Some of the largest online retailers and companies that own consumer retail brands filed for bankruptcy in 2025.

At least seven retailers in the Top 2000 filed for bankruptcy in 2025, unveiling trends and challenges that led to their financial struggles. The Top 2000 refers to North America’s largest online retailers based on their annual ecommerce sales. And some of the largest retailers in the Top 2000 also operate physical stores that suffered in 2025.

They cited a mix of challenges. Consumers are buying less in stores and competitors have taken market share, some said. And macroeconomic factors, such as tariffs, played a key role as well.

Below are the seven largest online retailers in North America to file for bankruptcy in 2025. Parentheses beside their names indicate their ranking in the Top 2000 Database.

1. Hudson’s Bay Co. (No. 26)

The largest retailer in the Top 2000 to file bankruptcy in 2025 was the Canadian corporation Hudson’s Bay Co. (HBC). It filed for the Canadian equivalent of Chapter 11 bankruptcy in March. In June, it sold its intellectual property. Hudson’s Bay had purchased the retail brand Saks Incorporated in November 2013. Then, in 2021, it established Saks Fifth Avenue’s ecommerce business as a standalone company called Saks.

First revealed in July 2024, HBC sought to purchase Neiman Marcus Group (which it did in December that year for $2.7 billion). In doing so, it created an entity called Saks Global that brought together Saks Fifth Avenue, Saks Off 5th, Neiman Marcus and Bergdorf Goodman. Despite the merger, each retailer continued to operate independently under its existing brand name, according to the announcement.

In December 2024, retail investor Saks Global completed a $2.7 billion acquisition of Neiman Marcus Group. That combined two major players in luxury retail under one corporate umbrella. The deal brought together Saks Fifth Avenue, Saks Off 5th, Neiman Marcus, and Bergdorf Goodman under the newly formed Saks Global. Despite the merger, each retailer will continue to operate independently under its existing brand name, according to the announcement.

Now, in December 2025, Saks is reportedly considering filing for its own bankruptcy.

2. Forever 21 (No. 109)

The parent company of Forever 21, F21 OpCo, announced in March that it had filed for bankruptcy. That marked Forever 21’s second bankruptcy in six years.

F1 OpCo operates Forever 21 stores and filed for Chapter 11 in Delaware. Upon filing for bankruptcy, the retailer began liquidation sales at all of its roughly 300 stores. The chain had reported that it projected its assets to be between $100 million and $500 million, with liabilities between $1 billion and $1o billion. The filing specifically pointed to rivals Temu and Shein as being factors in their demise.

“While we have evaluated all options to best position the Company for the future, we have been unable to find a sustainable path forward, given competition from foreign fast fashion companies, which have been able to take advantage of the de minimis exemption to undercut our brand on pricing and margin, as well as rising costs, economic challenges impacting our core customers, and evolving consumer trends,” said Brad Sell — chief financial officer at F21 OpCo, which operates Forever 21 stores — at the time.

Prior to its bankruptcy filing, Forever 21 ranked No. 111 in the Top 2000. In addition, before the retailer’s bankruptcy filing, Digital Commerce 360 had projected that Forever 21’s online sales would reach $904.84 million in 2025.

3. Rite Aid (No. 128)

Rite Aid filed for Chapter 11 bankruptcy in May. That marked its second bankruptcy filing in two years. In September 2024, Rite Aid had named a post-bankruptcy CEO.

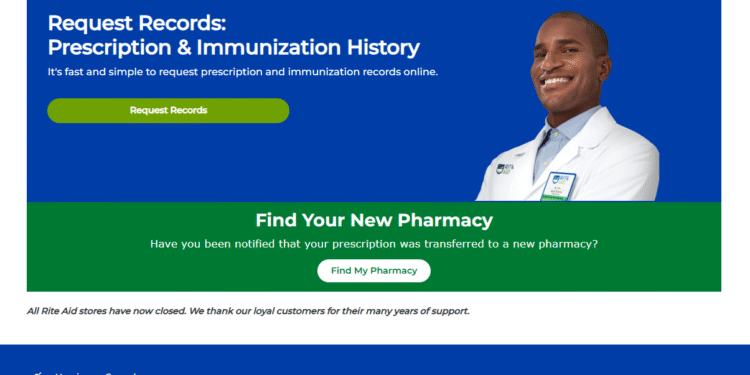

It completed the 2025 bankruptcy process in October, when it had officially closed all stores. As of December 2025, RiteAid.com redirects to a site for customers to request records, including prescription and immunization history. It also has a button to help customers find a new pharmacy.

As part of the bankruptcy process, Rite Aid looked to sell its assets. It had announced that it had closed around 1,250 stores — all its remaining locations. Retail competitors that run pharmacies acquired prescription files and other assets from more than 1,000 former Rite Aid locations.

The Rite Aid website reflects the online retailer’s 2025 bankruptcy filing and store closures. | Image credit: Rite Aid homepage, Dec. 24, 2025

4. Joann (No. 300)

Joann Inc. had emerged from one bankruptcy process in 2024. Then, in January 2025, the crafting supplies retailer voluntarily filed for Chapter 11 protection once again. It sought to keep stores open as it looked for a new solution.

The company announced Jan. 15 that it began the bankruptcy process anew in the U.S. Bankruptcy Court for the District of Delaware.

“Since becoming a private company in April, the Board and management team have continued to execute on top- and bottom-line initiatives to manage costs and drive value,” said Michael Prendergast, interim chief executive officer at Joann, in the bankruptcy announcement. “However, the last several years have presented significant and lasting challenges in the retail environment, which, coupled with our current financial position and constrained inventory levels, forced us to take this step.”

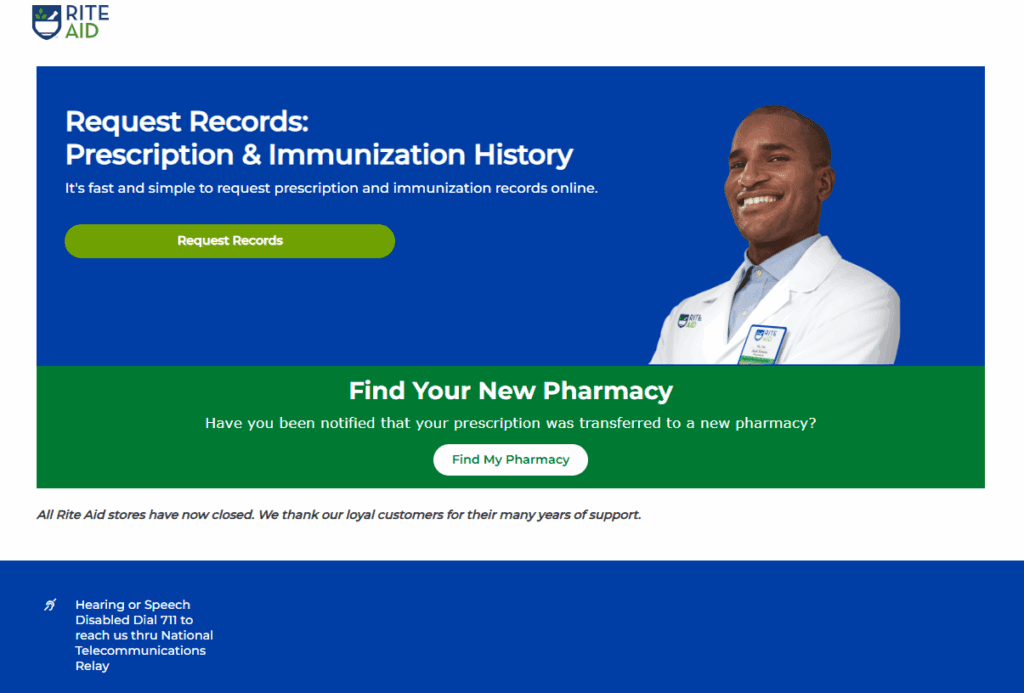

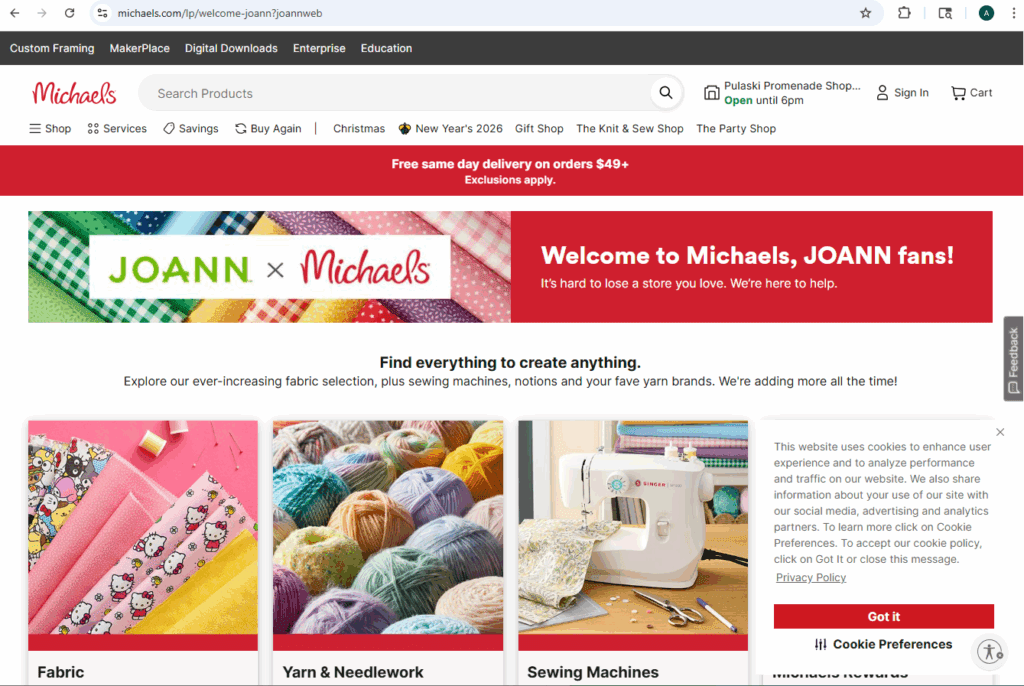

In June 2025, Michaels acquired Joann intellectual property and its private-label brands.

The Michaels website displays a welcome page for Joann, which was one of the seven of the leading online retailers in North America to file for bankruptcy in 2025. | Image credit: Michaels website, Dec. 24, 2025

5. Claire’s (No. 388)

Jewelry retailer Claire’s filed for Chapter 11 bankruptcy, it announced in early August.

The filing was less than four years after the retailer went public and marked its second bankruptcy in seven years. Claire’s cited macroeconomic conditions.

CEO Chris Cramer said at the time that the decision was difficult but necessary.

“Increased competition, consumer spending trends and the ongoing shift away from brick-and-mortar retail, in combination with our current debt obligations and macroeconomic factors, necessitate this course of action for Claire’s and its stakeholders,” Cramer said.

Prior to its bankruptcy filing, Claire’s ranked No. 390 in the Top 2000. Also, before the retailer’s bankruptcy filing, Digital Commerce 360 had projected that Claire’s online sales would reach $201.02 million in 2025.

6. iRobot (No. 459)

The maker of Roomba robotic vacuums, iRobot Corp., filed in December for Chapter 11 bankruptcy.

It agreed to sell the company to its primary contract manufacturer. Under the agreement, a company called Picea will acquire 100% of iRobot’s equity through a court-supervised process. Shenzhen PICEA Robotics Co. Ltd. and Santrum Hong Kong Co. Ltd. together comprise Picea.

To support ongoing operations, iRobot said it has filed customary motions allowing it to pay employees, vendors, and other creditors in the normal course of business. The company said supply chain relationships, logistics partners and global distribution will remain in place throughout the Chapter 11 process.

CEO Gary Cohen said the company intends for the transaction to provide financial stability while maintaining continuity for customers and partners.

“The transaction will strengthen our financial position and will help deliver continuity for our consumers, customers, and partners,” Cohen said in a statement.

7. Liberated Brands

Liberated Brands — which previously operated in-store and online retail for chains such as Billabong, Boardriders and Quiksilver — filed for bankruptcy in early February. As of Sept. 27, 2023, it has partnered with Authentic Brands Group to be the physical-store and ecommerce operator for a variety of brands.

By that point, Authentic Brands had already owned more Top 1000 retail brands than most conglomerates. Boardriders ranks No. 474 in the Top 2000.

After Liberated Brands filed for bankruptcy in February 2025, the court entered an order authorizing the debtors to discontinue operations and proceed with store closures for their brands.

“In December 2024, Liberated’s North American license rights for its wholesale operations under the Volcom, RVCA, and Billabong brands were terminated as a result of Liberated’s default under the associated licenses,” wrote Todd Hymel, CEO of Liberated Brands, in a signed court filing dated Feb. 3. “In connection with this termination, Liberated’s United States and Canadian wholesale and e-commerce license rights with respect to those brands were transitioned to new operators, with Liberated retaining a limited right to sell through prior-season branded inventory (subject to certain restrictions).”

That compounded “an already dire liquidity situation,” he wrote. Vendors began holding back in-transit inventory and pending inventory shipments that Liberated Brands intended to sell in spring 2025.

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the online retail industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, X (formerly Twitter), Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.