Coinspeaker

Bitcoin Options Traders Bet on $115K, Leverage Risk Looms

Regardless of the anticipated value volatility of round $100K, Bitcoin

BTC

$101 855

24h volatility:

3.4%

Market cap:

$2.02 T

Vol. 24h:

$152.71 B

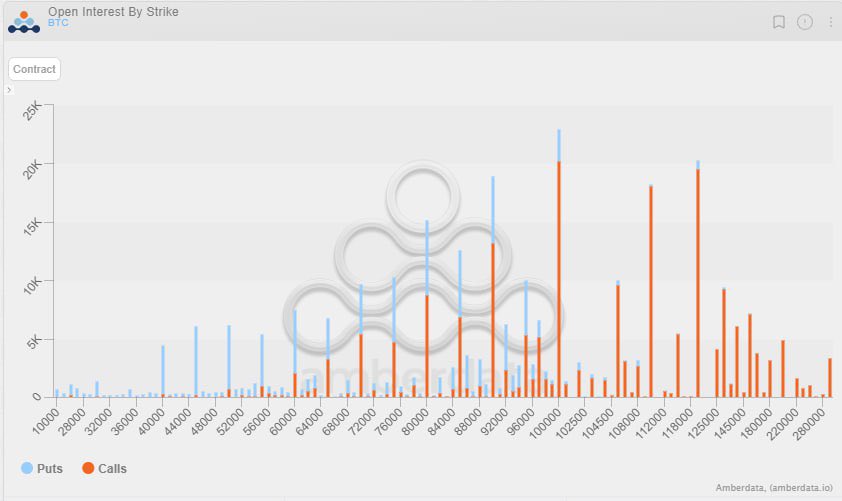

choices merchants have elevated bets on $110K and $115K value targets by January 2025. Based on the most recent insights from the choices change Deribit, most merchants purchased extra name choices (bullish bets) for a $115K value goal by thirty first January 2025.

At press time, the most important choices expiries by Open Curiosity (OI) had been in December 2024 and March 2025. Galaxy Digital’s Kelly Greer noted that about $4B in OI was being betted on the BTC value, hitting $100K and $110K (strike costs) by the top of 2024 or Q1 2025.

Nonetheless, with BTC lately tapping $100K, some aggressive bets had been additionally positioned on the $120K goal.

Leverage Threat Stays

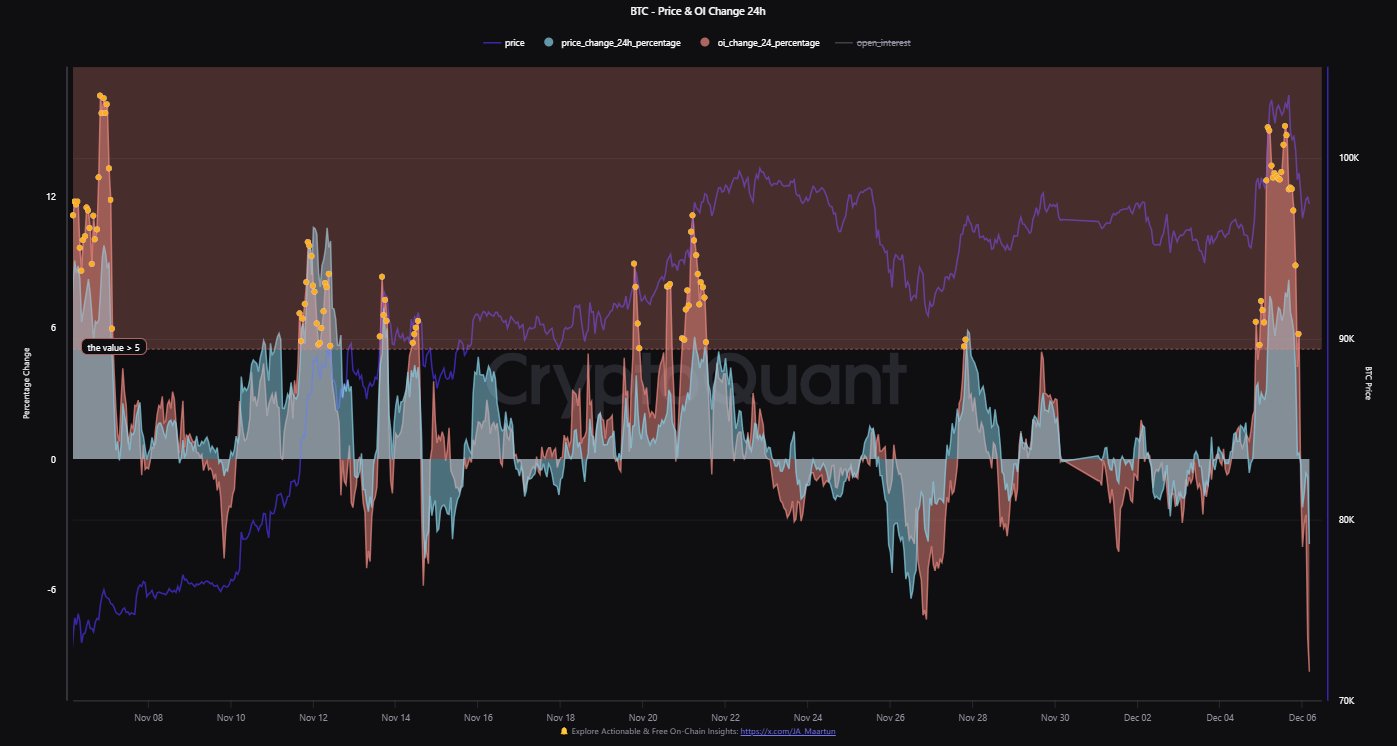

Regardless of the bullish outlook from the choices market, BTC might face wild value swings on what analysts have blamed on high-leveraged (borrowed cash) gamers and greed. Based on CryptoQuant’s JA Martunn, the latest flash crash from $104K to $90.5K was pushed by leverage.

“Leverage-driven pumps indicated vital danger, as the value surge was fueled by leverage. Open curiosity rose by greater than 15%,” wrote Martunn.

Traditionally, leverage-driven rallies have led BTC to face sharp pullbacks and native tops. Moreover, they set off wild volatility as leveraged positions are liquidated, exacerbating value swings. The latest BTC flash crash uncovered the broader market to $1B of liquidations.

Sharing his ideas on the identical, Jake Ostrovsksis, choices and OTC (Over the Counter) dealer at market maker Wintermute, cautioned that the BTC market was prone to 2-way volatility.

“Movement stays undeniably sturdy with topside persevering with to dam, nonetheless, funding charges point out the numerous use of leverage… this leaves us prone to 2-way volatility,” Ostrovsksis informed Bloomberg.

That meant that regardless of the bullish sentiment in Choices, the market might nonetheless witness a +$10K value swing on both aspect, similar to on December 5.

That being mentioned, BTC value was again in its short-term ascending channel chalked since mid-November. Nonetheless, it was muted under a key roadblock at $98K. A surge above it might push it to the mid-range and the short-term upside goal of $105K.

Nonetheless, a breach under the channel might nonetheless push the cryptocurrency to the latest lows at $90.5K or $85K.