Index funds are a favorite bogeyman of many fund managers and analysts, as the nice whooooosh of cash flowing from lively to passive methods has accelerated and broadened in recent times.

Goldman Sachs’ chief US fairness strategist David Kostin and his crew have taken a take a look at a number of of the extra frequent scary arguments on how that is wrecking markets, and got here away . . . unconvinced.

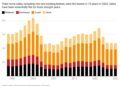

This will shock lots of people, given how monumental this pattern is, and the US inventory market is its floor zero. As Kostin’s report notes, a cumulative $2.8tn has flowed into passive US fairness funds through the previous decade, whereas actively-managed funds have seen $3tn yanked out.

In consequence, the median proportion of S&P 500 shares owned by passive funds has risen from 18 per cent twenty years in the past to 26 per cent. When you weight by {dollars}, 24 per cent of the S&P 500 index is now owned by passive funds.

It’s pure to imagine this should be having all kinds of pernicious results. How may a pattern so pervasive not?

FTAV has been planning on doing a correct effortpost on the subject for some time, however within the meantime listed below are Goldman’s takes on a number of of the extra frequent tropes, with a few of our personal ideas.

💥 Does passive investing improve correlations? 💥

One of the vital frequent anti-passive arguments is that the tsunami of “dumb” cash is inflicting shares to extra in lockstep, eroding the supposed market effectivity that underpinned the delivery of index funds.

Nevertheless, Kostin factors out that there’s zero proof of this in inventory market correlations. This has for generations ebbed and flowed completely independently of the passive pattern — and has in truth been usually falling over the previous decade, regardless of the rising passive tide:

From a top-down perspective, the influence from passive possession has not been obvious in S&P 500 inventory correlations. Usually, inventory correlations are low in market environments the place firm particular fundamentals dictate efficiency and are excessive when macro components comparable to financial progress have an effect on all the fairness market in the same method. A standard investor concern is that demand from passive buyers will not be tied to company-specific components, and consequently would trigger inventory returns to be much less micro-driven. A time collection of S&P 500 inventory correlation has proven a downward pattern over the previous decade, and this 12 months fell to a low of 0.08, the same degree to troughs reached in 1995, 2000, 2006, 2007, 2017, and 2018.

💥 Does passive investing drive valuations? 💥

One other standard trope is that the trillions of {dollars} of valuation-blind passive cash is swamping fundamentals and main a secular improve in inventory market valuations, and/or cyclical bubbles such because the current AI inventory increase.

The primary has all the time been a weak argument. The four-decade decline in rates of interest is a way more compelling rationale for the four-decade improve in fairness valuations. And if index funds didn’t exist, the cash that has gone into them would simply have gone into lively funds anyway, resulting in the identical supposed general valuation improve.

The second leg of the argument appears superficially extra compelling. In any case, most passive methods use capitalisation-weighted indices, so some individuals suppose that the more cash goes into passive funds should merely be shovelled into the largest shares, making them greater and greater.

Nevertheless, it is a basic misunderstanding of how index funds perform. If a inventory goes up the fund doesn’t want to purchase extra because it already holds a proportional amount of it. Solely new incremental {dollars} going into the fund could be divvied up based on any new weighting, however this is able to be reflective of the costs and valuations set by lively managers.

And lo, Goldman has disentangled various factors and checked out how they have an effect on valuations, and located that fundamentals stay completely dominant.

Throughout the S&P 500, we additionally discover after controlling for fundamentals, passive possession doesn’t assist clarify any further variation in valuation multiples. A cross-sectional regression of S&P 500 inventory P/E multiples on metrics comparable to earnings progress expectations, length, earnings stability, revenue margins, and asset turnover exhibits that basic metrics assist clarify 50% of the variation in valuation multiples as we speak. If we incorporate variation in passive possession into this framework, it doesn’t assist clarify any incremental variation throughout multiples. As well as, the significance of passive possession for inventory multiples, other than not being statistically important, is weaker than the significance of fundamentals.

💥 Is passive investing completely passive? 💥

That is usually bandied about as a foolish “gotcha” query, as if the overwhelming majority of those that use passive methods accomplish that just for dogmatic market-efficiency zealotry. They do it as a result of the long-term web outcomes each for people and establishments are vastly higher.

The road between “lively” (which has in actuality usually been very passive in apply) and “passive” (which, sure, depends on some usually lively selections on index composition) has all the time been blurry. And that’s significantly true now that ETFs are rising, as Goldman factors out.

From a market construction perspective, buying and selling in passive funding autos doesn’t all the time replicate passive shopping for. During times of excessive fairness market volatility our choices strategists have discovered that ETF buying and selling volumes account for a big share of buying and selling in contrast with decrease volatility environments. In the course of the previous 12 months ETF volumes accounted for 28% of the tape. However, not all ETF buying and selling is passive. For instance, hedge funds make the most of ETFs as hedges in lieu of particular person inventory shorts.

There are many legitimate questions that may and must be requested about index building, and never sufficient individuals recognize how refined variations in selections at S&P, FTSE Russell or MSCI can have giant results.

For instance, BlackRock’s flagship US know-how inventory ETF consists of Alphabet and Meta, whereas Vanguard and State Avenue’s don’t (they’re technically categorised as communications corporations, not info know-how). Main corporations are even moving their headquarters purely to draw extra of the passive bid.

However as an argument towards index funds this difficulty is fairly weak sauce, given the abysmal long term results of lively funds.

💥 Does passive investing have an effect on inventory returns? 💥

This can be a considerably associated however subtly distinct level from the valuation difficulty. However some individuals argue that mechanistic index fund shopping for can energy returns, by — in apply — consuming up the free float of an organization. That makes its inventory worth transfer extra powerfully on any incremental shopping for.

Nevertheless, Goldman’s fairness analysts examined whether or not shares with larger passive possession generated higher returns and located little discernible sample. Actually, extremely passive-owed shares have usually underperformed for the previous decade regardless of the highly effective bull run:

S&P 500 shares with excessive passive possession haven’t persistently outperformed low passive possession shares. We assemble an equalweighted sector impartial issue to check whether or not shares with excessive passive possession outperform counterparts with low passive possession. Information used to compute passive possession shares is launched quarterly and displays modifications in possession throughout the finished quarter. The issue is rebalanced at first of every quarter based mostly on knowledge that covers the coincident quarter. Efficiency since 2000 has been inconsistent, shares with larger passive possession outperformed up till 2014 earlier than plateauing and subsequently giving again of a lot of the early 2000s good points over the previous 5 years.

To supply up a concrete instance, you’ll be able to see proof of this within the rally of the “Magnificent Seven” shares which have powered the US inventory market over the previous couple of years.

Some have argued that they’ve been pushed by momentum-riding passive funds, however they’re truly comparatively much less owned by passive funds than the US inventory market as a complete. As FTAV has beforehand argued, index funds are price takers, not price makers.

It must be mentioned that there are some extra nuanced, vital analyses of passive investing popping out of academia and the finance trade lately, which we’ll undergo totally sooner or later.

There are actually numerous examples of the way it can have an effect on particular person corporations and securities — a few of them fairly enjoyable (promise). We’ve even had the primary index-related insider buying and selling case, with an S&P government in 2022 discovered guilty of getting a buddy to purchase places and calls on corporations about to be included or relegated from influential benchmarks.

However as the most recent US Weekly Kickstart report from Kostin’s crew exhibits, one must be extraordinarily sceptical of arguments that passive investing is affecting markets on a macro degree. Goldman Sachs has made the full report free to read for FTAV readers, and you can find it here.

Not that it will cease any of the hand-wringing. Be happy to inform us how silly we’re and why index funds are worse than the Black Dying, Marxism and the Star Wars prequels within the feedback.

Additional studying:

— Super passive goes ballistic; active is atrocious (FTAV)

— Passive attack: the story of a Wall Street revolution (FT)