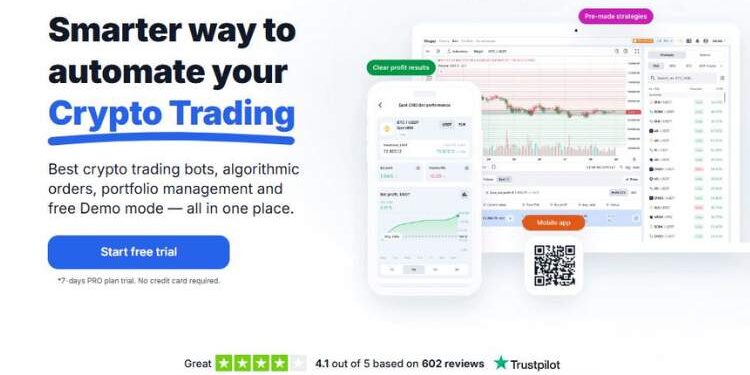

You open Bitsgap expecting another bot dashboard—but soon you’re launching grid, DCA, combo, futures bots, linking multiple exchanges, and even playing with the AI Assistant. One Redditor joked: “their AI picks low‑liquid pairs—so watch your volume,” which is both a warning and a wink.

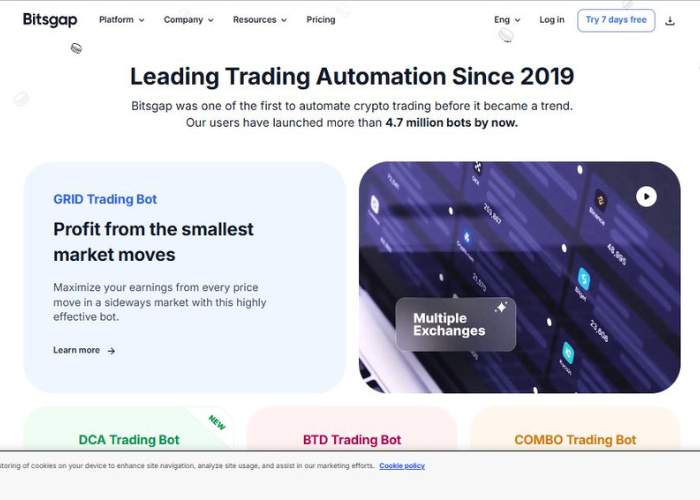

What Bitsgap Is—and What It Isn’t

This tool is an all‑in‑one automated crypto trading platform that supports over 15 exchanges, including Binance, Coinbase Pro, KuCoin, Huobi. It offers:

- Grid, DCA, Futures, BTD (Buy‑The‑Dip), and Combo bots

- AI optimization and an AI Assistant for strategy suggestions

- Smart Orders: trailing, stop‑loss, take‑profit, OCO

- Demo mode for risk‑free testing

- Unified portfolio management and analytics dashboards

It’s not a self‑learning ML super bot—more like plug‑and‑play automation with helpful AI tweaks.

My Testing Journey (Non‑Linear, Low‑Drama)

Day 1: Signed up, connected Binance via API, flipped on demo mode. Built a basic grid bot in minutes. Felt proud.

Day 2: Went live with a small amount. Bot placed trades, but early losses hit—felt that gut punch. Real bot trading has teeth.

Day 3: Tried a futures bot with DCA and trailing take‑profit. The overnight bounce gave a small profit—felt like redemption.

Day 4: Explored AI Assistant suggestions—one suggested pairing looked promising. I backtested in demo—result was meh. Learned to question it.

Also: Tried Copy Marketplace. Followed a shared strategy. Got Telegram alerts when trades hit. Felt human‑connective. Support: responded to a lagged trade alert issue kindly and quickly.

Feature Table: What’s under the hood

| Feature | What It Does | My Take—Real Insight |

| Grid Bot | Executes buy/sell within price grids | Solid in range markets—easy to set up |

| DCA Bot | Dollar-cost averaging over dips | Handy in volatile market—entry spacing matters |

| Futures & Combo Bots | Allows leveraged strategies long/short | Powerful if you understand risk—but risky if not careful |

| AI Assistant | Suggests bot setups and optimizes parameters | Helpful pogo stick—good ideas but still human‑unchecked |

| Smart Orders | OCO, trailing, TP/SL orders across exchanges | Real edge compared to native exchange UI |

| Demo + Backtest | Simulate without risk or capital | Great for learning—but no slippage or fees realism |

| Multi‑exchange UI | Manage all balances, bots, portfolio from one place | Time‑saver if you trade across exchanges |

Pros & Cons (Straight From My Desk)

What’s Great:

- Quick setup with minimal friction

- Low barrier to entry, demo trading to build confidence

- Multi‑exchange consolidation: one dashboard for everything

- AI Assistant and smart orders give edge without code

- Support widely praised for responsiveness and tutorials

Where It Trips Up:

- Demo mode misleading—backtests assume perfect fills; real trades need add‑ins

- Some reviewers report bots drained accounts when strategies mis‐behaved

- Overhyped AI sometimes misses context or volume issues

- Refund complaints from some users—especially if cancellation occurs late or real bots used

- Premium plans climb steeply depending on bot usage and speed needs

Pricing & Value Snapshot

| Plan | Monthly (Annual) | Bot Limits | Key Features |

| Free | $0 | Demo bots unlimited | Demo, smart manual trading, limited bots |

| Basic | ~$21/mo (yrly) or $26/mo | 3 grid, 10 DCA bots | AI assistant, live manual tools |

| Advanced | ~$49/mo (yrly) or $62/mo | 10 grid, 50 DCA, futures | Trailing, reinvest, advanced bots |

| Pro | ~$108/mo (yrly) or $135/mo | 50 grid, 250 DCA bots | AI optimized modes, portfolio analysis |

Paid plans include smart UI, AI assistance, and higher bot limits. Free users can play, but won’t unlock full power.

The Emotional Ride

First few losses stung hard. Bot says “executed,” my account says “ouch.” Felt foolish. Then a small profit day made me smile again. It was a push‑pull of hope and second‑guessing—common in bot trading. Later, support fixed an alert delay with kindness—which reminded me I wasn’t locked into a black box; there are real humans on the other end.

Trustpilot reviews confirm: many users love the simplicity and steady returns. Others warn about bot drains and refund friction. One sad streamer said they were funneled into a webinar scam via Bitsgap email. That shook my confidence.

Who’s Bitsgap For?

- Traders wanting no-code bot automation across exchanges

- Those who test strategies via demo/backtest before risking funds

- Users who appreciate AI suggestions but remain hands‑on

- People managing portfolios across many crypto wallets

Not great for those expecting “bot does it all”—no human decision-making involved, no deep AI trading logic. Also, high‑frequency arbitrage traders may find latency or limits.

Improvement Suggestions

- Demo mode should simulate slippage and exchange fees

- Transparency around AI pick quality—low volume pair warnings

- Improve refund flow and remind users before auto-renewal

- Add more global exchange support and faster alerts for high volume periods

Final Verdict

Bitsgap is a robust, multi‑exchange crypto bot engine—not magic, but powerful if used wisely. It’s beginner-friendly yet scales for intermediate users who add trailing, futures, and portfolio analytics. Without AI‑learning magic, it still packs AI‑style convenience.

Expect to spend time testing in demo mode, monitor real trades, and refine your bot rules. If you’re looking for automation that doesn’t require scripting, Bitsgap delivers plenty of features and control.

Try the free plan or 7‑day Pro trial. Build a small bot, monitor performance, tweak cheaply. If it adds up over time, scale thoughtfully. If not—a lesson learned early is worth more than unrealized profit.

Need help building a grid+DCA combo bot or tweaking trailing rules? Happy to walk you through real parameter setups.