Coinspeaker

Crypto Inflows Surge with $436 Million as Rate Cut Speculation Intensifies

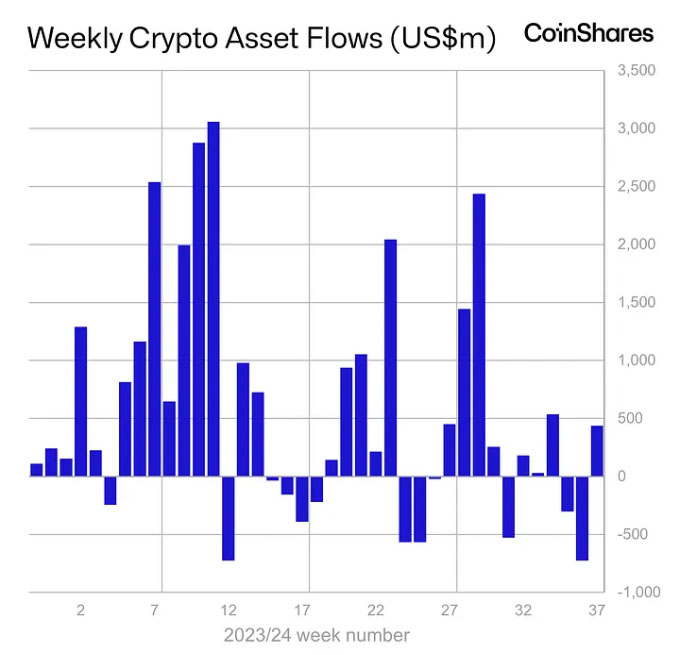

The crypto market skilled a sudden change after weeks of regular downtrend, with funding merchandise gaining $436 million within the second week of September 2024, according to CoinShares. This uptick marks a significant shift following $1.2 billion in withdrawals in the course of the prior weeks. Buyers are speculating on a doable 50-point interest rate cut by the Federal Reserve, set for announcement on September 18.

Supply: CoinShares

Feedback from former New York Fed President Invoice Dudley considerably influenced market sentiment. His insights have boosted investor confidence, prompting many to revisit their positions, notably in Bitcoin. CoinShares’ head of analysis, James Butterfill, famous that this shift has strongly impacted capital flows.

Bitcoin Takes the Lead with $436 Million Inflows

Bitcoin

BTC

$60 335

24h volatility:

3.4%

Market cap:

$1.19 T

Vol. 24h:

$40.44 B

, as soon as once more, stands as the highest gainer, securing $436 million in inflows, successfully reversing a streak of 10 consecutive days of outflows that totaled $1.18 billion. On the flip facet, quick Bitcoin merchandise designed for bearish bets on the cryptocurrency noticed outflows of $8.5 million after weeks of optimistic momentum, signaling a rising bullish sentiment amongst merchants.

Whereas Bitcoin thrived, Ethereum continued to face challenges. The second-largest cryptocurrency by market capitalization skilled $19 million in outflows. This decline was largely attributed to considerations surrounding the layer-1 protocol, notably within the wake of the “Dencun” improve, which has raised questions on profitability in Ethereum-based ecosystems.

Regionally, the US dominated inflows with a hefty $416 million, adopted by Switzerland with $27 million, and Germany contributing $10.6 million. Nonetheless, regardless of this robust influx, buying and selling volumes in exchange-traded funds (ETFs) remained flat, registering solely $8 billion for the week effectively beneath the year-to-date common of $14.2 billion.

Along with the cryptocurrency inflows, blockchain equities additionally obtained a lift, with $105 million in inflows. This surge has been linked to the introduction of recent ETFs within the US market, additional highlighting the rising investor confidence within the broader blockchain and crypto asset area.

Ethereum Faces Outflows whereas Solana Shines

In the meantime, Solana

SOL

$130.9

24h volatility:

-0.7%

Market cap:

$61.30 B

Vol. 24h:

$2.25 B

continued its streak of optimistic inflows, marking the fourth consecutive week of capital influx with $3.8 million. Solana’s constant efficiency starkly contrasts Ethereum’s current challenges and signifies rising curiosity in various layer-1 options.

The resurgence of inflows into crypto merchandise and blockchain equities displays renewed optimism out there. The anticipated charge lower from the Federal Reserve is anticipated to loosen monetary circumstances, which might additional profit the digital asset area. Whereas Ethereum continues to face headwinds, the broader cryptocurrency ecosystem is positioned to achieve from macroeconomic shifts.

As buyers await the Fed’s last choice, the market stays in flux, however optimism is obvious in these newest figures, with Bitcoin on the forefront of this resurgence.

Crypto Inflows Surge with $436 Million as Rate Cut Speculation Intensifies