Coinspeaker

Semler Scientific Acquires 211 Bitcoins for $21.5M, Reaches 2,084 BTC Holdings

Semler Scientific Inc. (NASDAQ: SMLR), a healthcare-focused expertise agency, continues to achieve consideration for an aggressive Bitcoin funding technique. Between December 5 and December 15, 2024, Semler added 211

BTC

$103 737

24h volatility:

3.4%

Market cap:

$2.05 T

Vol. 24h:

$105.60 B

to its portfolio at a median worth of $101,890 every, totaling $21.5 million in investments throughout the span.

Semler Scientific has acquired 211 BTC for ~$21.5 million at ~$101,890 per #bitcoin and has generated BTC Yield of 67.0% QTD and 92.8% since adopting our BTC treasury technique in Might. As of 12/15/24, we held 2,084 $BTC acquired for ~$168.6 million at ~$80,916 per bitcoin. $SMLR

— Eric Semler (@SemlerEric) December 16, 2024

The corporate disclosed a rise in bitcoin holdings to 2,084 BTC, with the acquisition costing $168.6 million in whole. Every Bitcoin buy averaged $80,916, factoring in related charges and bills. Semler funded these acquisitions by proceeds from its ongoing at-the-market (ATM) inventory providing and operational money flows.

Semler’s ATM providing has confirmed to be a significant fundraising device. As of December 13, 2024, the corporate raised $100 million in gross proceeds by promoting shares. Not too long ago, it boosted the overall providing capability to $150 million, signaling confidence in its capacity to leverage fairness markets to help its bitcoin technique.

BTC Yield Hits 92.8% Since Treasury Technique Launch

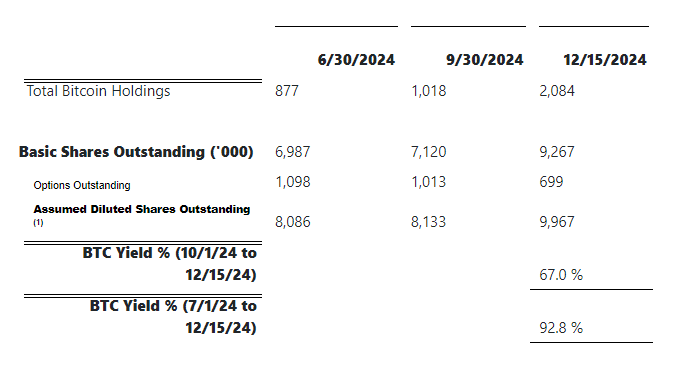

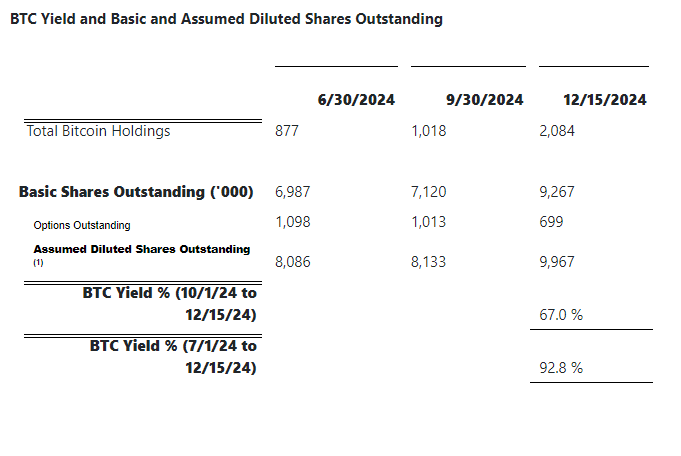

A standout spotlight of Semler’s bitcoin enterprise is its BTC Yield, a novel efficiency metric. Between July 1 and December 15, 2024, the BTC Yield surged to 92.8%. This huge BTC Yield measures the expansion in bitcoin holdings relative to assumed diluted shares excellent. For the October-December interval alone, the BTC Yield reached 67%, underlining the fast growth of its bitcoin reserves.

Supply: Semlerscientific

BTC Yield serves as a device to evaluate the effectiveness of Semler’s strategy in buying bitcoin in methods the corporate believes profit stockholders. Whereas the KPI will not be a standard measure of monetary efficiency, Semler emphasizes that it dietary supplements buyers’ understanding of its technique to fund bitcoin purchases utilizing inventory gross sales.

The corporate has been candid in regards to the limitations of BTC Yield, noting that it doesn’t account for all sources of capital used for bitcoin purchases. Regardless of this, the metric underscores Semler’s capacity to show fairness funding into substantial digital asset holdings.

Semler Expands Shares Amid Bitcoin Push

Semler’s aggressive bitcoin technique aligns with its broader monetary imaginative and prescient. By December 2024, it had elevated its share rely considerably. Fundamental shares excellent climbed from 6.99 million in June 2024 to 9.27 million by mid-December. Together with inventory choices, the assumed diluted shares reached 9.97 million.

Regardless of the deal with bitcoin, Semler doesn’t view its cryptocurrency holdings as instantly influencing its inventory worth. The corporate reiterated that its inventory worth depends upon varied components, not simply the market worth of its bitcoin holdings.

Whereas the BTC Yield metric is spectacular, Semler has clarified its nuanced objective. It’s not an indicator of stockholder returns or operational efficiency. As a substitute, it displays administration’s deal with utilizing fairness capital in methods they hope will drive long-term stockholder worth.

Semler Scientific Acquires 211 Bitcoins for $21.5M, Reaches 2,084 BTC Holdings