America’s declining birth rate has gone from niche policy concern to mainstream news, as economists, demographers, and even the president weigh in on what it means for the future of the country.

Much of the focus has landed on the impact on large-scale systems like Social Security, the labor force, and even the housing market. But there’s a more immediate shift playing out at the local level, in the places where the population of young children is shrinking fastest: What will these cities look like with fewer children?

For decades, America’s family map seemed intuitive. If you wanted more space and lower costs, you moved to the places where families were growing: Salt Lake City, Phoenix, Denver. These metros were affordable and built much of their appeal around being family-friendly—a quality many assumed would be stable, if not permanent.

But even in these growing cities, the youngest cohort is thinning out.

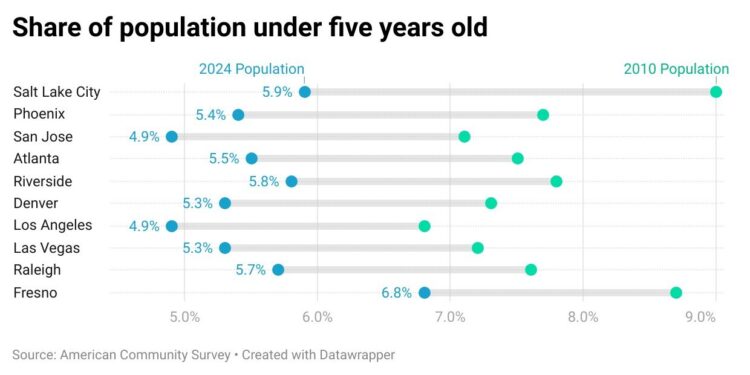

A Realtor.com® analysis of U.S. Census American Community Survey data from 2010 and 2024 reveals a broad shift: The share of residents under age 5 has declined in nearly every one of the nation’s 50 largest metro areas. In 2010, the under-5 population ranged from 5.4% to 9%. By 2024, it had narrowed to 4.2% to 6.8%. Even metros that added residents overall now have fewer children, proportionally, than they did a decade ago.

It poses an important question: Can cities remain family-friendly even as children make up a smaller share of their population?

Where the under-5 share is falling the fastest

Historically, the population of children has reflected an area’s ability to attract, support, and retain families. But the city whose population below age 5 shrank the most challenges this long-standing ideal.

Salt Lake City posted the single steepest drop in the under-5 population share between 2010 and 2024, down 3.1%. It’s a significant finding given that Salt Lake City has long been treated as a prototype of the family-friendly growth metros.

But the drop likely has less to do with a lack of family-friendly amenities and more to do with a nationwide decline in birth rates, which hit a record low in 2024, according to the Centers for Disease Control and Prevention data.

The same whiplash shows up in other places that, reputationally, have been magnets for families: Phoenix is down 2.3%, Denver is down 2%, Atlanta is down 2%, Riverside, CA, is down 2%, and San Jose, CA, a coastal tech powerhouse with some of the country’s most expensive housing, is down 2.2%.

The pattern is notable because these metros have been defined by explosive growth in the past five years, driven by strong job markets and amenities. Yet their shrinking share of young children reveals a growing disconnect: Population growth no longer guarantees generational renewal.

Where the under-5 share remains relatively high

Only a small handful of large metros still clears the 6% mark of children under age 5 in 2024. Fresno, CA, sits at the top of this group at 6.8%, followed by Houston at 6.5%. Dallas and Memphis, TN, are tied at 6.3%, and Indianapolis is close behind at 6.2%. San Antonio, TX, comes in at 6.1%, and Oklahoma City rounds out the list at 6%.

These are promising signals that, at least on this measure, young families still make up a bigger share of the local population than they do in peer regions.

But the twist is that these metros are not immune to the declining number of child residents. Even in places that remain baby-heavy by 2024 standards, the direction of travel is still downward compared with 2010.

Where the under-5 share fell the least

The metros where the under-5 share fell the least are the ones that most effectively puncture the easy narratives. This list isn’t dominated by Sun Belt boomtowns or “new economy” magnets, as one might expect.

Instead, it includes places often associated with aging populations, high costs, or long-running out-migration. Yet, they still posted comparatively small drops in the under-5 share between 2010 and 2024.

New York City stands out with the smallest decline in this dataset, down just 0.7%. Pittsburgh and Hartford, CT, follow closely, each down 0.8%. Then there’s a tight cluster of metros where the baby share declined by roughly 0.9 to 1 percentage point: Miami; Boston; Detroit; Tampa, FL; Baltimore; Virginia Beach, VA; and Cleveland.

Once again, there are no easy answers here, but these modest declines may be due to these cities already having proportionately small shares of children under the age of 5 in 2010, averaging just 6.2% compared to almost 7% for the top 50 metros overall that year.

What makes a family-friendly city?

Regardless of whether or not you have (or want) children in your life, the fact that the under-5 share of the population is falling across all the 50 biggest metros should raise alarm bells. The decline is geographically spread, signaling a structural shift rather than a localized trend. While multiple forces are clearly at play, one factor appears to carry disproportionate weight: affordability—specifically, the combined cost of housing and child care.

At least, that’s the blunt takeaway from the Manhattan Institute’s analysis of family-friendly metros: When you look at where children actually live and where families are moving, the cost of living is the variable that keeps showing up as the dominant through line.

The metros with the strongest family pull aren’t reliably the ones with the best scores on other quality-of-life indicators; they’re the ones where daily life is simply cheaper to run. Look no further than Salt Lake City, once a bastion of affordability. Today, the median home price sits at $600,000—well above the national median of $420,000, according to data from Realtor.com.

And the shift matters more now than maybe ever before because the constraints on the family have changed. Remote and hybrid flexibility means more households can act on preferences they used to suppress—more space, lower fixed costs, less financial strain around housing and care.

How do cities change when there are fewer children?

In that frame, the choices a city makes to attract and keep families start functioning like a long-term economic strategy for families with and without children.

In a New Yorker piece earlier this year exploring a future with fewer children, writer Gideon Lewis-Kraus traveled to South Korea—where the fertility rate has fallen to about 0.7, far below the U.S. rate of roughly 1.6—and found the clear signs of demographic collapse in everyday life: “no-kids zones” posted on businesses, pregnancy seats on Seoul’s metro left conspicuously empty, and a culture where parents describe having to apologize to neighbors in advance for the noise a baby might make.

He also describes public infrastructure and institutions repurposing around the shift: day care centers converted into nursing homes, and even schools transformed into cafés, resorts, or family campgrounds because there simply aren’t enough children to keep them open.

And if that’s a future cities want to avoid, it will require more deliberate choices, argue Hanna Love and Jennifer S. Vey of the Brookings Institution.

The “childless city” isn’t destiny, they say; it’s the downstream result of policy and planning decisions—whether cities build enough family-sized housing, invest in safe streets and parks, expand child care and transit access, and design public space for kids as well as consumers.

In other words, cities can either default into an economy that caters to affluent, child-free adults, or choose, intentionally, to stay livable for families across incomes and keep the next generation from being priced out of the places where opportunity concentrates.