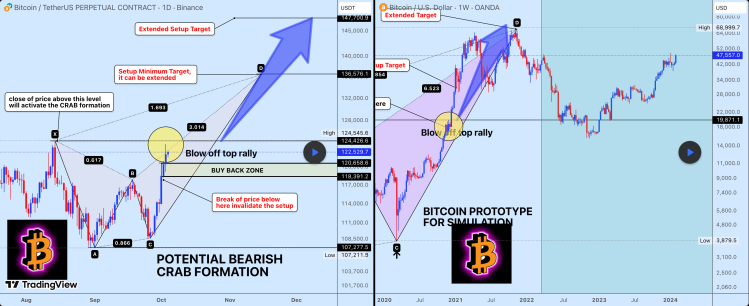

While the Bitcoin price seems to have deviated completely from the four-year cycle that dictated the previous bull and bear markets, there are still some similarities that remain that suggest that it could still play out in a similar way. The major similarity that has emerged is the formation of a bearish crab pattern back in 2021, and now, the same pattern has reappeared. Thus, taking a look at the direction of the 2021 formation could give an insight into where the Bitcoin price is headed next from here.

The Pattern That Triggered The Bitcoin Price Explosion

In an analysis, crypto analyst Weslad was the one who pointed out that the Bearish Crab Pattern had returned, and this was formed on the daily chart as well. Interestingly, the current formation looks eerily similar to the way it formed back in 2021, suggesting that the resulting trend could play out the same.

Related Reading

Back in 2021, when the Bearish Crab Pattern came up, the result was a price explosion that sent the Bitcoin price toward its $69,000 all-time high. This “Blow-off top” rally is usually the last rally in a bull market, and its end often signals the start of the next bear market.

With this pattern, though, there are a number of targets to watch out for that could show where the price is headed next. The first of these is that the Bitcoin price would need to complete a daily close above the $124,545 level, and this is known as the Activation Trigger.

Next in line is what Weslad refers to as the “Buy The Dip Zone”. This would be the ideal price range to enter Bitcoin in the case of a retrace, and this lies between $118,000 and $120,000. A dip toward these levels is nothing to worry about, as it means that the bulls are still in control.

Related Reading

Both of the zones outlined above, if held, would see the Bitcoin price continue its bullish rally. If the final, explosive leg does play out as it did back in 2017-2021, then the Crab pattern suggests that the Bitcoin price will at least go to $136,000, with an extended target of $147,000, and the possibility that it goes further toward $160,000.

However, the final target is the bearish one that could send the Bitcoin price crashing back downward, and it lies at $107,000. According to the crypto analyst, a break below this level would invalidate the entire bullish thesis, calling it the “line in the sand.” Weslad explains that “The invalidation level at $107K is crucial. A break below there means the setup is broken, and we must re-assess.”

Featured image from Dall.E, chart from TradingView.com