One of the more entertaining aspects of financial social media is watching hyperbole get passed around like a hot potato. Almost every month, there seems to be a new label designed to classify where people supposedly stand in society.

We already have poor, low income, lower middle class, middle class, DUPs, HENRY, mass affluent, Fat FIRE, poor millionaire, and rich.

If there is one thing we love in addition to earning money, it is categorizing ourselves and others. And if we can categorize others below where we stand, we might feel a little better about our own situation.

Since 2009, I’ve seen this phenomenon play out repeatedly on Financial Samurai.

Commenters will say things like, “Things are dire. The economy is collapsing. People are losing their livelihoods.” But when I try to empathize and ask how they are doing, the response is almost always the same: “I’m actually doing great. It’s everybody else that’s doing badly.”

I always get a kick out of that response. And since 2009, the economy along with risk assets have generally performed well.

Lately, the newest label gaining traction, especially with the rise of artificial intelligence, is the so-called permanent underclass.

What Is the Permanent Underclass?

The term sounds ominous, and that’s intentional.

The permanent underclass refers to a group of people believed to be structurally locked out of economic mobility. They are not temporarily struggling, but effectively excluded from meaningful participation in the labor market across generations. Unlike cyclical or transitional poverty, the word permanent implies that escape is statistically rare, even during periods of economic growth.

Although some people assume the concept emerged alongside artificial intelligence, the idea is decades old. Sociologists began using the term as far back as the 1960s to describe populations increasingly detached from stable employment due to structural changes in advanced economies.

The concept gained wider attention in the 1980s, as researchers studied how deindustrialization, the disappearance of middle-skill jobs, and geographic segregation created pockets of persistent poverty largely untouched by economic expansions.

Artificial intelligence didn’t invent the idea. It resurrected and intensified the fear.

As AI expands into cognitive work, the concern is that millions of jobs will disappear faster than workers can retrain. If machines can write, analyze, diagnose, code, and design at scale, what happens to the people who can’t keep up?

The argument is that AI won’t merely widen inequality, it will permanently harden it.

A Shrinking Window to Escape The Underclass

Because AI is advancing so quickly, there’s a growing sense of urgency to escape the underclass before the door closes for good.

One solution is to embrace AI to make you more productive compared to workers who don’t. My favorite solution is to own as much appreciating assets as possible that generate as much passive income as possible to break free.

For investors, the bull market since 2023 has helped. The S&P 500 is up roughly 80% over the past three years. Unfortunately, it still takes a lot of invested capital to generate life-changing wealth. A $100,000 investment that grows to $180,000 doesn’t suddenly grant economic freedom.

When ChatGPT first came onto the scene in 2022, some of us, including myself, estimated the window to escape was about 10-15 years. If true, 10-15 years is long enough to save aggressively, invest consistently, get promoted, and generate good side income.

If the Global Financial Crisis hadn’t hit from 2008–2010, I would have been able to escape work ten years after graduating from William & Mary. Instead, the GFC delayed that exit until 2012, or by three years.

At the time, I was earning about $80,000 a year in passive income. It wasn’t big money, but it was enough. I was happy because I was free, which was good enough for me without kids.

The Escape Window Is Narrowing

Today, the window seems much shorter to build enough wealth. Five to maybe ten years tops? The CEO of Anthropic has publicly suggested it could be as short as two.

Creating enough wealth in five years is possible if you already have a solid base. But if you’re just starting your career, or still in college, the odds are impossibly low. That reality helps explain why so many young people are taking outsized risks in speculative assets that generate no profits or income like crypto, meme coins, NFTs (so dumb), gold, and silver.

The thinking is simple: better to take a shot at generational wealth than remain stuck in a soul-sucking 9-to-5 forever. The irony is that “forever” is now an illusion, as AI is already beginning to disintermediate millions of workers.

As a parent of two young children, I’ve felt an increasing pressure to help them avoid getting stuck after graduation, living at home with limited options and no clear path upward. As a result, I’ve been spending more time with them and trying to teach them as much as I can in an age appropriate way.

I tell myself I have 18 years to impart whatever wisdom I can, so I better get cracking.

But if AI is going to eliminate accounting jobs, marketing jobs, finance jobs, teaching jobs, medical jobs, writing jobs, tech jobs, acting jobs, law jobs, real estate jobs, and sales jobs, as so many AI company leaders almost gleefully publicize, then I sometimes wonder what the point of trying so hard is anymore.

If entire career paths are shrinking or disappearing, why not just live life and YOLO? For a child, the 13 years in grade school can be magical years filled with JOY or pressure cooker, stressful years filled with DREAD.

At times, it feels like it might be healthier to accept our fate and to focus on enjoying the present instead of constantly striving. After all, how can humans realistically outwork or outsmart machines that never sleep and improve exponentially?

It’s Okay to Be Part of the Underclass

Being part of the underclass doesn’t sound good, but it’s really a matter of perspective.

Most of us won’t starve. We adapt. And labels, ultimately, are just labels. Let’s not get hung up on them.

Today, I consider myself part of the underclass because I don’t have stable employment. There is no upward mobility for me. At 48, it’s unlikely I could land a job capable of comfortably supporting a family of four in San Francisco. All I have are my books and this site. And we all know being a professional writer doesn’t pay well.

If my wife returned to work, best case, we could earn a combined $250,000 – $300,000 a year. I’d assign a 20% probability. That might sound like a lot elsewhere, but in San Francisco, ~$140,000 for a family of four qualifies as low income for subsidized housing and free childcare.

More realistically, our combined active income would top out around $150,000–$200,000. To get there, I could be a tennis instructor making $70,000 – $90,000 a year, while driving for Uber on the side. Maybe my wife could get a job as a grade school teacher making $65,000 – $100,000 a year.

So instead of striving 50 hours a week to climb further up the socioeconomic ladder, being satisfied with what we have may be best.

FIRE and the Underclass May Be Two Sides of the Same Coin

At the same time, I also consider myself FIRE, the movement I helped popularize starting in 2009 while planning my escape from finance. Our passive and semi-passive income covers our basic living expenses.

Ironically, those of us who are FIRE are no longer economically mobile either, because we’ve purposefully opted out. The longer we stay out of the labor market, the harder it becomes to re-enter at a meaningful level. In that sense, FIRE is a self-chosen version of the underclass.

Which is why labels matter far less than we think. We can call ourselves whatever best fits our mindset or life stage. FIRE. Underclass. Something in between. Whatever. As long as we are surviving, we can call ourselves whatever we want.

Why Escaping the Underclass May Matter Less Than We Think

Most permanent underclass arguments assume economic dignity must come primarily from paid labor. Fall behind in the labor market, and you’re left behind in life.

That assumption ignores two major forces already reshaping outcomes.

- First, the expansion of means-tested benefits.

- Second, the declining cost of upward mobility

Means-Tested Benefits Are Increasing

Many elite colleges now offer free tuition for families earning under $200,000. That income would have placed a household firmly in the upper middle class a generation ago. Now, it’s considered low income, which is great for now ~80% of families who make this much or less. Although most of our children can get into elite colleges, the pressure to provide free tuition will spread to other colleges that want to compete for headcount.

Without having to save $200,000 – $400,000 in today’s dollars for college per child, parents gain flexibility. They can retire earlier or choose work that is more meaningful, even if it pays less.

They can also redirect some of that money toward improving their lives today, whether that means more travel, more time with family, or simply less financial stress.

Run the calculations yourself and see how many working years you reclaim by not having to save so aggressively for college. The difference may surprise you.

Government support now extends well beyond food assistance to include healthcare subsidies, child tax credits, housing support, and education grants. In times of crisis, intervention has been swift and substantial – from PPP loans and stimulus checks to forced mortgage modifications.

The federal government is already rolling out investment accounts for newborns. Over time, some form of universal basic income (UBI) may emerge to further stabilize baseline living standards. The government must if they continue to let AI run rampant, and if politicians want to maintain power.

These programs don’t make anyone rich, but they raise the floor and reduce downside risk.

The Floor Is Rising, Even as the Ceiling Compresses

If artificial intelligence reduces traditional employment while society simultaneously provides education, healthcare, and basic security at a lower personal cost, the urgency to escape the underclass diminishes.

Not because ambition disappears, but because survival and dignity are no longer as tightly tied to dominance in the labor market.

The Grind Is Not Enjoyable

I went through the meat grinder in my earlier years, pushing as hard as I could to earn as much money as possible while the opportunity was there. During that period, I developed TMJ, sciatica, plantar fasciitis, chronic lower back pain, and ground my molars nearly flat. The physical and mental sacrifice required to maximize income took a real toll.

That experience helped me realize something important. Even when people have enough, many cannot help but continue sacrificing their time, health, and peace of mind in pursuit of more money and status. The ladder never feels tall enough once you are on it.

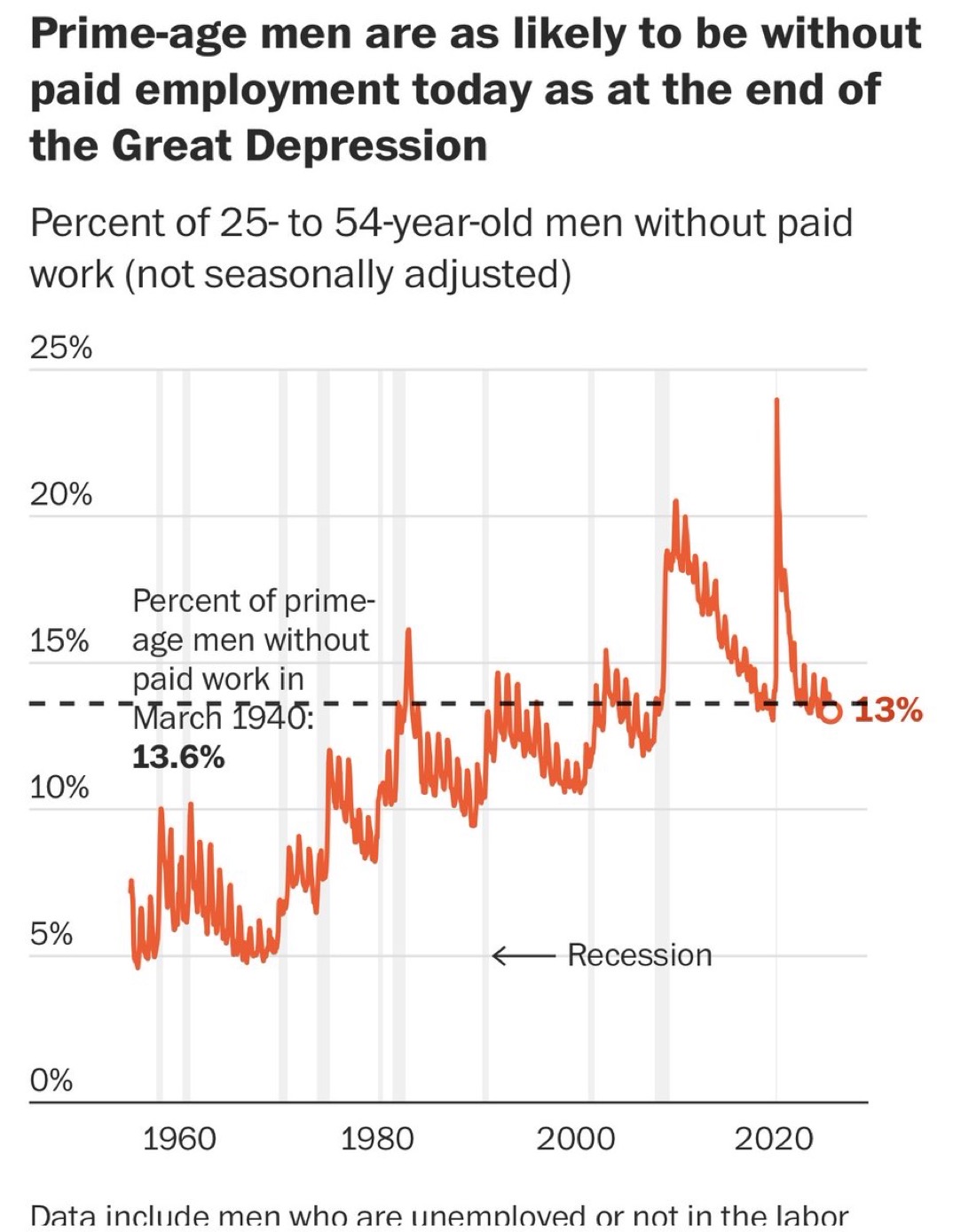

However, given the labor market is weakening, it becomes easier to let go. And once you’re off the status ladder, you might wonder why you climbed it for so long. Isn’t your health and happiness worth far more?

I see this dynamic not just in my health, but in my personal life as well. One of my biggest regrets is delaying having children by about five years because I was overly focused on my career. Yes, raising children in San Francisco is expensive. But I didn’t need at least a million dollar net worth to do so.

If I had more confidence that I wouldn’t slip through the net, I would have proposed to my wife and started a family sooner. Greater support from the government and wealthy institutions would have been amazing.

Thankfully, We Can Invest In Our AI Overlords

We do not have to sit back and accept getting disrupted by AI while its employees become extraordinarily wealthy. Yes, it is difficult to land jobs at the top AI companies. But we can invest in them to avoid getting let behind.

Once we become investors, the power dynamic shifts. Instead of fearing displacement, we participate in the upside. The AI employees are now working for us.

The key is to build enough exposure so your investment position resembles the equity compensation of an employee.

For example, imagine a mid-level engineer at OpenAI earns a $350,000 base salary and holds $500,000 in company stock. If you strongly believe in OpenAI’s future, you could invest in an open-ended venture fund that owns OpenAI and build a $500,000 proportional exposure yourself immediately or over time.

You will not receive the $350,000 base salary. But you also will not be working 50 hours a week under constant performance pressure.

Another approach is to construct your AI exposure as if you were an entry-level employee across multiple companies. Entry-level tech workers might receive roughly $50,000 in stock grants. If you have $500,000 in capital, you could allocate $50,000 into 10 promising AI companies and diversify your risk.

Now that’s strategic investing where you recreate a situation where you get the benefits of what a full-time AI employee would get without having to work.

My AI Investing Hedge So Far

So far, I have built over $700,000 in exposure through Fundrise Venture. About half of that total has come from investment returns rather than initial capital.

I wish I had invested more in 2023 when valuations were lower, especially with Anthropic, a core Innovation Fund holding, raising another $30 billion at a $380 billion valuation. But I did not have that kind of liquidity at the time. Instead, I have been steadily allocating free cash flow into the fund over the past two and a half years. I also reinvested some of my house sale proceeds from early 2025 into the fund.

At the same time, I now recognize that I overfunded my children’s 529 plans since 2017 and 2019. I was overly aggressive with superfunding and ongoing contributions, not anticipating how quickly AI would begin compressing the value of a traditional college degree.

In hindsight, I probably allocated about $250,000 too much toward college savings. That capital would have been better deployed into private AI companies with asymmetric upside.

As this WSJ graphic images shows, the key is to INVEST harder not work harder. If you invest harder, your Return On Effort improves and so does life.

A Push Toward Greater Wealth or Greater Social Safety Nets

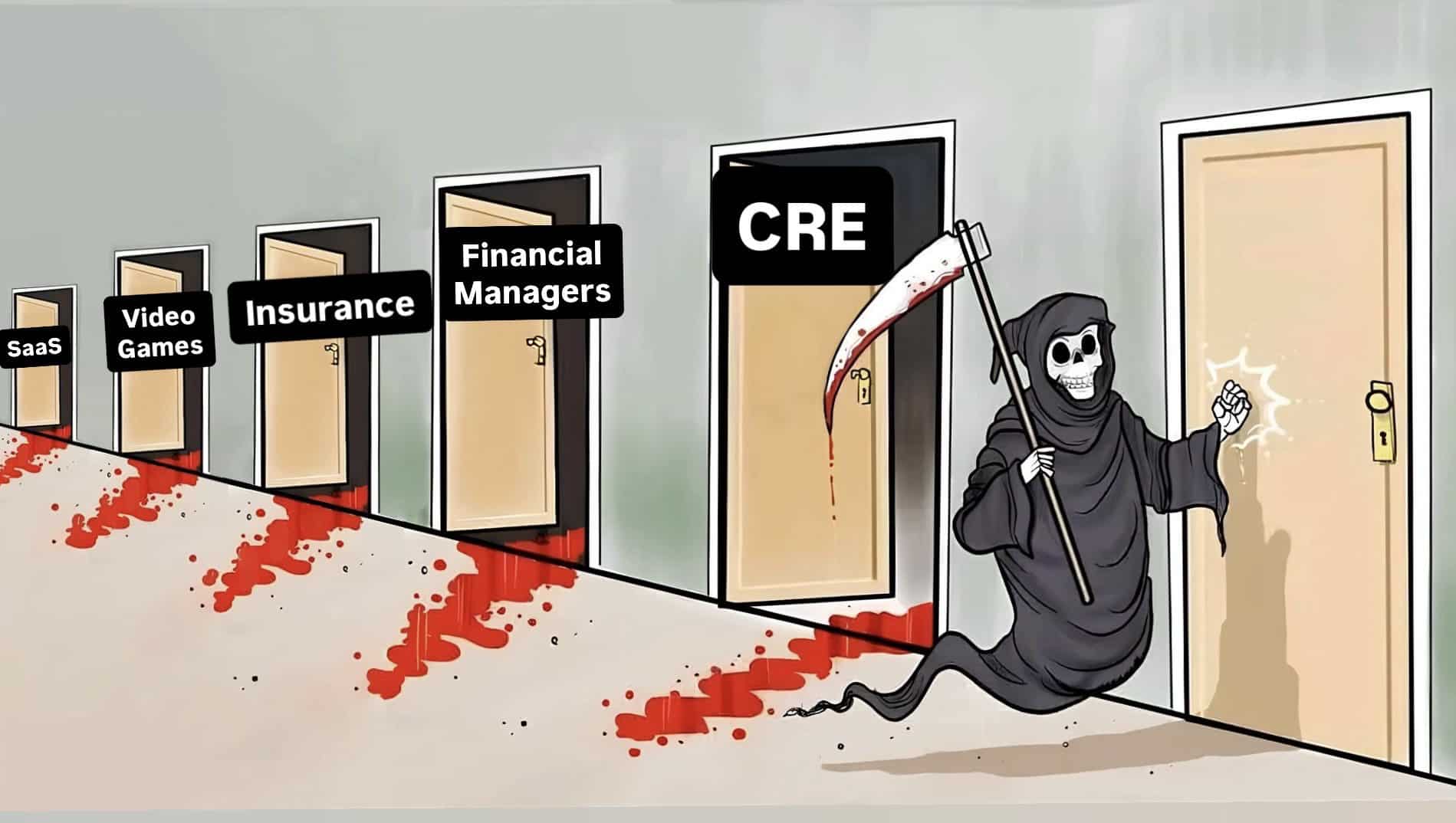

There is little doubt that AI will eliminate millions of jobs over time. Tools like Claude Code from Anthropic have already disrupted large segments of the software industry. When a company’s share price drops 40% in just a few months, mass layoffs are inevitable.

Instead of grinding endlessly in a losing race, this path involves advocating for stronger social safeguards so people can live with dignity even if traditional career mobility declines. That means pushing governments and institutions to expand healthcare access, education, housing support, and baseline income security.

Capital ownership and scarce skills will continue to matter enormously in an AI-driven economy. Meanwhile, inequality will continue to worsen. But falling out of the economic race may not be the catastrophe many fear.

For some, opting out of hyper-competition may turn out to be a rational choice, not a failure. More living, less grinding for more money we don’t truly need may become en vogue.

Is This The Income And Life You Really Want?

A $500,000 household income sounds amazing. But it usually comes with long hours, tremendous stress, frequent travel, and the need to live in an expensive city packed with millions of other strivers.

The vacation property you worked so hard to buy becomes an underutilized drag. Private school tuition keeps cash flow tight. Meanwhile, your kids just want more time with you.

Since 1999, I’ve met thousands of such couples in New York City and San Francisco. Beneath the surface success, I often sense a quiet, collective desperation to opt out and live a simpler life.

The Rise Of The FIRE Movement Once More

And if, after thinking through all of this, you still feel a strong desire to avoid getting stuck economically, then lean fully into the FIRE movement.

Cut expenses ruthlessly. Raise your saving rate to 50% or more. Invest aggressively and consistently. Treat market volatility not as a threat, but as an opportunity to accumulate ownership in the very companies reshaping the world. If AI doesn’t shut millions out of upward mobility, then at least you’ll have built more wealth and strengthened your family’s defenses.

For those who are especially driven, or perhaps especially anxious about the future, aim higher for the next 5 – 10 years. Build enough investable assets to generate sufficient passive income not just for your household, but for your children’s future households as well.

When you reach that point, you can observe the changes brought by AI with curiosity instead of fear. You can watch how industries transform without worrying whether your paycheck survives the transition.

Financial independence does not eliminate uncertainty.

But it gives you the space to navigate it with confidence. And that may be the ultimate luxury in an age of exponential change.

Reader Questions And Suggestions

Readers, do you consider yourself part of the underclass? Would being permanently stuck in the underclass be such a bad thing if governments, institutions, and the wealthiest people do more to support others? Are you considering taking work down a notch due to growing support? Or do you plan to adopt the principles of FIRE to escape before the gates shut?

To increase financial independence sooner, join 60,000+ others and sign up for the free Financial Samurai newsletter. This way, you never miss a thing.