The annual “iPhone day” has come and gone.

Apple on Friday launched the most recent technology of its hottest units: the iPhone 16 family, Watch Series 10 and AirPods. The brand new fashions hit retailer cabinets Sept. 20, and because it all the time appears to do, the tech big introduced a number of hype to the launch.

At its Fifth Avenue flagship retailer in New York, Apple’s high brass, together with CEO Tim Cook dinner, greeted excited clients, a lot of whom waited hours in line to be the primary to get their arms on these new units.

One govt, Deirdre O’Brien, Apple’s senior vp of retail, was particularly excited on Friday.

“We stay for at present, we actually do. And you’ll simply really feel the power, and it is exhausting to sleep the night time earlier than,” she advised TPG in an unique interview on launch day. (She slept about 4 hours on Thursday night time, she advised TPG.)

Preorders for the brand new units started Friday, Sept. 13, just some days after the corporate’s particular keynote occasion, throughout which the tech big unveiled its newest merchandise, together with a brand-new model of AirPods.

From upgrades to the cameras, battery and sturdiness to noise cancellation within the entry-level AirPods, the most recent units will probably enchantment to many customers, particularly those that are all the time on the highway.

And for those who’re interested by splurging for some new tech, O’Brien shared some suggestions for maximizing the expense. This is all the things you have to know.

Making the acquisition

When it is time to purchase a brand new Apple system, O’Brien says no retailer is best outfitted than Apple’s proprietary retail shops.

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Apple workers know all of the ins and outs of the brand new merchandise, and it is that “connection” and “capacity to teach our clients” that makes the shopping for expertise higher, she mentioned. O’Brien highlighted that the shops provide an end-to-end expertise that she believes is best than what’s provided by third-party resellers.

Apple retailer workers (or specialists, as they’re known as) will reply questions, arrange your system (together with activating your cell service) and even provide useful suggestions and tips at what the corporate manufacturers “In the present day at Apple” classes.

Since iPhone demand often appears to outstrip provide when a brand new product rolls out, O’Brien suggests clients can tip the chances of their favor by monitoring on-line availability for his or her most well-liked units after which place an in-store pickup to order the system they need.

In fact, many different shops promote Apple tech; as an example, you’ll be able to decide up an iPhone from the provider of your selection (AT&T, Verizon or T-Mobile) or via third-party distributors reminiscent of Best Buy and Walmart.

Typically, shopping for an iPhone via a 3rd celebration could be a higher deal than going immediately via Apple, particularly throughout limited-time promotions, so you may need to examine your choices earlier than pulling the set off.

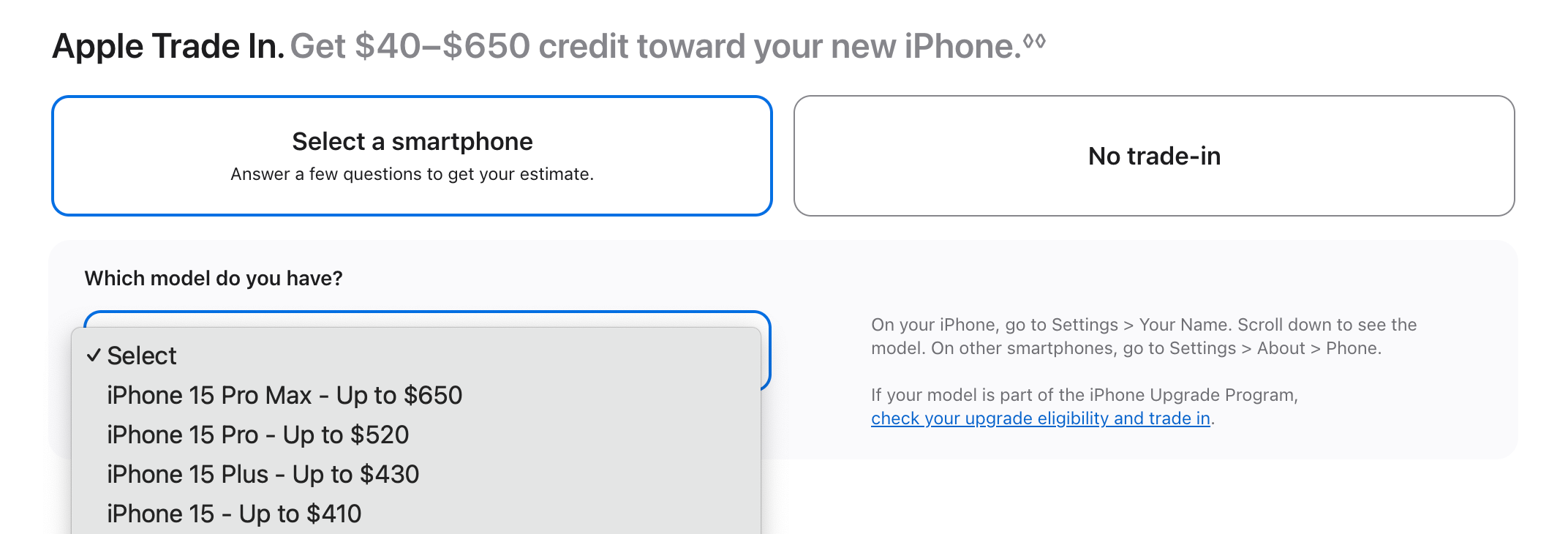

Commerce-in choices

The brand new iPhones actually aren’t low-cost, and O’Brien’s high tip for making the acquisition far more reasonably priced is to commerce in your present system.

“Primary, you’ve got bought that worth,” O’Brien mentioned of the Apple Trade-In program, which recycles used telephones. “Quantity two, it is nice for the surroundings, and the surroundings is such a key worth of ours at Apple.”

You probably have any spare units mendacity round, Apple will give you credit score (or a present card) towards the acquisition of a brand new cellphone. Credit vary from $40 for the iPhone 7 Plus (2016) to as a lot as $650 for those who hand over final 12 months’s iPhone 15 Professional Max.

You will have to make your buy immediately via Apple to reap the benefits of this explicit trade-in provide, although some third-party sellers have comparable promotions out there.

In fact, you may all the time need to learn the phrases and circumstances of any trade-in affords.

Purchasing portal bonuses

Whereas O’Brien shared some suggestions, there are different issues to contemplate when shopping for new units to maximise your worth.

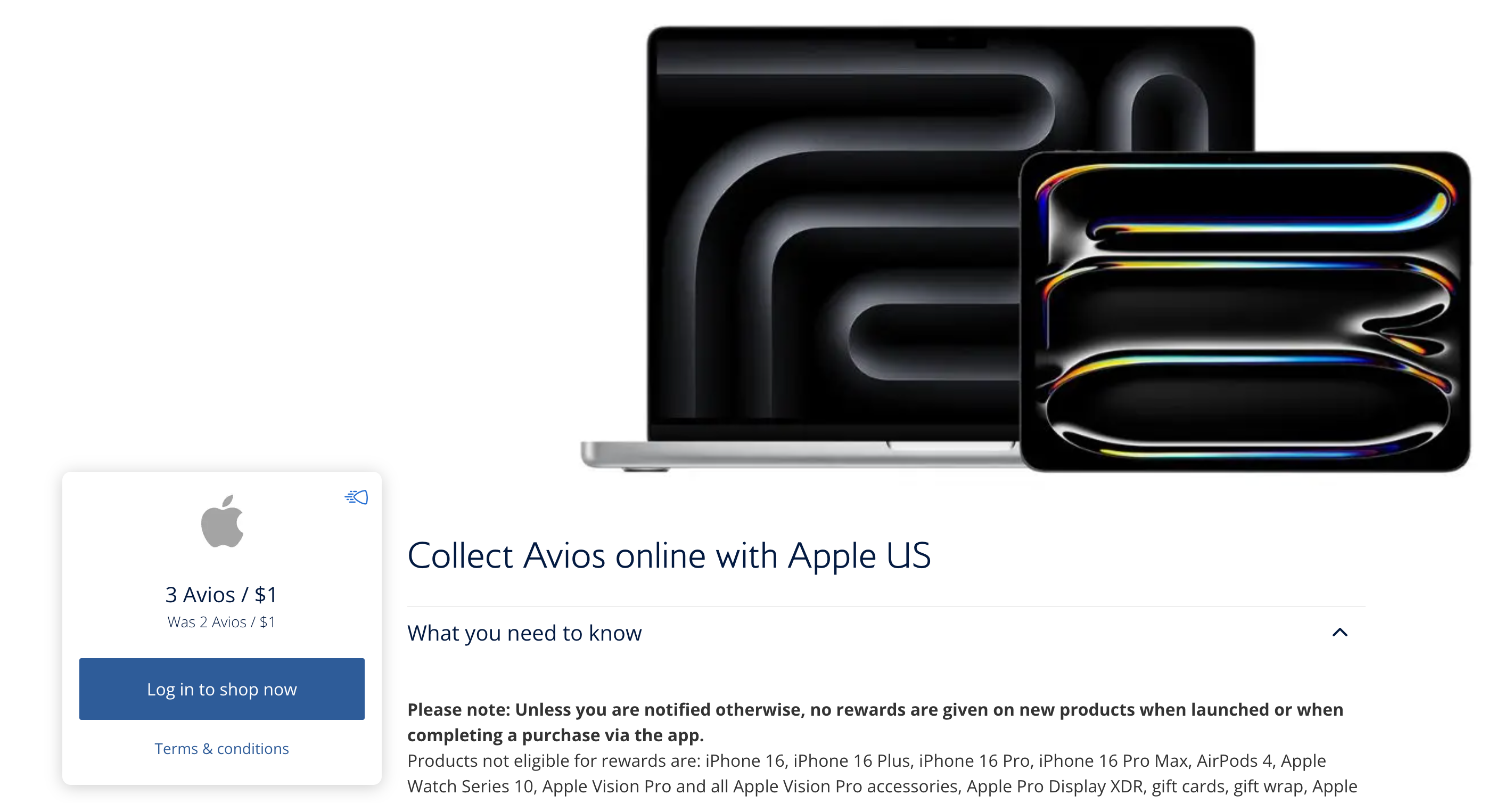

For one, verify for shopping portal bonuses. In case you begin your buying journey at one among these portals, you may nonetheless be redirected to purchase the system immediately from Apple, however you may earn extra factors or miles. Some units are restricted from portal bonuses proper after launch, although that is actually one thing to search for for those who resolve to make your buy at a later date.

I would suggest utilizing a shopping portal aggregator like Cashback Monitor to simply establish the most important return.

Which playing cards to make use of

The following large query is which bank card to make use of on your buy.

In O’Brien’s thoughts, that is the Apple Card.

“You’ll be able to all the time use an Apple Card, and there is a number of nice options that include the cardboard,” she mentioned.

The Apple Card is not the worst choice since you’ll be able to reap the benefits of an interest-free month-to-month installment plan and earn 3% again if you buy immediately via Apple. The knowledge for the Apple Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

But it surely’s not essentially your finest decide to maximise rewards and prolonged guarantee protection.

Traditionally, I’ve made my Apple purchases with The Platinum Card® from American Express. Although you may earn simply 1 American Express Membership Rewards level (which is value 2 cents, in response to TPG’s September 2024 valuations) per greenback spent, the cardboard’s included purchase protection is a superb insurance coverage coverage if I find yourself breaking or dropping my iPhone.

Plus, Amex affords ongoing cellphone protection with the Platinum Card, making this card my high decide for iPhone purchases.

Finally, given the excessive value of Apple’s newest units, I would deal with cards that offer purchase protection and prolonged guarantee advantages moderately than people who provide the best return. Different high purchase-protection picks embody:

| Card | Most protection quantity (per merchandise or declare) |

Most protection quantity (per card or account) | Protection period (days) | Incomes price on Apple purchases | Annual charge |

|---|---|---|---|---|---|

| American Express® Gold Card* | $10,000 per merchandise (or $500 per occasion for pure disasters) | $50,000 per card, per calendar 12 months | 90 | 1 Membership Rewards level per greenback | $325 (see rates and fees) |

| Capital One Venture X Rewards Credit Card | $10,000 per declare | $50,000 per account | 90 | 2 Capital One miles per greenback | $395 |

| Ink Business Cash® Credit Card | $10,000 per declare | $50,000 per account | 120 | 1% money again | $0 |

| Blue Cash Everyday® Card from American Express* | $1,000 per merchandise (or $500 per occasion for pure disasters) | $50,000 per card, per 12 months | 90 | 3% money again on U.S. on-line retail purchases, on as much as $6,000 in purchases per 12 months (then 1%) | $0 annual charge (see rates and fees). |

| Chase Freedom Flex® | $500 per declare | $50,000 per account | 120 | 1% money again | $0 |

* Eligibility and profit ranges fluctuate by card. Phrases, circumstances, and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by AMEX Assurance Firm.

Shield your funding

Apple and different third-party retailers promote AppleCare+ and different proprietary warranties. These could possibly be value contemplating, particularly for unintentional harm on non-iPhone units, however savvy spenders who’ve the appropriate bank card could also be lined for harm to their iPhones.

As of late, a few of our high beneficial bank cards additionally provide ongoing cellphone safety, so long as you pay your provider invoice with an eligible card that offers loss and damage protection. That in and of itself might cowl an annual charge if you find yourself damaging your system.

Personally, I would suggest utilizing both the Amex Platinum, the Chase Freedom Flex or the Capital One Venture X, all of which supply each buy safety and cellphone safety advantages.

| Card | Protection/deductible | Notable exclusions | Incomes price on cellphone invoice | Annual charge |

|---|---|---|---|---|

| Ink Business Preferred® Credit Card | As much as $1,000 per declare, with a most of three claims per 12-month interval (with a $100 deductible per declare) | Beauty harm that does not have an effect on the cellphone’s capacity to operate; misplaced telephones | 3 Chase Final Rewards factors per greenback* | $95 |

| The Platinum Card from American Categorical** | As much as $800 per declare, with a most of two claims per 12-month interval (with a $50 deductible) | Beauty harm that does not have an effect on the cellphone’s capacity to operate; misplaced telephones | 1 Amex Membership Rewards level per greenback | $695 (see rates and fees) |

| Chase Freedom Flex | As much as $800 per declare, with a most of two claims value $1,000 per 12-month interval (with a $50 deductible) | Beauty harm that does not have an effect on the cellphone’s capacity to operate; misplaced telephones | 1 Chase Final Rewards level per greenback | $0 |

| Capital One Enterprise X Rewards Credit score Card | As much as $800 per declare, with a most of two claims value $1,600 per 12-month interval (with $50 deductible) | Beauty harm that does not have an effect on the cellphone’s capacity to operate; misplaced telephones | 2 Capital One miles per greenback | $395 |

*Earn 3 Final Rewards factors per greenback on the primary $150,000 in mixed purchases every account anniversary 12 months within the classes of journey, transport purchases, web, cable and cellphone companies, and promoting purchases with social media websites and search engines like google and yahoo.

**Eligibility and profit ranges fluctuate by card. Phrases, circumstances and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by New Hampshire Insurance coverage Firm, an AIG Firm.

Assembly minimal spending

Lastly, one other consideration can be to time your splurge with the opening of a brand new card. This manner, you would be a lot nearer to assembly the minimal spending requirement to earn a big sign-up bonus. One among our high picks in the intervening time is the Chase Sapphire Preferred® Card, which is providing 60,000 bonus factors after you spend $4,000 on purchases within the first three months of account opening.

You could find a full listing of high affords here. Simply notice that not all of those playing cards embody buy safety and prolonged guarantee perks, so for those who’re seeking to prioritize protection over factors, check with the chart above.

Associated studying:

For charges and charges for the Amex Platinum Card, click on here

For charges and charges for the Amex Gold Card, click on here

For charges and charges for the Blue Money On a regular basis, click on here