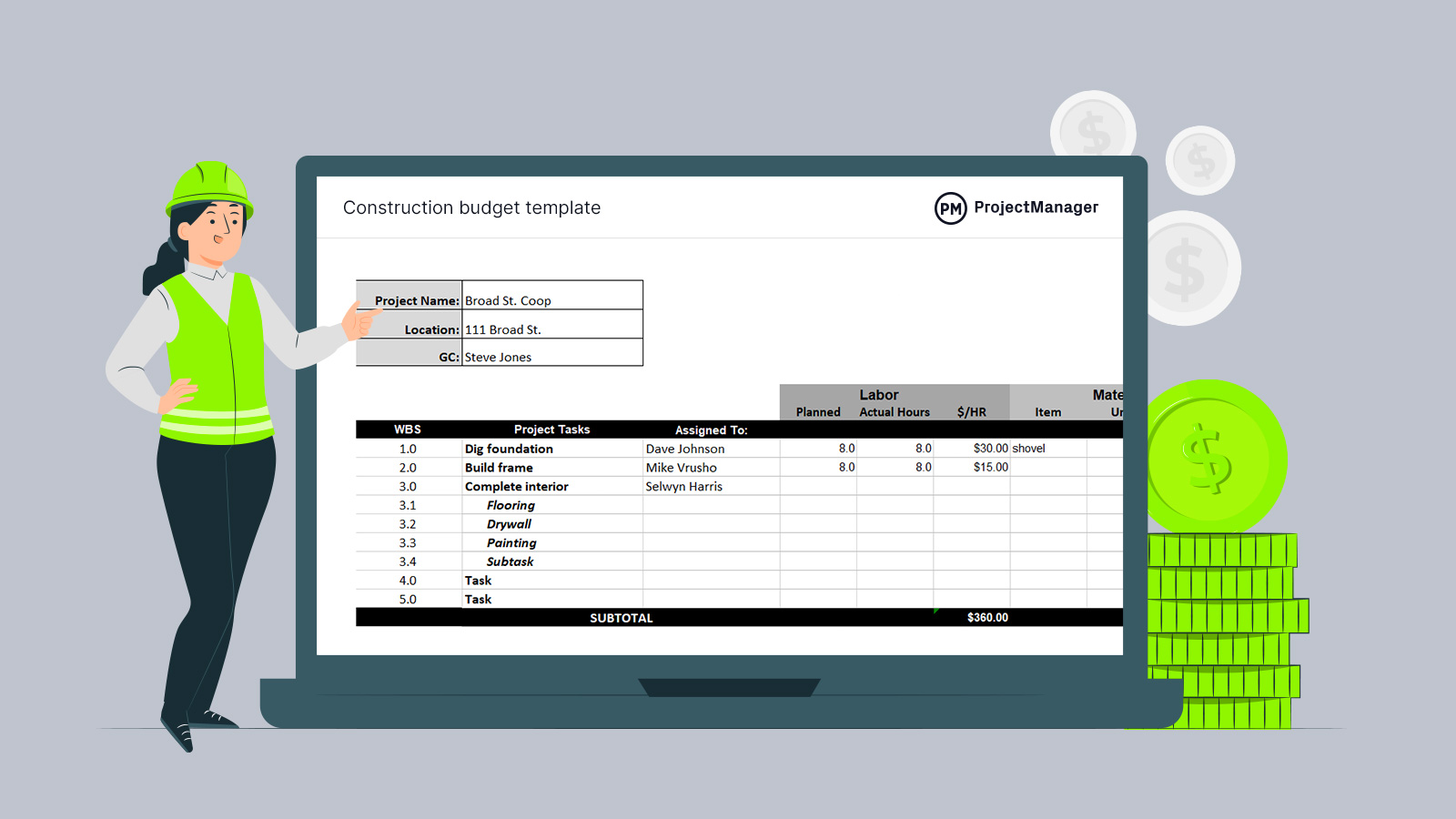

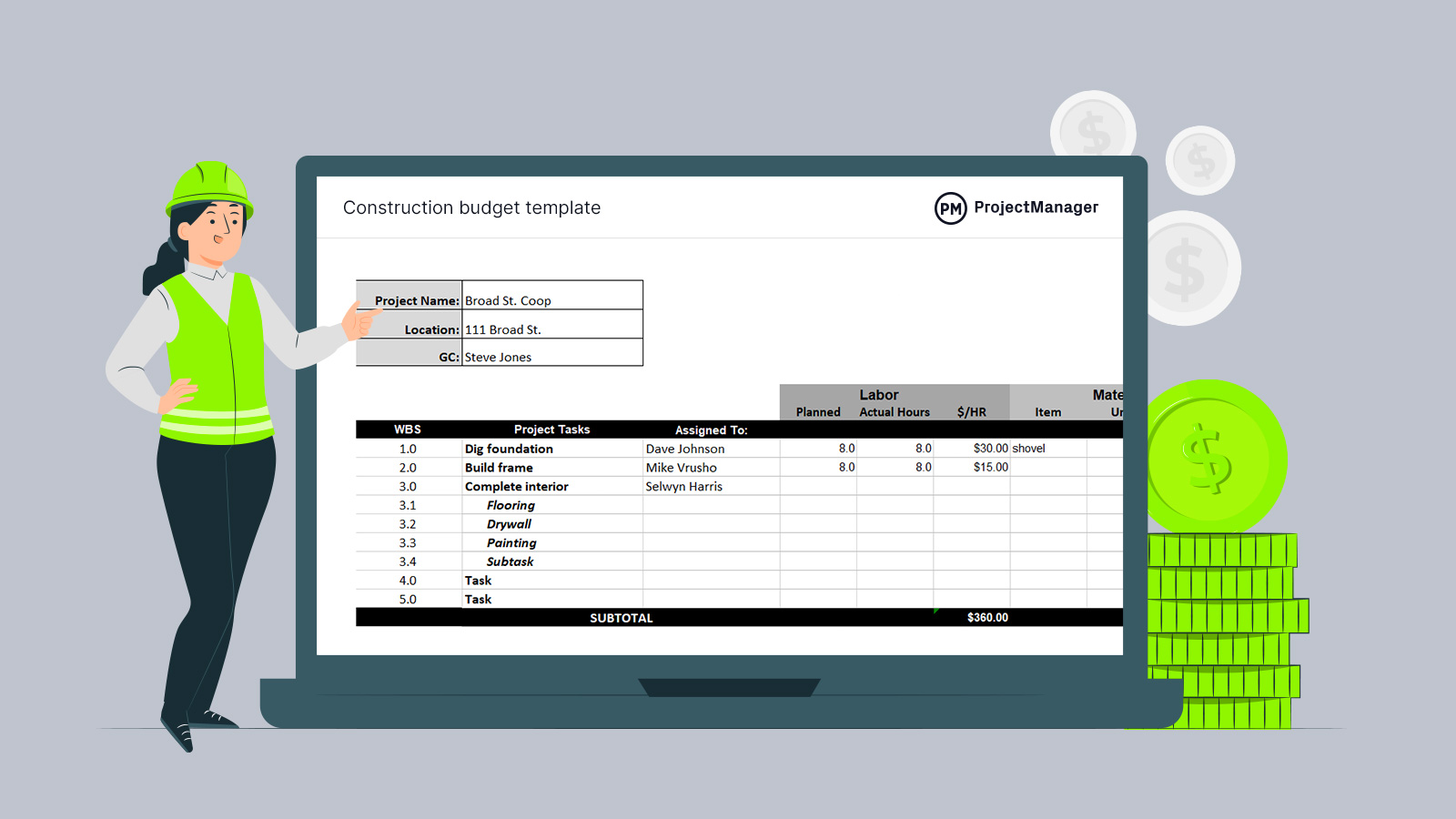

Construction Budget Template

Built for cost visibility, this construction budget template for Excel helps teams break down labor, materials and equipment expenses while tracking planned versus actual costs using automated formulas that support tighter financial control throughout construction.

Construction Schedule Template

Planning construction timelines becomes easier with this schedule template, which uses Gantt chart functionality to map task dependencies, critical paths and resource allocation, helping teams visualize progress and manage sequencing more effectively.

How ProjectManager Helps Obtain a Construction Loan

Construction teams deserve software designed to help track costs, create budgets and support financial visibility on construction projects. ProjectManager’s award-winning software has project views like the Gantt chart, task list, sheet, calendar and kanban board that all update with the latest project data.

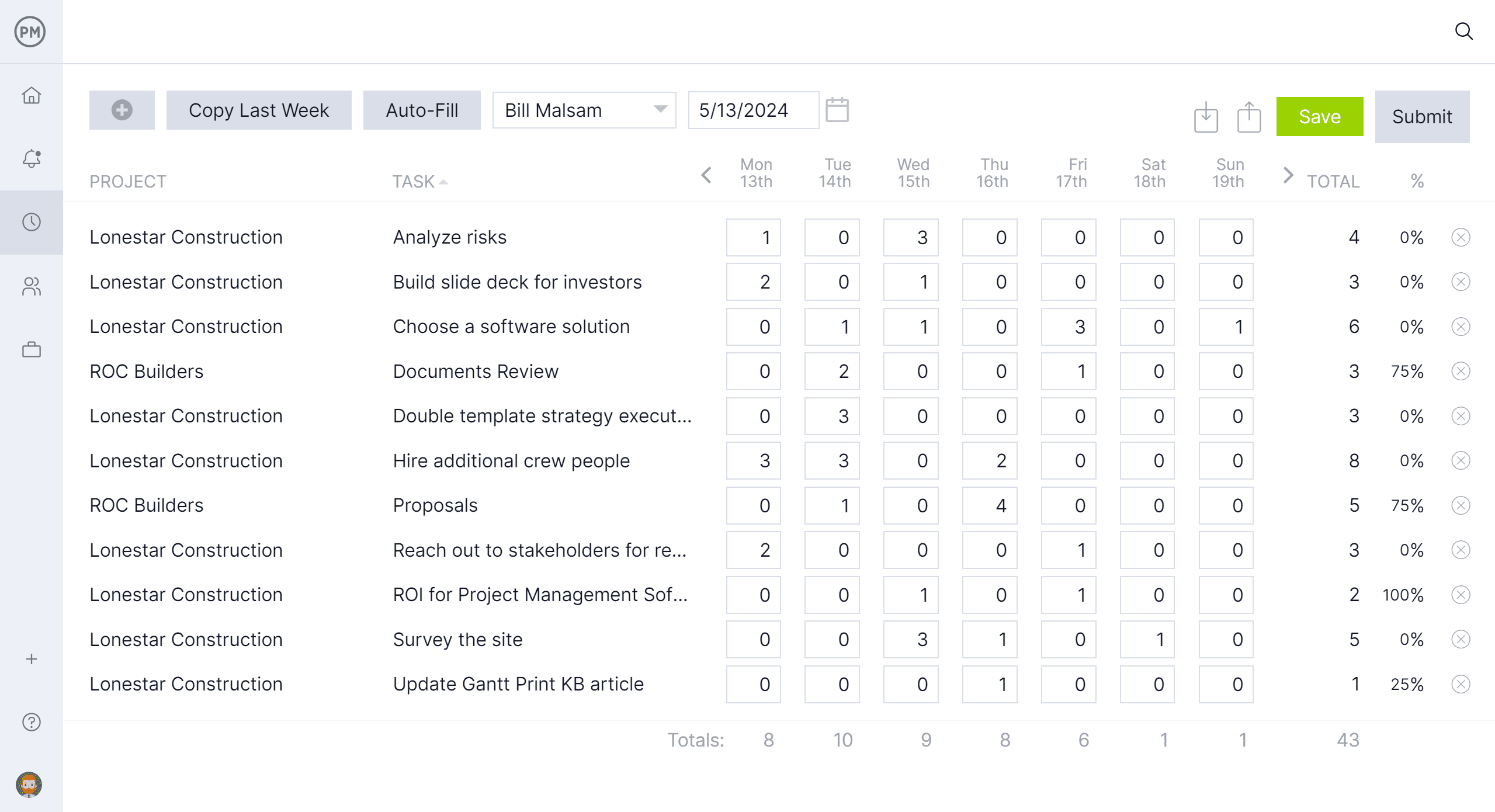

Timesheets Inform Cost Tracking

As teams log their hours on our built-in timesheets, whether from the field or in an office, this data feeds directly across the software to ensure everyone is aligned. As accurate labor cost tracking is often one of the biggest cost drivers in construction, this is essential documentation. It informs things like cost audits, invoices and payroll reconciliation.

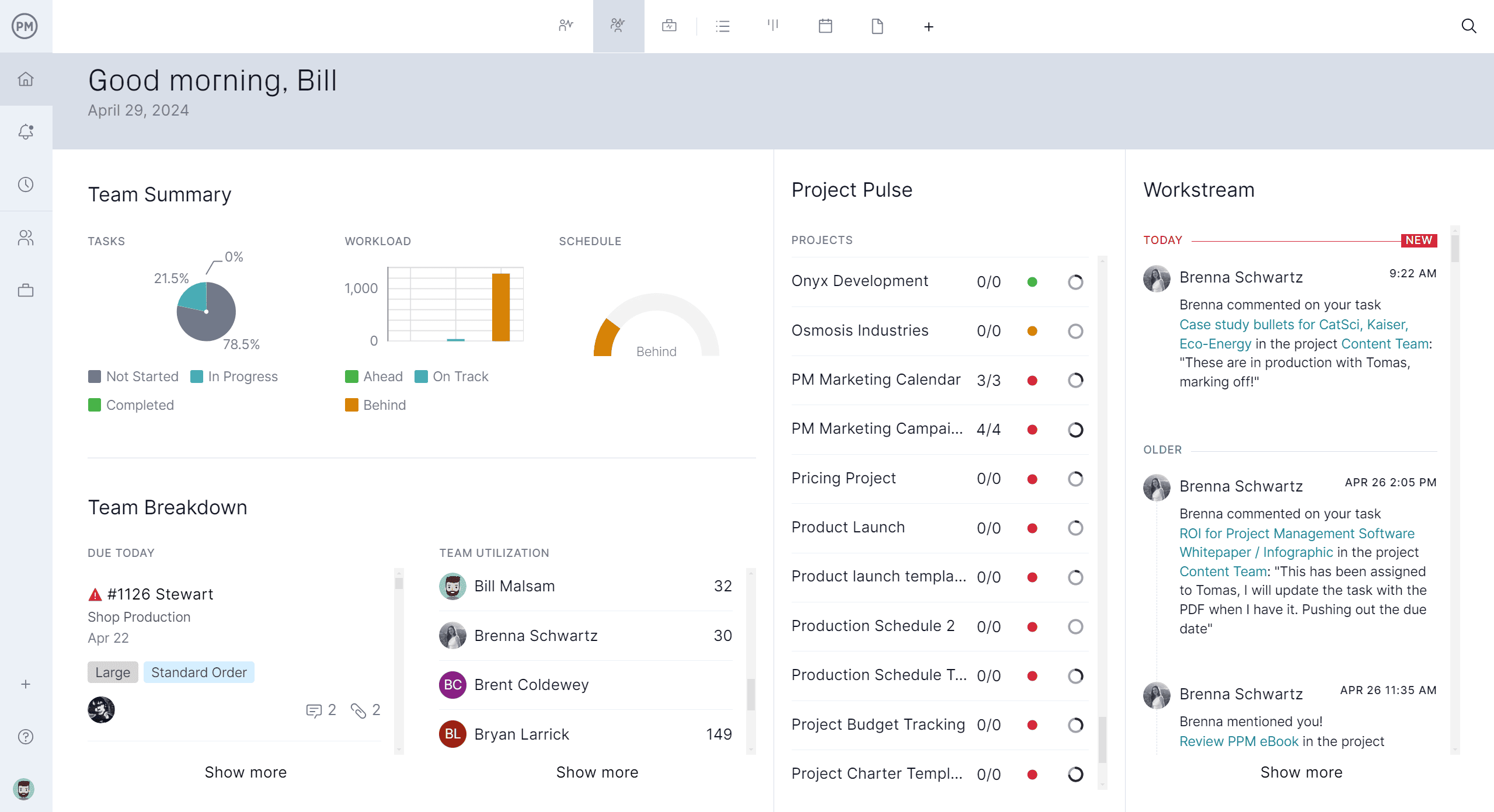

Real-Time Dashboards Aggregate Financial Data

For a high-level overview of how projects or portfolios are progressing, take advantage of our dashboards. At a glance, you can see updates on budget status, equipment expenses and labor costs. This provides stakeholders with immediate insight into financial health. It also highlights budget variances and spending trends without manual reporting. Then, in a few clicks, generate custom reports and share them with stakeholders.

Related Construction Project Management Content

ProjectManager is online construction project management software that connects teams, whether they’re in the office or on the job site. They can share files, comment at the task level and stay updated with email and in-app notifications. Get started with ProjectManager today for free.