Coinspeaker

What’s Next for Bitcoin? On-Chain Signals and ETF Inflows Spark Optimism

Because the crypto market liquidation surpassed $500 million over the previous 24 hours, Bitcoin

BTC

$100 887

24h volatility:

2.9%

Market cap:

$2.00 T

Vol. 24h:

$109.61 B

registered a 24-hour low at $94,306. Nevertheless, BTC value has since bounced again and reached a market value of $97,727.

This bullish comeback in BTC value coincides with an increase in institutional demand. Additional, the restoration rally step by step undermines the short-term correction.

US Spot ETF Nets ~$440 Inflows

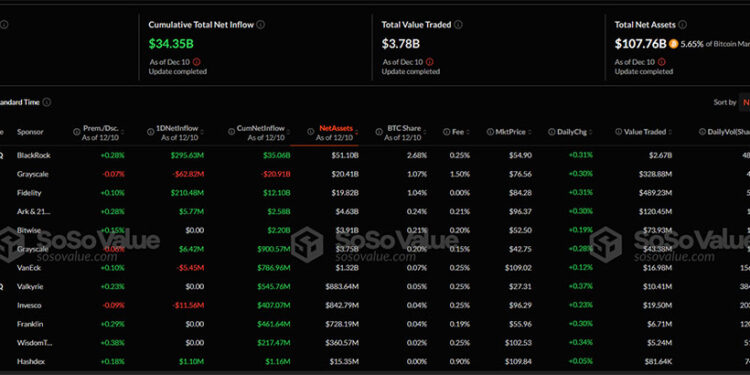

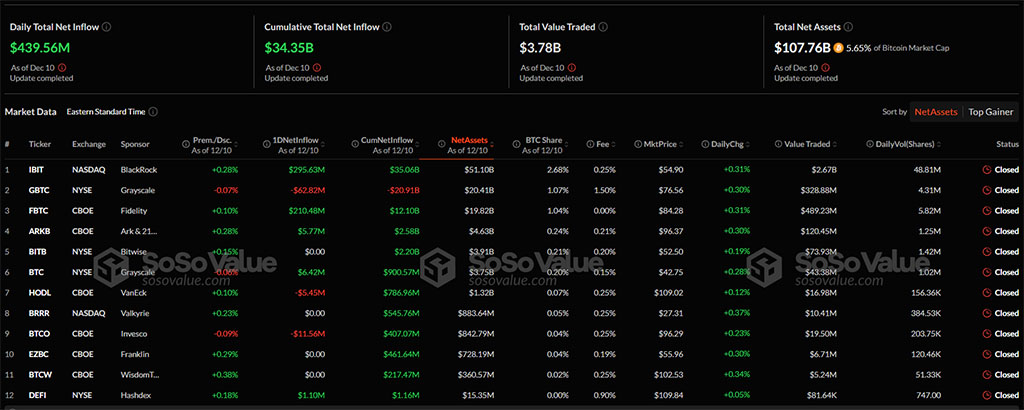

The US spot Bitcoin ETFs registered a day by day whole internet influx of practically $440 million within the institutional race to build up BTC.

BlackRock led the way in which yesterday with a $295.63 million influx. Following in its footsteps, Constancy collected $210.48 million price of BTC over the previous 24 hours.

This has led to the overall internet belongings of the US spot ETFs reaching $107.76 billion, or 5.65% of the BTC market cap. Out of 12 registered BTC ETFs, 5 recorded a internet constructive stream, whereas 3 recorded a internet outflow, leaving 4 ETFs with a internet zero stream.

Because the restoration in BTC good points momentum, the on-chain indicators are beginning to flash a purchase sign.

Bitcoin’s Imply Age of Funding Turns 31% Youthful

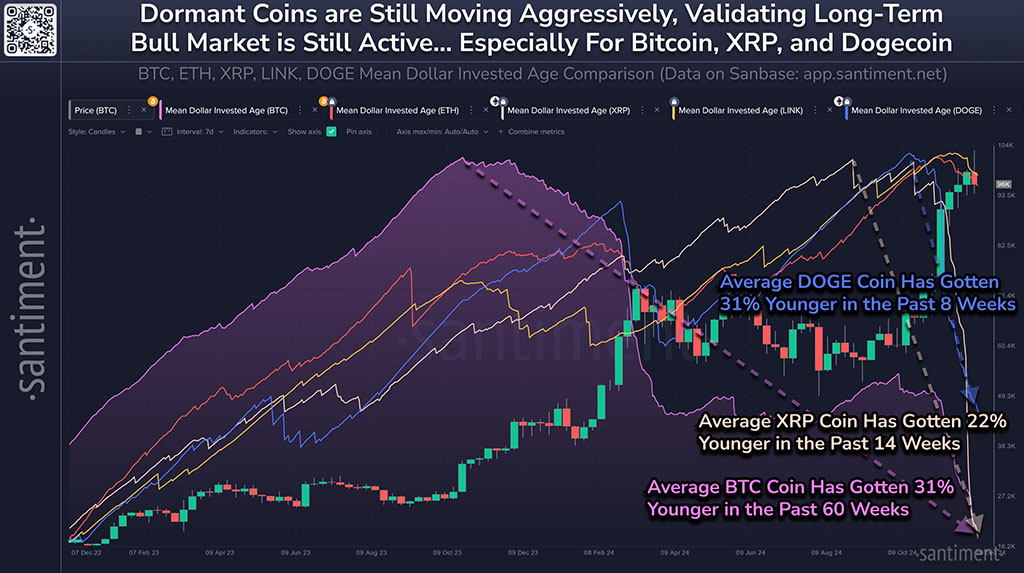

One of many underrated metrics in crypto, imply greenback invested age, helps this sign because the market step by step recovers from the current retracement.

Based mostly on the on-chain indicator, the imply age of BTC investments is all the way down to 439 days. This interprets to a 31% youthful imply age over the previous 60 weeks.

Moreover, for XRP

XRP

$2.44

24h volatility:

5.7%

Market cap:

$139.64 B

Vol. 24h:

$14.82 B

, the imply age of funding is all the way down to 865 days, making it 22% youthful over the previous 14 weeks. In the meantime, Dogecoin’s

DOGE

$0.42

24h volatility:

6.0%

Market cap:

$61.35 B

Vol. 24h:

$7.55 B

imply funding age has dropped to 370 days, making the DOGE 31% youthful over the previous 8 weeks.

The imply greenback age invested line drops for Bitcoin, and the highest altcoins sign that the older and stagnant wallets are circulating the dominant cash. Because the circulation comes from giant key stakeholders or whales, the rising community exercise marks a wholesome sign for the bull run.

The imply age of funding is a vital indicator that has proved its mettle within the 2017 and 2021 bull markets. Within the earlier bull runs, the markets peaked and began taking place when the imply ages began rising or getting older once more.

Therefore, regardless of the short-term value fluctuations in Bitcoin and the highest altcoins, the drawdown within the imply age of funding indicators a medium to long-term bullish market.

MVRV Ratio Reveals Room for Progress

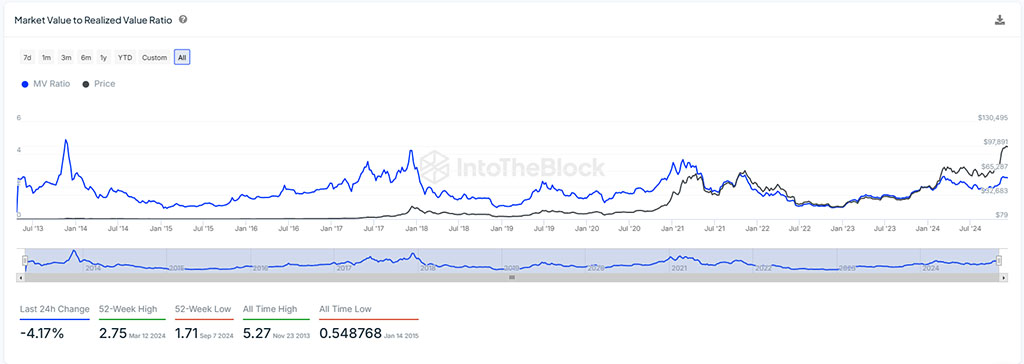

One other key on-chain indicator for predicting the bull market’s peak is the market-value-to-realized-value ratio. That is the market cap ratio to every deal with’s common buying value.

Presently, the MVRV ratio stands at 2.55 in comparison with the 2021 bull run peak of three.68. Within the 2017 bull run, the MVRV ratio peaked at 4.24 and 4.91 in 2013.

Because the MVRV ratio continues to fall throughout consecutive bull runs’ peak, it stays an important sign for predicting bullish exhaustion. At 2.55, the on-chain indicator indicators room for progress.

Bitcoin Targets New All-time Excessive

Because the BTC value bounces from the essential assist of $94,425, it marks a V-shaped restoration to problem the short-term resistance trendline. The restoration rally has surpassed the 50 SMA line within the 1-hour chart.

Additional, it assessments the resistance confluence of the 38.20% Fibonacci stage at $97,945 and the resistance trendline. The short-term pullback has resulted in a dying cross within the early time-frame and warns of a bearish crossover between the 200 and 100 SMA line.

Supply: Tradingview

Because the restoration rally good points momentum with the rising ETF inflows, the probabilities of a breakout rally have basically elevated. Nevertheless, the BTC value motion showcases the formation of low-range value candles as they attain the resistance zone.

This warns of one other potential pullback to retest the 23.60% Fibonacci stage at $96,600. However, with the on-shell indicator signaling a bullish run forward, the breakout of the native assist trendline will present a shopping for spot level for value motion merchants.

With this breakout rally, the Fibonacci ranges paint important resistance on the 61.80% Fibonacci stage close to the $100,000 psychological mark. Closing above this may improve the probabilities of BTC reaching the $103,647 mark, doubtlessly creating a brand new all-time excessive.

Based mostly on the Fibonacci ranges, the value targets for a brand new all-time excessive are $106,145 and $109,333.

In conclusion, with the intraday restoration and on-chain indicators, the bull run in Bitcoin exhibits the potential to maintain the minor hiccup.

What’s Next for Bitcoin? On-Chain Signals and ETF Inflows Spark Optimism