Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

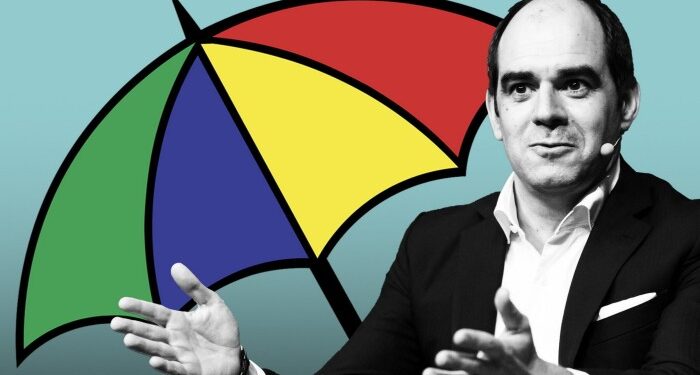

Legal & General, the British finance company that is one of Europe’s largest asset managers, has acquired a real estate investor as part of a strategic push into private markets under chief executive António Simões.

L&G, which manages £1.1tn in assets, has taken a 75 per cent stake in Proprium Capital Partners, a $3.5bn global real estate private equity group, the companies have confirmed.

Under the terms of the deal, which is subject to regulatory approval, L&G will eventually acquire 100 per cent of Proprium. The value of the deal was not disclosed.

The move is part of a broad strategic expansion by L&G into private markets following a restructuring of the FTSE 100 financial services business by Simões, who took on the top job last year.

It comes after L&G poached Eric Adler from US insurer Prudential to lead its asset management division, after combining the unit with its private markets business. The deal marks the first acquisition under Adler, who is focused on growing L&G’s asset manager and expanding into private markets globally.

The UK-based financial services group wants to boost its private markets assets from about $50bn to $85bn and is targeting £500mn to £600mn in operating profits by 2028.

L&G’s latest acquisition underscores how traditional asset managers are seeking to expand into private markets in search of higher returns.

Some of the world’s largest asset managers — including BlackRock, Franklin Templeton and Capital Group — are expanding into private markets through acquisitions and partnerships with specialist providers. Private asset funds come with the potential to earn higher fees than for public market products, but expose clients to new risks.

L&G will provide up to $300mn to support Proprium’s funds as part of the deal. Proprium was spun out of Morgan Stanley’s real estate special situations team in 2013. Its investments include Germany’s A&O Hostels and pub group Admiral Taverns in the UK.

About 60 per cent of Proprium’s investments are in Europe, and the group also has a presence in Asia-Pacific. L&G says both regions are growth areas.

L&G’s real estate assets amount to about £22bn and include large-scale regeneration projects, industrial property and affordable housing. L&G also acquired an equity stake last year in US-based real estate investor Taurus, as it seeks to broaden its real estate business beyond the UK, where the bulk of its assets are focused.

Adler said the deal will expand L&G’s geographical presence and help to broaden its investment offering.

Tim Morris and Philipp Westermann, co-managing partners of Proprium, said there was “immense opportunity” in expanding into global real estate. The deal is set to close at the end of the year.

As part of the agreement, Proprium’s management team will continue to operate independently and will keep its current leadership structure, teams and investment process.