A combination of factors this week will have all eyes on the Federal Reserve’s meeting on Sept. 16–17 and whether any drop in interest rates will happen. First, inflation data was mixed. Although producer prices fell after a hefty uptick in July, consumer prices edged higher in August. I don’t expect this to derail a cut in the federal funds rate, however.

The Fed has a dual mandate. Its two priorities are full employment and price stability. Though prices continue to be thorny, full employment is the side of the mandate that is likely to carry more weight at the next meeting, given the softening unemployment rate, lower pace of hiring, and still restrictive rate policy. An uptick in jobless claims to a roughly four-year high is just another point of support.

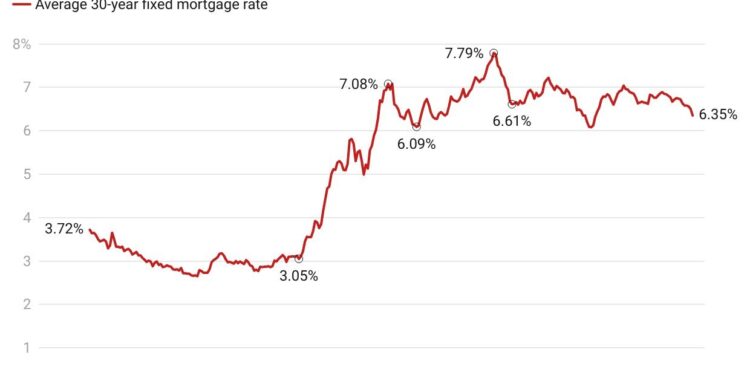

This week’s mortgage rates fell sharply to 6.35% for a 30-year fixed home loan. Rates are now below 6.5% for the first time in 11 months. When mortgage rates dipped into the low 6% last year, we saw a bump in home sales in the following months. Data already points to a sizable increase in purchase mortgage applications. Home sales are likely to follow, but this won’t be a total unlock for housing: The majority of homeowners still have outstanding mortgages with rates below 6%.

Higher mortgage rates have been a key contributor to a slower housing market, but home purchase sentiment edged lower in August over job concerns and a more modest home price outlook.

The Realtor.com® August Housing Trends report aligns, showing that the jump in active listings in the past year led prices to flatten.

While the national market has moved into balance between buyers and sellers, the report reveals striking regional variation: 7 of the 50 largest markets are already in buyer’s market territory, 23 are in balance, while 20 still favor sellers.

With some markets in the buyer’s territory, weekly data showed that sellers were less eager to get into the market. Newly listed homes were down nearly 2%, the largest annual decline since January.

There are still plenty of seller’s markets, however, especially in the Northeast and Midwest, regions that have a lock on our Hottest Markets list. Across the 20 hottest markets, more robust buyer demand helped drive listing prices up by 3.6% even though they were flat nationally.

But also on the hottest markets roundup are metros where homes are priced below $300,000.

Finally, with more than $12 trillion in real estate value exposed to severe or extreme climate risks from flooding, hurricane-driven wind, and wildfire, consumers are facing difficulty obtaining and renewing homeowners insurance, and 3 in 4 believe it could become unaffordable if costs continue to rise.

This is one of several reasons why I expect climate risk information to be of growing interest to consumers looking for a home and homeowners wanting to make smart investments to mitigate and defend against risks.