Coinspeaker

Former BitMEX CEO Arthur Hayes Predicts 30% Bitcoin Pullback before $250K Surge, Warns of 10-Year Yield Curve

In a three-part essay series beginning with “The Ugly“, former CEO of BitMEX Arthur Hayes offers a deeply analytical perspective on crypto markets, political influences, and macroeconomic forces. Hayes recalls an unexpected avalanche at 1600 meters that forced a swift change in course. Similarly, he warns of growing uncertainties driven by central bank policies, shrinking liquidity, and the volatile meme coin craze.

Initially bullish on Bitcoin

BTC

$101 762

24h volatility:

0.4%

Market cap:

$2.02 T

Vol. 24h:

$40.00 B

in early 2025, Hayes now foresees a pullback to $70,000-$75,000 before a potential surge to $250,000 by year-end. His revised outlook hinges on shifting central bank balance sheets, erratic banking credit rates, and the infamous $TRUMP meme coin. Hayes draws parallels to the late 2021 market crash, cautioning against the unchecked bullish sentiment that could spark painful corrections.

“History doesn’t repeat itself, but it does rhyme. I don’t believe this bull cycle is over; however, […] I think we are more likely to go down to $70,000 to $75,000 Bitcoin and then rise to $250k by the end of the year,” Arthur Hayes explained.

Exploding Debt, Rising Yields: What’s Next?

The US Treasury debt, a cornerstone of the global economy, has exploded to $36.22 trillion, doubling from $16.70 trillion in 2019. Hayes warns of a potential financial crisis if the 10-year treasury yield hits 5-6%. Such an increase could destabilize institutions leveraged against treasuries, leading to economic fallout. Treasuries, often seen as the world’s reserve assets, could become liabilities if their value collapses.

Adding to the strain, traditional treasury buyers, including the Fed and major banks, have scaled back purchases. Relative value hedge funds in the UK, Cayman Islands, and Luxembourg now dominate the market. But with rising repo yields and stricter margin requirements, their sustainability is at risk, threatening treasury market stability.

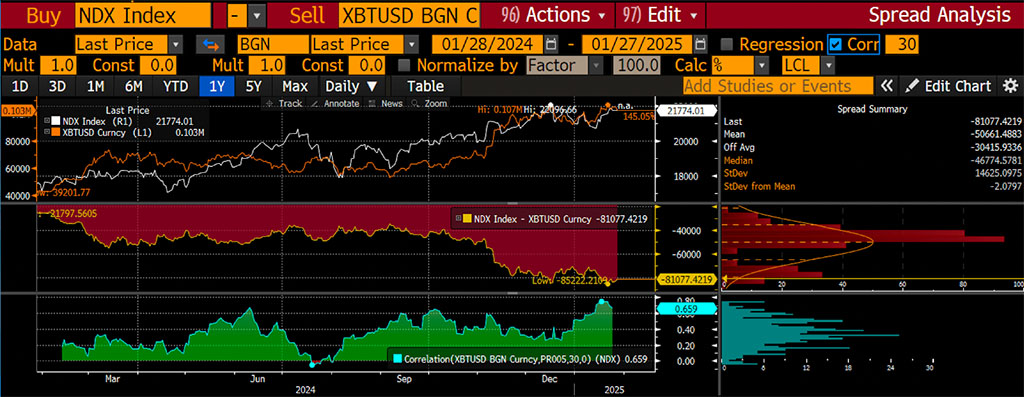

Bitcoin, traditionally considered independent of conventional markets, is now displaying stronger connections to the Nasdaq 100. The surge in 10-year treasury yields and inflation concerns has triggered a sharp rise in its 30-day correlation, indicating that Bitcoin may function similarly to a high-duration bond. As interest rates increase, Hayes predicts further declines in Bitcoin price.

“In the long term, Bitcoin is uncorrelated with stock prices, but it can be very correlated in the short term. Here is the 30-day correlation between Bitcoin and the Nasdaq 100. It’s high and rising. This is not good for the short-term price prognosis if stocks get smoked due to the rising 10-year yield,” Hayes wrote.

In response to market instability, Hayes highlights Maelstrom’s conservative approach. Reducing exposure to cryptocurrencies while holding staked $USDe with yields of 10-20% is central to their strategy for navigating short-term volatility.

Source: Cryptohayes/Substack

Global Liquidity Crisis

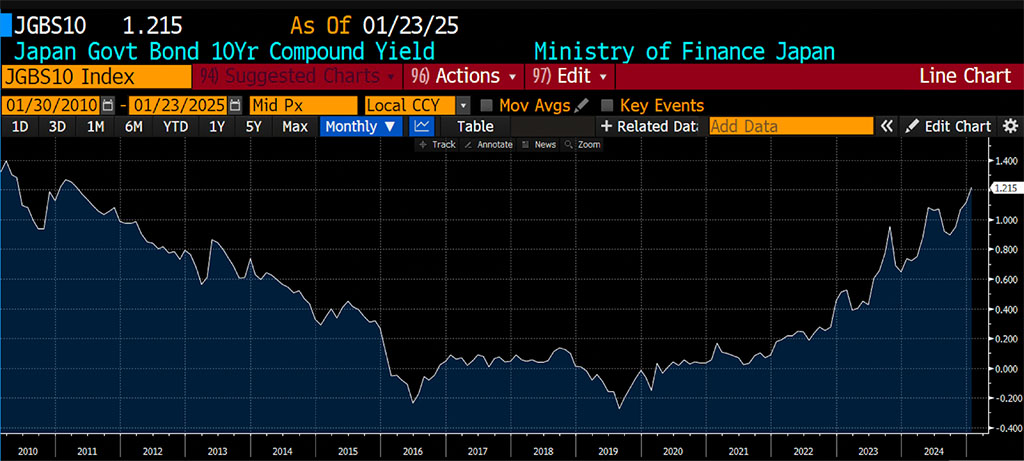

Outside the US, central bank actions add to the turbulence. In early 2025, the Bank of Japan raised its policy rate to 0.50%, causing Japanese Government Bond (JGB) yields to hit 15-year highs. Higher borrowing costs and slower money supply growth have forced Japanese firms to repatriate capital and sell foreign assets, including US treasuries. This sell-off compounds liquidity challenges in global markets.

Source: Cryptohayes/Substack

Meanwhile, China’s People’s Bank of China abruptly halted yuan-based reflationary measures in January 2025, signaling a major policy shift. Strengthening the yuan and stopping bond purchases, China appears to be responding to internal pressures or bracing for US negotiations. The move tightens global liquidity, directly impacting crypto markets reliant on fiat liquidity.

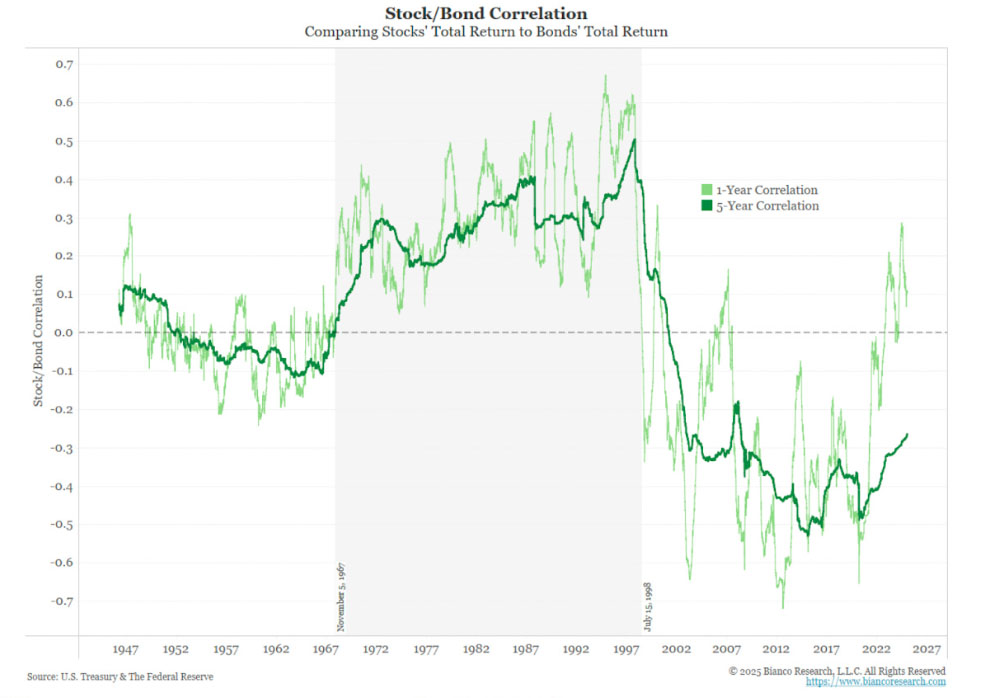

Source: Bianco Research

Hayes also notes a troubling resurgence in stock-bond correlations, reminiscent of the 1970s. Persistent inflation fears have caused both asset classes to decline together as yields rise, undermining traditional diversification strategies and amplifying market instability.

In a nutshell, Hayes emphasizes the dangers of constrained global liquidity. With the US, China, and Japan all tightening monetary policies, fiat-priced assets, including Bitcoin, face significant headwinds. He predicts a 60% chance of a 30% Bitcoin correction, urging caution.