Invoice processing is a essential but labor-intensive enterprise operation that historically requires handbook data extraction and entry into accounting techniques. This handbook strategy is time-consuming and vulnerable to human error. To guage automated options, we carried out a comparative evaluation of main doc processing options and LLMs:

- Amazon Textract API

- Claude Sonnet 3.5

- Google Doc AI

- Microsoft Azure Doc Intelligence

- Rossum

Our research assessed these instruments’ capabilities in precisely extracting knowledge from various bill codecs and qualities, aiming to quantify their effectiveness as options to handbook processing.

Benchmark outcomes

We evaluated bill processing efficiency throughout invoices of various high quality and distinction ranges. Whereas all instruments demonstrated sturdy efficiency with high-quality photographs, their accuracy declined considerably when processing lower-quality paperwork. Among the many instruments examined, Claude Sonnet 3.5 exhibited the best general accuracy and resilience throughout the complete spectrum of doc qualities.

Methodology

Measurement: Our analysis methodology centered on the accuracy of key-value pair extraction. Every extracted subject was assessed utilizing a binary classification: appropriate extraction or incorrect/lacking extraction. The accuracy metric was computed utilizing the next system:

Accuracy = (Variety of Appropriately Extracted Key-Worth Pairs) / (Complete Variety of Key-Worth Pairs)

This technique enabled goal comparability of extraction efficiency throughout totally different instruments and doc sorts.

Pattern dimension: Discovering bill knowledge is difficult because it entails private info like emails and names. We used greater than 400 key worth pairs from 20 publicly obtainable bill samples.

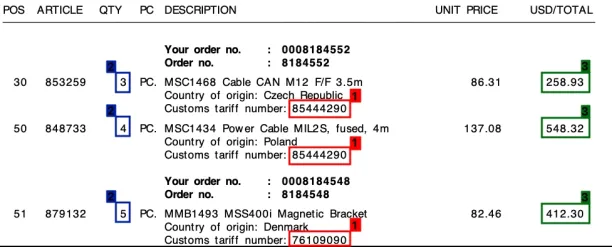

Samples: Whereas all options appropriately processed prime quality photographs, extraction high quality declined in photographs like these:

Positive-tuning: Though the merchandise we tried have been profitable to find whole quantities, they’d points in extracting pricing particulars. It’s doable to get higher outcomes by fine-tuning some merchandise. In just a few merchandise, customers can click on on a price within the picture to appropriate mannequin output.

To be honest to all suppliers, we didn’t carry out any fine-tuning. With fine-tuning, all suppliers must be capable of obtain increased success charges within the second time they course of these paperwork. Nevertheless, our focus on this benchmark is autonomous operations which requires fashions to supply appropriate, dependable outcomes based mostly on paperwork that they beforehand didn’t see.

Timeline: All assessments have been accomplished in December 2024.

Subsequent steps

Rising members: Since this research gives insights into present bill processing capabilities throughout Massive Language Fashions (LLMs), OCR applied sciences, and specialised bill processing instruments, we plan to increase our evaluation by incorporating further state-of-the-art LLMs to supply a extra complete benchmark of automated bill processing options.

Rising pattern dimension and variety.

What’s bill OCR?

Bill parsing makes use of automated instruments equivalent to NLP, NLU, OCR, and different knowledge extraction applied sciences to routinely extract knowledge from invoices in varied codecs, equivalent to PDFs, photographs, and so forth.

An bill parser is a software program program that extracts info equivalent to

-

Vendor title

-

Bill quantity

-

Quantity due

and inputs it in a machine-readable format. This knowledge will be utilized for a number of capabilities, equivalent to automating accounts payable, finishing month-end accounting closures, and managing invoices.

The parser software program is often built-in into an bill processing system, which automates the complete course of from the receipt of an bill to fee.

Paperwork written in a sure markup language are learn and dealt with by parsers. They break the doc up into smaller items, referred to as tokens, after which take a look at every token to determine what it means and the place it suits within the construction of the entire doc.

To do that, parsers must know rather a lot in regards to the grammar of the markup language in query. This provides them the power to acknowledge every token and work out the precise connections between them.

The method is comprised of 5 steps:

1. Enter

Invoices will be acquired in a wide range of codecs, together with paper, electronic mail, or digital codecs equivalent to PDF or XML. The bill parser software program will usually settle for these invoices as enter.

2. Optical Character Recognition (OCR)

If the bill is in a scanned paper or picture format, the parser will use OCR expertise to extract textual content from the picture. This enables the parser to entry the information contained throughout the bill.

Some bill parser options use AI-powered OCR expertise that may routinely extract info from PDFs, images, and scanned knowledge with out the necessity for brand spanking new guidelines or templates. That is as a result of the AI can deal with semi-structured and unfamiliar paperwork and enhance over time. The extracted info will be custom-made to solely embrace particular tables or knowledge entries.

The parser will then extract particular info from the bill, equivalent to the seller title, bill quantity, date, and merchandise particulars. That is usually achieved utilizing a mix of sample recognition and machine studying algorithms.

Some bill parsing software program has the aptitude to extract key info such because the bill date, quantity, tax identification numbers, and varied totals by utilizing predefined filters:

Some parser instruments provide the power to extract line merchandise info from invoices with a constant format by making a separate doc parser for every particular vendor or buying and selling accomplice structure:

4. Knowledge validation

As soon as the information has been extracted, the parser will validate the knowledge to make sure that it’s correct and full. This could embrace checking that the date is within the appropriate format, that the seller title matches a predefined checklist of distributors, or that the merchandise particulars match the anticipated format.

5. Knowledge output

The extracted and validated knowledge is then outputted in a format that may be simply imported into the consumer’s accounting or ERP system. This may be within the type of a CSV file, database file, or straight into an accounting software program.

Manually extracting knowledge from invoices and getting into it right into a system will be difficult for corporations as there are a number of complexities:

Human error

Invoices can include a considerable amount of knowledge, and handbook entry will increase the chance of errors, equivalent to typos, transposition of numbers, and incorrect knowledge entry. Inaccuracies in knowledge entry are answerable for an estimated $600 billion in yearly losses. Processes like accounts payable want appropriate knowledge export from monetary paperwork.

Time-consuming

On common, it takes 17 days, or roughly 75% of a month, to manually course of a single bill.

Many various items of necessary info are included in invoices, and they’re all introduced in a key-value fashion the place a person identification serves as each the important thing and the worth. The method of manually extracting these pairs is time-consuming and entails many inspections to guarantee accuracy. Even some OCR algorithms battle to detect extracted values with out context. Automated bill processing will help staff concentrate on extra advanced duties.

Lack of standardization

Invoices from totally different suppliers might have totally different codecs. Every bill is generated with a singular format that may pose difficulties when processing and deciphering these patterns. The paperwork, equivalent to emails, paper, and PDFs, might undergo plenty of digital and paper information earlier than being authorized for fee, making handbook extraction of knowledge difficult and liable to error.

Course of inefficiency

The handbook dealing with of invoices, which incurs a median price of just about $23 per bill, will be each time-consuming and costly, resulting in an inefficient and repetitive course of.

Knowledge loss potential

There’s a danger of dropping knowledge if invoices are misplaced or broken or if knowledge is just not entered appropriately into the system.

OCR software program usually face difficulties in extracting line gadgets from invoices as effectively. That is as a result of transaction tables might lack horizontal or vertical strains, making it tough for ocr bill processing to determine context for the extracted gadgets. Collected digital bill or bill photographs will be used on this course of.

How to decide between your bill processing vendor?

1. Select a supplier that provides an answer consistent with your organization’s knowledge privateness insurance policies.

Your organization’s knowledge privateness coverage might be a show-stopper to utilizing exterior APIs equivalent to Amazon AWS Textract. Most suppliers provide on-premise options so knowledge privateness insurance policies wouldn’t essentially cease your organization from utilizing an bill seize answer. The accounts payable workflow should be handled with cautious consideration because it regularly entails confidential enterprise and monetary info.

2. Select a supplier that may present a constant knowledge construction whatever the textual content on the paperwork.

There are two ways in which deep studying based mostly bill seize corporations work. Firms like Textract return key worth pairs. So for instance, if an bill calls the whole quantity as “Gross quantity”, the opposite calls it “Complete quantity” and one other German bill calls it “Summe”, Textract provides you the information in 3 totally different buildings for these 3 paperwork. In a single, you’ve got a key worth pair with the important thing “Gross quantity”, in one other “Complete quantity” and within the German one, you get “Summe”. Different suppliers designed constant knowledge buildings that work for all invoices. In all 3 eventualities, you’ll get “Complete quantity” which the important thing they use of their output file. This makes analytics and processing simpler as you don’t must cope with many various structured knowledge codecs.

3. Ask for the false optimistic and handbook knowledge extraction charges

Then run a Proof of Idea (PoC) mission to see the precise charges on the invoices acquired by your organization.

-

False positives are invoices which might be auto-processed however have errors in knowledge extraction. These are tough to determine and might disrupt operations. For instance, incorrect extraction of fee quantities can be problematic. Minimizing this must be absolutely the focus.

-

Handbook knowledge extraction is important when automated knowledge extraction system has restricted confidence in its consequence. This might be attributable to a special bill format, poor picture high quality or a misprint by the provider. That is additionally necessary to reduce however there’s a trade-off between false positives and handbook knowledge extraction. Having extra handbook knowledge extraction will be preferable to having false positives.

That is the primary quantitative benchmarking now we have seen on this area and can comply with an identical methodology to arrange our personal benchmarking.

4. Leverage a PoC to measure the potential automation fee

This depends upon the variety of fields you count on to seize from the paperwork. A typical set of ~10 fields together with gadgets like buy order ID, vendor title, vendor title and so forth. can allow knowledge entry into ERP and funds. Finest apply distributors obtain ~80% STP by extracting all of those ~10 fields with virtually no errors ~80% of the time. Although there could also be errors once in a while, manually checking the biggest funds can be certain that no important mistaken fee slips by way of the online.

5. Ask for superior processing choices supplied by the seller

Extraction is step one in knowledge assortment, it must be adopted by knowledge processing generally. For instance, invoices must be checked for VAT compliance (e.g. home invoices with out VAT want to elucidate why VAT is excluded) and failure to accomplish that may lead to important fines for the corporate relying on the nation.

6. Ask for the way the answer learns about new invoices

Finest options have an interface for permitting your group to assist information the answer. As your organization’s worker picks the key-value pairs, the bill seize answer takes notice so it may be extra assured a few related bill subsequent time.

7. Consider the ease-of-use of their handbook knowledge entry answer

It is going to be utilized by your organization’s back-office personnel as they manually course of invoices that may not be routinely processed with confidence.

Past this, greatest apply procurement questions make sense. For instance:

- How extensively adopted is their answer? Have they got Fortune 500 clients?

- Are their clients proud of their answer and help? May very well be good to ask an acquaintance from an organization that’s already utilizing their answer. Since bill automation is just not an answer that might enhance advertising or gross sales of an organization, even rivals may share with each other their view of bill automation options.

- What are the choices to combine the answer to your organization’s techniques (e.g. ERP)? Is IT on-board with the combination strategy?

- What’s their Complete Price of Possession (TCO)? Completely different options use totally different items of pricing (e.g. worth per web page or worth per doc) which makes this comparability tough. Nevertheless, utilizing a pattern out of your archives, you possibly can have an estimate of the associated fee.