Coinspeaker

$1 Billion of Bitcoin Options Expire as BTC Price Holds Above $60,000

It’s been a tricky week for Bitcoin

BTC

$62 421

24h volatility:

2.6%

Market cap:

$1.23 T

Vol. 24h:

$24.58 B

and crypto traders internationally amid heightened volatility following the escalating Israel-Iran battle earlier this week. As of at present, October 4, a complete of 17,500 Bitcoin choices will expire with a put-call ratio of 0.75, with a notional worth of $1.07 billion and a max ache level of $63,000.

With the US elections simply six weeks from now, Bitcoin is more likely to see some volatility within the carefully contested battle between Kamala Harris and Donald Trump. Widespread platform Greeks.stay reported that each one main maturity implied volatilities (IVs) are at common ranges in comparison with final yr. Additionally, these IVs will stay supported by way of the upcoming US elections. The subsequent two weeks will present a positive window for positioning forward of the fourth quarter.

Widespread crypto analyst Ali Martinez reported that there’s been a notable improve in Bitcoin’s Taker Purchase/Promote Ratio on the OKX alternate. In line with Martinez, this spike indicators a surge in aggressive shopping for, which may point out potential upward momentum for Bitcoin within the close to future.

There was a spike within the #Bitcoin Taker Purchase/Promote Ratio on @okx! This means a surge in aggressive shopping for — an indication of upward momentum forward! pic.twitter.com/QgZ9qkhSls

— Ali (@ali_charts) October 4, 2024

With greater than a 6% dip on the weekly chart, Bitcoin traders wait on the sidelines for clear indicators to emerge for the following value motion. Quinn Thompson, the chief funding officer at Lekker Capital, stated that traders ought to take advantage of the chance by shopping for the BTC dips.

He added that the present value of round $61,000 is a no brainer whereas including that the “macro backdrop” of the BTC value motion has modified considerably compared to the previous drops.

BTC Value Surge Forward as Demand Stays Sturdy

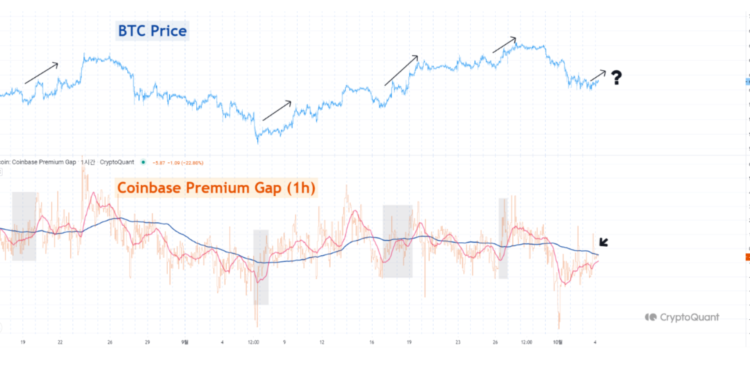

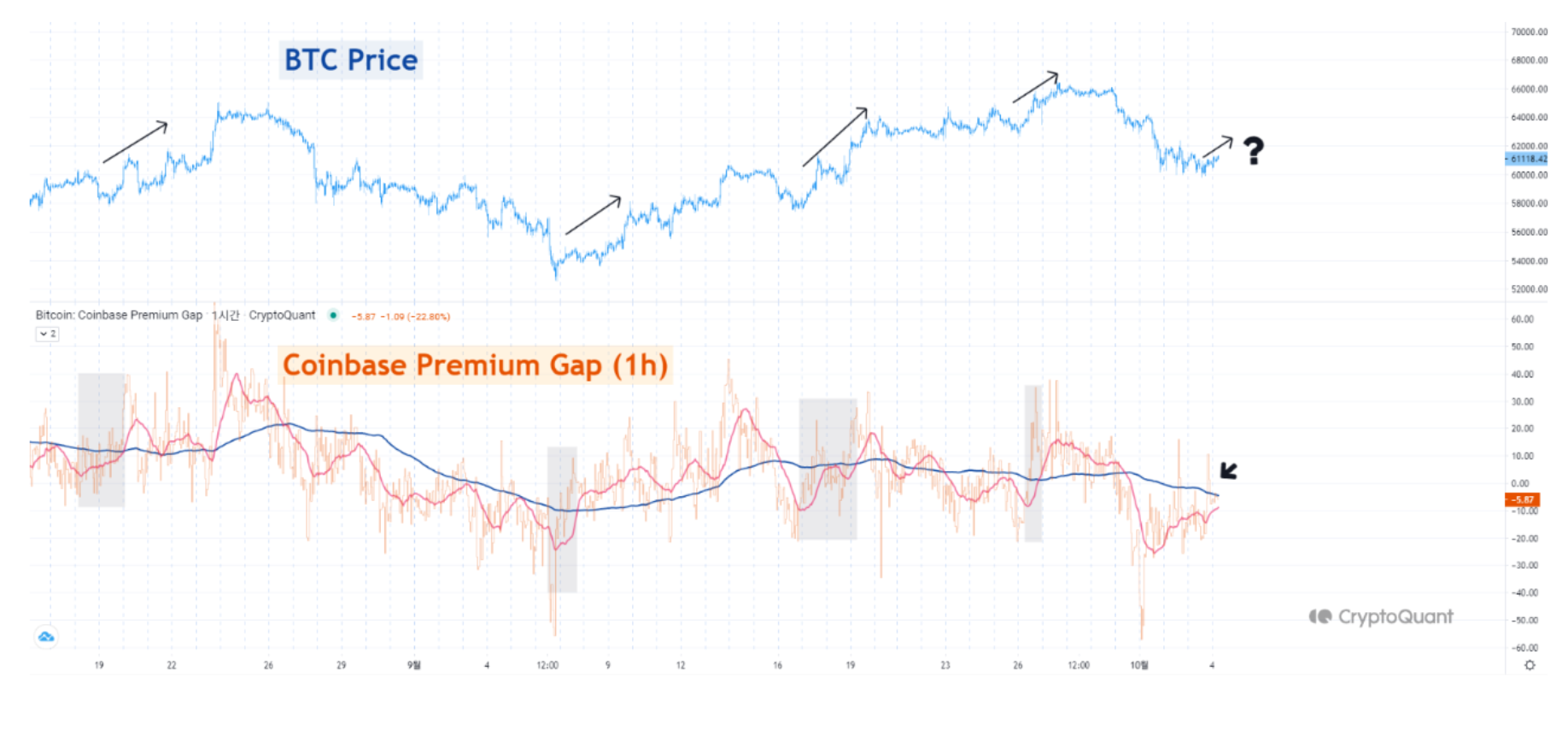

On-chain blockchain analytics platform Cryptoquant just lately reported that there’s sufficient chance of a short-term BTC value improve ending the latest downward promoting strain.

Behind the scenes, demand stays sturdy, as highlighted by the widely-watched Coinbase premium metric. This metric tracks the value distinction between the BTC/USD pair on Coinbase, the most important U.S. alternate, and the BTC/USDT equal on Binance.

In line with CryptoQuant contributor Yonsei_dent, shifting averages of the premium’s dimension are carefully linked to particular Bitcoin value developments. He defined:

“We analyzed the Coinbase Premium Index on a 1-hour timeframe to watch short-term momentum, using the 24-hour (every day) and 168-hour (weekly) shifting averages for added context. Traditionally, when the every day shifting common kinds a golden cross by crossing above the weekly shifting common with sturdy momentum, we noticed important value actions shortly after that.”

-

Courtesy: CryptoQuant

Such a golden cross situation occurred even over the past month thereby pushing up the BTC value to $66,000.

$1 Billion of Bitcoin Options Expire as BTC Price Holds Above $60,000