Keep knowledgeable with free updates

Merely signal as much as the UK home costs myFT Digest — delivered on to your inbox.

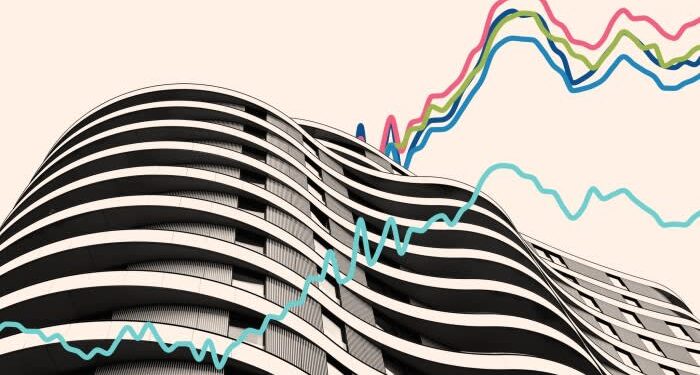

Flat costs have underperformed all different property varieties within the UK over the previous 5 years because the shift to versatile working, landlords exiting the market and considerations about cladding hit the section.

The typical price of an condominium has risen at half the tempo of some other property sort since 2019, earlier than the Covid-19 pandemic, in accordance with a Monetary Occasions evaluation of official information.

Figures from Land Registry, the register of property possession, present the common flat price £232,400 in June, up 14 per cent on the identical month in 2019.

In the identical interval, the common property worth rose by about 25 per cent to £288,000, whereas indifferent, semi-detached and terraced home costs rose by virtually 30 per cent.

Variations in worth development, which was broadly equal throughout property varieties between 2010 and 2019, emerged throughout the nation with the Covid-induced “race for house” and persevered because the housing market absorbed the impression of rising rates of interest.

Tom Invoice, head of UK residential analysis at property company Knight Frank, stated the pattern in flat costs was partly the results of “extra everlasting modifications to the best way persons are taking a look at their work-life steadiness, with elevated working from residence”.

Paul Dales, economist at consultancy Capital Economics, stated flat costs had been hit by a “structural shift in folks wanting more room after the pandemic”, in addition to elevated “worries about cladding” within the wake of the Grenfell Tower fireplace in 2017.

Flames tore up the exterior cladded partitions of the high-rise condominium block in west London within the catastrophe, which claimed the lives of 72 folks.

A public inquiry this week stated the deaths were avoidable and that successive governments had failed to carry constructing product producers to dependable security requirements, whereas housebuilder Barratt warned fixing fireplace issues of safety recognized after the blaze would take one other three to 5 years.

Richard Donnell, govt director at property consultancy Houseful, stated the Grenfell fireplace and a probe opened in 2019 by the competitors watchdog into the leasehold housing market, which intervened over the rise in floor rents and probably unfair gross sales practices, had “mixed to drive . . . underperformance of flat costs”.

Landlords promoting properties to keep away from rising taxes and mortgage prices have additionally contributed to the underperformance of flat costs, which has been geographically widespread however most extreme in London.

Evaluation of the Land Registry information confirmed condominium costs within the capital — the place greater than half of households live in a flat — barely modified between June this yr and June 2019, making it the worst-performing area in England and Wales.

Donnell stated tax modifications affecting buy-to-let traders and abroad consumers had “hit demand at a time when there was lots of uncertainty about investing in London usually by enterprise” after the Brexit vote.

Different elements have been at play, together with a rise in mortgage-free consumers, who have a tendency to buy homes relatively than flats, persevering with to assist housing demand when the surge in mortgage prices hit the market. Affordability points have additionally pushed some folks out of London.

A string of price rises by the Financial institution of England took the price of borrowing from a file low of 0.1 per cent in late 2021 to a 16-year excessive of 5.25 per cent in August final yr. The rise led to increased mortgage charges, making it harder for potential consumers.

Matt Thompson, head of gross sales at property company Chestertons, stated London flat costs have been “starting to get well”, helped by cheaper mortgage merchandise after the BoE minimize charges final month for the primary time since Covid struck.

“What is going to ultimately occur is that the market rebalances and when flat costs begin to look engaging or extra engaging . . . then folks will transfer again in,” Invoice stated.