Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In 1271, Marco Polo set off from Venice to meet the Mongol ruler, Kublai Khan, in China. After four years of travelling he reached Cathay and was welcomed by the Khan, who made him ambassador to India and Myanmar. He served in Asia for 17 years.

The record of his travels contains many comments on the sophistication of China compared with Europe, not least in its use of paper money. The bark of mulberry trees was processed and used to replace gold or silver as currency. The incredulous Italian considered it as wondrous as alchemy, though he noted that any merchant who declined to accept the Khan’s money faced execution. So perhaps not so wondrous after all!

Most of the time we all get on with using money without worrying about what it is — or having to be threatened to accept it. However, there are moments when doubts creep in. Today, you may notice increasing concern in the media about the currency of global trade, the US dollar.

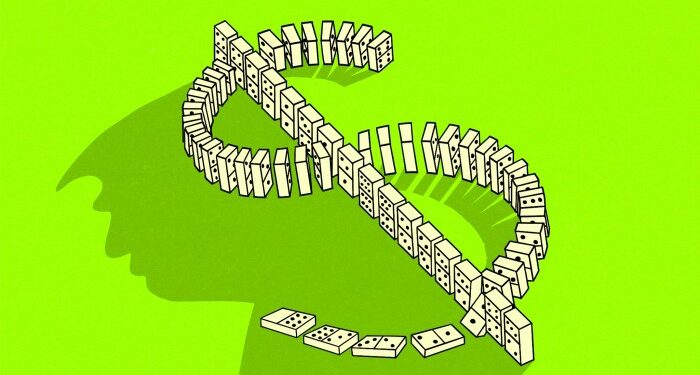

The big worry with currencies is whether they will hold their value. This is fundamental to their acceptance. The ease with which governments can print more can be dangerous. With money literally growing on trees, Kublai Khan could just grow more trees. But the value of his bark money consequently diminished, and his people learned the challenges of inflation.

Despite our general faith in the principle of money, over the past century few currencies have convinced global savers that their value will endure. The US dollar is an exception. That is why it has reigned supreme as the currency of global trade for 75 years.

Will Donald Trump tarnish that record and damage its standing? He is certainly giving it a go. The dollar has fallen 10 per cent against most currencies this year. A weak dollar was known to be part of Trump’s policy, despite this being unusual for a rightwinger and despite it making Americans poorer in euro, yen or renminbi terms. Improving export competitiveness was seen as more important.

Does this matter for investors? There are reasons to be concerned. We have seen the dollar weaken at the same time as long-term bond yields are rising. Media commentary around this might be causing those holding US equities and Treasuries (US government debt) to fret. That is most of us!

Here is the issue. Trump’s big bad (sorry — “beautiful”) bill will add significantly to the scale of US borrowings and only modestly to tax receipts. So the US government has a lot of bonds to issue, and their riskiness is inevitably rising.

There is a looming issue surrounding section 899 of the unfair foreign tax bill, which threatens a levy on overseas holders of US assets. These assets include Treasury bills. This would amount to a modest default on obligations.

Credit agencies have recently downgraded the US sovereign debt rating. Nobody thinks the US will fail to pay its bills, but if you add section 899 to the impact of a falling dollar and tariff-induced inflation, then you are potentially being short-changed on the value of those repayments.

Could other currencies replace the dollar? In Europe, the Deutsche mark used to be regarded as “strong”, but the euro has not achieved that reputation. ECB head Christine Lagarde believes it has the potential to become more important in global trade. The Swiss franc remains respected.

In 2005, Beijing moved from managing the renminbi against the dollar to using a basket of currencies. US Federal Reserve economists have noted that its role in international trade is increasing and is likely to grow. But it seems unlikely that any of these currencies will challenge the dollar’s status for a while, given the breadth, depth and ubiquity of dollar-denominated financial structures.

That should ease some of your worries. Yet a currency’s reputation as a store of value is undoubtedly undermined by undisciplined economics. A weak currency deters overseas investors from buying a country’s bonds. There is a concern that recent events may lead to Beijing buying less US debt, which could be quite a problem, given how much needs to be issued. That could see the yield the US has to pay to attract investment rise substantially, which is a downward force on the value of existing Treasury holdings.

Unsurprisingly, many long-term investors are reducing the amount of their assets in dollars. Currency risk is part of the rationale, though there is also concern that US administrations no longer play by the rules. It is quite a statement on governance and trust when investors switch US assets into Chinese ones.

There is also the perception that US equities should not represent 70 per cent of the global index, especially when their valuations look relatively high. Valuation seems a much stronger argument to me for rebalancing equity portfolios a little away from the US.

Currency fears should not factor too heavily in the decision. When you buy a share in a large global business, such as Microsoft, you pay in the currency where the company is listed, but the long-term value of the share is based on the cash flows it generates in the many currencies in which it trades. You can therefore leave the currency risk management to the company.

In 1716, 400 years or so after Marco Polo returned to Venice, the first paper money was issued in Europe. John Law, a maverick Scot, printed paper money in France. When the French cottoned on to the fact that this money was not fully backed by noble metals, a banking crisis and inflation soon followed.

History rings too many warnings for us not to accept that the US dollar may one day be superseded. But there seems little need to get too anxious about this for now.

Simon Edelsten is a fund manager at Goshawk Asset Management