By many objective measures, 2025 was a good year. Investment returns were solid. I published another bestseller in Millionaire Milestones. My kids are healthy, happy, and continuing to grow in loving environments. On paper, I should feel satisfied.

But the reality is different.

The downside of writing consistently, responding to hundreds of questions, managing the family finances and rental properties, and spending an enormous amount of time with my kids is that there isn’t much time left over for me. Since 2009, I’ve been waking up at around 5 AM to write before work, and since 2017, to write before the family wakes up to spend more time with them.

And I’d like to finally let off the gas.

2026 is also my last full year in my 40s. Maybe this is a midlife reckoning. But I’m no longer as motivated as I once was. I’m grinding too much and feel underappreciated. That disconnect has been weighing on me.

My expectations and effort were too high for 2025. As a result, disappointment followed. Therefore, my goal is to simplify, relax more, and lower expectations for myself and for others. This way, life will be more balanced and the household will be more harmonious.

Changing From a FIRE Lifestyle to a Regular Lifestyle

Because I am burned out, my goal for 2026 is to return to average. I probably should aim for below average, but that feels like too dramatic a swing. Average will do for now.

To help me better understand what “average” actually looks like, I have been slowly surveying other dads on how much they work, play, rest, spend, and care for their children. My goal is to act more like them.

FIRE Can Mess Up Your Perspective

The thing about living the FIRE lifestyle since starting Financial Samurai in 2009 and leaving work in 2012 is that it can make you myopic. You lose sight of the so called real world and how most people actually live.

When you are constantly trying to optimize your time and money, you stop doing things purely for enjoyment. Instead of splurging on a vacation or a car, you think about saving for a 529 plan or maximizing retirement contributions.

You also stop doing things when everyone else does them. Waiting in line for lunch at noon feels dumb so you eat at 11 a.m. or 1:30 p.m. instead. Driving during rush hour seems crazy so you arrange plans in the middle of the day or evening. Over time, this mindset can make you rigid about what to do, when to do it, and what is not worth doing at all.

Further, when you have both money and time on your hands, you can fall into the mindset of “if I can, I must.” Once you no longer have excuses like a work meeting, there’s no reason not to work out, pick up and drop off the kids, cook, clean, or write the next great American novel. And if you don’t do those things, the default assumption becomes that you’re simply being lazy.

Thankfully, having children who attend school has helped give me more perspective from other parents and nudged me toward a healthier and more balanced lifestyle. For a long time, the FIRE way was the primary lens through which I operated. Now I am realizing that it is time to loosen up and rejoin the normal flow of life a bit more.

Here are the eight changes I plan to make.

1) Spend 50% Less Time On Childcare

After 8.5 years, I’m moving away from my identity as a stay at home dad. I promised to be a stay at home dad for the first five years of each child’s life, and that mission is accomplished. Now I plan to reduce the average amount of awake time I spend with my kids to about three hours a day, down from roughly six or seven.

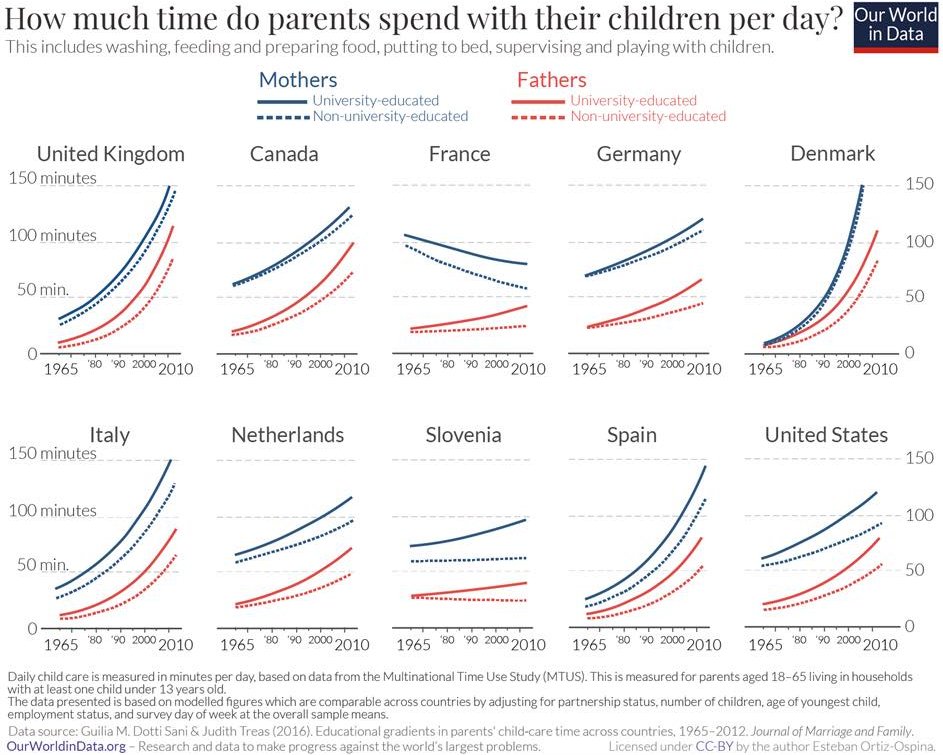

Before anyone freaks out, the average college educated father spends about 80 minutes a day with his children. At 180 minutes, I’ll still be well above average. It’s mainly the 4-7-hour Daddy Day camp sessions every Saturday and Sunday will shorten so I can do more of my own thing.

By my own calculations, I’ve already spent the equivalent of about 55 years of average dad time with my 8.5-year-old son and 42 years with my 6-year-old daughter. So by the time they leave the house at age 18, I will have spent a lifetime with both of them, even at my reduced rate. For those older parents out there who regret having kids late, know that you can make up for lost time.

I’ve front loaded my parenting and am glad that I did. But I also need to reclaim some personal time if I want to stay present and sane for the long run. If you don’t have kids, just know that your free-time will go to zero if you are not careful about making time for yourself.

2) Travel Solo More Without Guilt

I’ve been away from my family a total of only 11 days in eight years and nine months. And all 11 of those days were to see my parents to make sure they are OK (end of 2020 during pandemic) and loved (dad’s 80th birthday in Nov 2025). I’d like to do more adventure traveling on my own.

To figure out an appropriate number of days I can solo travel without feeling bad, I surveyed six other dads about how much they traveled for work in the past year. Their answers were 155 days, 68 days, 60 days, 45 days, 27 days, and 18 days. All are still married, which suggests their wives are probably okay with it. Three of the six wives had full-time jobs and also traveled for work.

Given that I’m the primary financial provider who has enabled my wife to be free since 2015 by helping her negotiate a severance package, my conclusion is that I should be able to travel at least 44 days a year guilt free. 44 days is the average of the five dads I know after throwing out the outlier who traveled for 155 days. If I want to take baby steps to normalcy, I cut that in half and still get 22 days of solo travel without disapproval.

Where To Go

This travel will include media and finance conferences in Asia, tennis tournaments on my bucket list, plus solo adventuring to new countries. Given I grew up overseas and lived in six countries before 14, travel is a part of me.

One of my regrets is not being a digital nomad before having children. But since I never got fired during the global financial crisis, I soldiered on until I left in 2012. Then I didn’t have the courage to travel alone, except once to Switzerland and Mallorca, which was a blast.

It will be tough to be away from my family, but I plan to spread the 22 to 44 days across two to four trips. I’m encouraged by the many families who make extended travel work, with one parent away while the other keeps the household running smoothly. They seem to do just fine, and in some cases, the time apart even strengthens appreciation and closeness when everyone is reunited.

3) Publish Less Frequently And Write Shorter Posts

In 2026, I plan to reduce my publishing schedule from four times a week to eventually three on average.

Instead of Monday, Wednesday, Friday posts plus a newsletter, I’ll aim for Monday and Thursday posts and a Saturday newsletter focused more on investing and real time thoughts. This way, I can better free up my weekends for family time, poker, and sports instead of spending a Friday or Saturday evening writing my newsletter. Everything will remain free, so not to worry.

I’ll start by implementing this new publishing schedule during every holiday week, beginning with MLK week on January 19. From there, I’ll roll it out over Spring Break, Summer Break, Fall Break, and Winter Break. One thing I’ve realized since becoming a parent is just how much time off children actually get each year. As a result, having kids doesn’t crimp an ideal FIRE lifestyle nearly as much as you might think.

I am also going to write more 1,000 – 1,200 word posts instead of 1,500 word plus posts. The goal is to get to the point more quickly and better capture the attention of a population with declining attention spans.

With the rise of AI, you also simply don’t need me as much anymore. Cutting my output by about 25 percent should free up meaningful personal time. Maintaining such a rigid schedule since July 2009 has created unnecessary stress sometimes, especially on the weekends. I’m proud of the consistency, but I don’t need to prove anything anymore.

4) Finish My Third Book With Portfolio Penguin

By giving myself permission to publish less on Financial Samurai, I can redirect that time toward finishing the first draft of my third book with Portfolio Penguin. The working title is Your Children Will Be OK: A Practical Guide to Raising Resilient, Capable Kids in an Uncertain World.

The topic aligns perfectly with where my focus is today, ensuring our children are taken care of and can successfully launch into adulthood in an increasingly competitive world.

A parent’s worry is never truly done, so the goal of this book is to help put that worry to rest and feel more confident about our children’s futures. I will share the various strategies to help show how you and your children will be okay.

5) Stay Unemployed For One More Year

I’ve decided to view remaining jobless while taking care of a family in San Francisco as a fun personal challenge. I’ll hit nine years in April 2026, and my goal is to make it to at least ten. This is one of the hardest FIRE challenges, especially since we live in one of the most expensive cities in the world where we choose to pay independent school tuition.

Having no steady income forces me to focus on better managing our money so that it doesn’t run out. A lack of retirement or healthcare benefits also helps me better sit with uncertainty. The longer I live with uncertainty, the more comfortable I feel when negative events occur.

That said, I still have this urge to seek a role at an AI-related startup again. I’m already investing as much as I can in private AI companies to help hedge for my children’s future. So why not see if I can go all-in to minimize regret? I’ll be in San Francisco for at least 3.5 years and both children are in school full-time.

I tried at the end of 2023 and ended up consulting part time with a fintech startup for four months. It was a good experience that taught me a lot about startup life and what it takes to compete successfully. With two years more time to take care of family, publish my book, and rethink the ideal scenario, I’m open to try again if the perfect fit comes along.

I assign only a 5% probability that I’ll find the right fit and receive an offer that I’d be willing to accept. After all, my goal is to stay unemployed for one more year. But there’s always still a chance.

6) Simplify My Rental Property Life

Aside from family, the two biggest sources of stress (and joy) in my life have been Financial Samurai and owning physical real estate. Financial Samurai is fun to operate, so the stress there is minimal and will be reduced with less weekend writing of the newsletter. Managing rental properties, however, is my least favorite activity and reliably sours my mood whenever something comes up.

I was relieved to sell one rental property in 2025, receiving a preemptive offer. But I still own three rentals in San Francisco and one in Lake Tahoe. My goal now is to keep my tenants happy so I can eventually sell another property as early as 2027, and no later than 2029 if we are to relocate to Honolulu.

Real estate was an outstanding wealth builder for me during my first 20 years out of college. At this stage, I’m less interested in maximizing returns and more interested in minimizing maintenance issues, tenant drama, and lightening my mental load. I’m hopeful 2026 will be a tame year for property management given I secured two new tenants in 2H 2025.

7) Not Lose The Gains Made Since January 1, 2023

My public investment portfolio is up about 100% since the beginning of 2023 and I plan not to lose a single dollar of it. Overall, I will gradually reduce risk and restrict new investments unless markets are down at least 3%. In addition, I will re-build my cash hoard by parking more money into 10-year Treasury bonds yielding ~4.2%.

There is real value in outsourcing to a money manager if you want to free up time, reduce stress, or simply have no understanding or interest in investing. The problem with me is that I earned an MBA, worked in finance for thirteen years, am a personal finance enthusiast, and cannot bring myself to outsource any financial management since I can do it well myself.

2025 was particularly stressful because I sold a rental property and reinvested most of the proceeds in March, right before markets took a dive. Combined with nonstop policy noise and higher stakes investing, I found myself exhausted by it all. Then I was also managing a relative’s seven-figure portfolio for free, which added to my stress. Yes, the markets eventually recovered, by the volatility took too much of a toll.

If I can earn the risk-free rate plus one or two percent for my overall taxable portfolio, I’ll be extremely satisfied after three years in a row of 20%+ gains. I am done being an active investor trying to outperform the S&P 500.

Establish New $100,000 Release Valve Fund

In addition, I’m going to mentally earmark $100,000 for nonproductive spending and unforeseen events. By doing so, any future car issue, home repair, accident, or other unpleasant surprise will already be accounted for. The goal is to reduce stress and anxiety when inevitable problems arise, instead of feeling blindsided every time something goes wrong.

Just as importantly, this cushion gives me explicit permission to spend on more things without guilt, rather than defaulting to saving and investing every extra dollar for my children. At the moment, the only big ticket item I can envision is replacing my car, which is now over ten years old. Even if I splurge on a $65,000 vehicle, I would still have $35,000 remaining in this “release valve” fund to absorb future mishaps. Knowing that buffer exists makes spending feel intentional rather than irresponsible.

Unlike an emergency fund, the release valve fund is designed to be spent and has already been mentally budgeted.

8) Shift From Seeking Appreciation To Finding Internal Validation

One of my biggest personal weaknesses is a strong desire to feel appreciated. It likely stems from childhood, when I was often told I was not good enough after losing a tennis match or doing poorly on an exam. When I work hard and that effort goes unacknowledged, I feel deflated, and over time, quiet resentment builds.

In fact, this tendency was one of the reasons I ultimately left my finance career. Despite strong performance, I felt underappreciated through slower promotions and compensation that did not reflect my contribution. Instead of staying frustrated, I chose a different path: I negotiated a severance, walked away, and built Financial Samurai so my effort and outcomes would be directly linked.

But if my goal for 2026 is to return closer to average, I need to accept a difficult truth: nobody will ever care about your output as much as you do. Expecting consistent recognition is a recipe for disappointment, not motivation. I need to learn to just suck it up and not expect a “thank you” or a “job well done.”

There is a certain honor in persevering at work you dislike, even in the face of mistreatment.

I also need to acknowledge hedonic adaptation. When you provide a stable and comfortable life for long enough, people naturally get used to it. What once felt extraordinary becomes normal. This is human nature, not malice, and blaming others for getting used to the good life only deepens unnecessary resentment.

Related: The Source Of All Stress In Life: Giving A Giant Crap

The Importance Of Intrinsic Motivation

At the same time, I’m realistic about who I am. I’m not wired to suddenly stop caring about recognition altogether. It’s hard not to feel disappointed after spending time thoughtfully answering a reader’s email that goes unacknowledged. So instead of trying to change my personality overnight, I need to reset my expectations and moderate my output.

By intentionally doing less, I lower the emotional cost of feeling overlooked. Less output means fewer unspoken expectations. Fewer expectations mean less resentment. And less resentment creates more peace.

Ultimately, this is about shifting from extrinsic validation to intrinsic motivation. I need to remind myself that I write, invest, build, and provide because it’s meaningful to me, not because I need acknowledgment. If appreciation comes, great. If it doesn’t, that has to be okay too.

A Sabbatical For A More Harmonious 2026

These eight changes are all designed to reduce stress, reclaim time, and help me live better. I liken it to being a professor on sabbatical, doing research or writing a book.

Instead of battling AI in the publishing world by writing more, I’ll invest in more AI companies disrupting the space. Instead of forcing creativity on a rigid schedule, I’ll give myself room to enjoy the process again. And instead of trying to financially provide and be a full-time parent, I’m going to go the more traditional route.

Each resolution will be challenging because old habits die hard. But they are necessary to prevent me from walking away from everything entirely.

I’ll continue to eat well, exercise daily, and take naps whenever possible. That part isn’t negotiable. The more time I reclaim for myself, the more present I can be for everyone else.

Readers, what are your resolutions for 2026? Have you found any effective ways to quiet the desire for recognition and simply feel at peace with your effort? If you’re a working parent, I’d love to learn how you balance career ambitions, travel, and family time without burning out. And if you’ve ever gone from being a constant grinder to taking a sabbatical or meaningful break, how did you adapt to the slower pace and recalibrate your sense of purpose?

Start The Year Off Right With A Free Financial Checkup

One tool I’ve leaned on since leaving my day job in 2012 is Empower’s free financial dashboard. It remains a core part of my routine for tracking net worth, investment performance, and cash flow.

My favorite feature is the portfolio fee analyzer. Years ago it exposed that I was paying about $1,200 a year in hidden investment fees. This money is now compounding for my future instead of someone else’s.

If you haven’t reviewed your investments in the last 6–12 months, now’s the perfect time. You can run a DIY checkup or get a complimentary financial review through Empower. Either way, you’ll likely uncover useful insights about your allocation, risk exposure, and investing habits that can lead to stronger long-term results.

Stay proactive. A little optimization today can create far greater financial freedom tomorrow.

Empower is a long-time affiliate partner of Financial Samurai. I’ve used their free tools since 2012 to help track my finances. Click here to learn more.