Coinspeaker

Three-Week Bloodbath: Global Crypto ETPs Face $3.8B Wipeout Following Market Correction

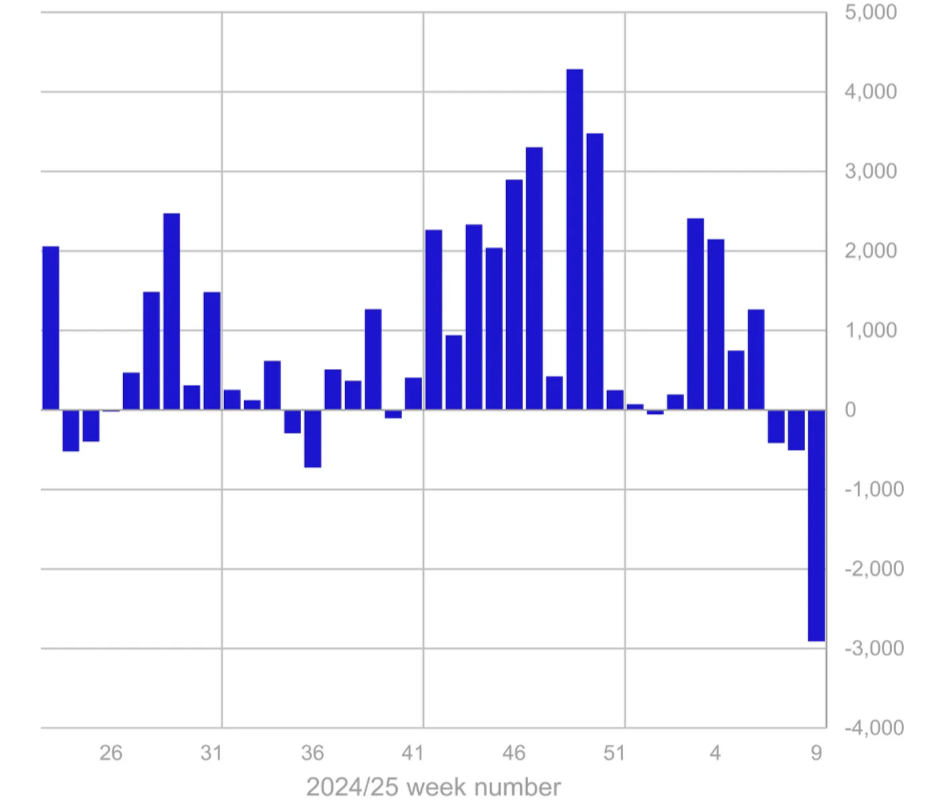

Following last week’s brutal crypto market correction and Bitcoin price drop under $80,000, cryptocurrency exchange-traded products (ETPs) witnessed a massive $2.9 billion in outflows. This marks three consecutive weeks of outflows wherein the overall global crypto ETPs have witnessed more than $3.8 billion wiped out, reported crypto investment firm CoinShares.

Some major events contributed to the crypto market bloodbath, such as the $1.5 billion Bybit hack along with the hawkish outlook shared by the US Federal Reserve. “These elements likely led to a mix of profit-taking and weakened sentiment toward the asset class,” noted James Butterfill, head of research at CoinShares.

-

Source: CoinShares

During the last week, Bitcoin was leading the outflows from global crypto exchange-traded products (ETPs) with a staggering $2.6 billion withdrawn. The month-to-date (MTD) outflows for Bitcoin ETPs were even higher, totaling $3.2 billion. In contrast, short Bitcoin ETPs experienced minor inflows of $2.3 million, indicating some interest in bearish positions.

Ethereum Leads the Altcoin Outflows

Along with Bitcoin, Ethereum exchange-traded products (ETPs) saw outflows worth $300 million during the last week. Despite this, the month-to-date (MTD) inflows for Ethereum ETPs remain positive at $490.3 million.

On the other hand, some altcoins delivered a better performance in comparison while seeing minor inflows. For e.g. Sui (SUI) emerged as one of the top performers with $15.5 million in inflows, marking a notable contrast to Bitcoin’s losses. Similarly, the XRP-based ETPs also followed the while recording $5 million in investor interest, highlighting growing interest in these altcoins.

The recent market sell-off has also impacted the total assets under management (AUM) for crypto ETPs, which dropped to $138.8 billion. This marks a significant decline from the all-time high of $173 billion recorded in January, reported CoinShares.

Bitcoin ETF Outflows Surge Significantly

Throughout last week, outflows from spot Bitcoin ETFs surged significantly until they turned positive on Friday, February 28. Furthermore, the report also notes that BlackRock’s iShares Bitcoin Trust (IBIT) registered its largest weekly outflows since inception, totaling $1.3 billion. This follows the first outflows of 2025, amounting to $22 million, recorded just a week earlier.

Despite the major outflows last week, BlackRock’s IBIT has recorded $3.2 billion in net inflows year-to-date with a total of $51 billion in assets under management. Grayscale Investments’ ETFs recorded modest outflows of $421 million last week.

In contrast, ProShares ETFs stood out as the only issuer to report inflows, with $76 million added during the same period. ProShares, now the second-largest ETF issuer after BlackRock, has accumulated $349 million in year-to-date inflows.

Three-Week Bloodbath: Global Crypto ETPs Face $3.8B Wipeout Following Market Correction