In his newest essay titled “Black or White?”Arthur Hayes, co-founder and former CEO of crypto alternate BitMEX, lays out an evaluation predicting that Bitcoin might soar to $1 million. Hayes argues that forthcoming US financial insurance policies underneath the second time period of Donald Trump might set the stage for unprecedented Bitcoin progress.

Hayes attracts parallels between the financial methods of america and China, coining the time period “American Capitalism with Chinese language Traits.” He means that, just like China’s method underneath Deng Xiaoping and continued by Xi Jinping, the US is transferring towards a system the place the federal government’s main objective is to retain energy, no matter whether or not insurance policies are capitalist, socialist, or fascist.

Why The Fiat System Is Damaged

“Much like Deng, the elite that rule Pax Americana care not whether or not the financial system is Capitalist, Socialist, or Fascist, however whether or not applied insurance policies assist them retain their energy,” Hayes writes. He emphasizes that America ceased being purely capitalist within the early twentieth century, noting, “Capitalism implies that the wealthy lose cash after they make unhealthy selections. That was outlawed as early as 1913 when the US Federal Reserve was created.”

Hayes critiques the historic shift from “trickle-down economics” to direct stimulus measures, significantly these applied throughout the COVID-19 pandemic. He distinguishes between “QE for the wealthy” and “QE for the poor,” highlighting how direct stimulus to the overall inhabitants spurred financial progress, whereas quantitative easing primarily benefited rich asset holders.

Associated Studying

“From 2Q2020 till 1Q2023, Presidents Trump and Biden bucked the pattern. Their Treasury departments issued debt that the Fed bought utilizing printed {dollars} (QE), however as an alternative of handing it out to wealthy [individuals], the Treasury mailed checks out to everybody,” he explains. This led to a lower within the US debt-to-nominal GDP ratio, because the elevated spending energy of the typical citizen stimulated actual financial exercise.

Trying forward, Hayes anticipates that Trump’s return to energy will usher in insurance policies centered on re-shoring essential industries to the US, financed by expansive authorities spending and financial institution credit score progress. He references Scott Bassett, whom he believes can be Trump’s decide for Treasury Secretary, noting that Bassett’s speeches define plans to “run nominal GDP sizzling by offering authorities tax credit and subsidies to re-shore essential industries.”

“The plan is to run nominal GDP sizzling by offering authorities tax credit and subsidies to re-shore essential industries (shipbuilding, semiconductor fabs, auto manufacturing, and so forth.). Firms that qualify will then obtain low cost financial institution financing,” Hayes states.

He warns that such insurance policies would result in important inflation and forex debasement, adversely affecting holders of long-term bonds or financial savings deposits. To hedge in opposition to this, Hayes advocates for investing in property like Bitcoin and gold. “As an alternative of saving in fiat bonds or financial institution deposits, buy gold (the boomer monetary repression hedge) or Bitcoin (the millennial monetary repression hedge),” he advises.

Associated Studying

Hayes helps his argument by analyzing the mechanics of financial coverage and financial institution credit score creation. He illustrates how “QE for the poor” can stimulate financial progress by way of elevated client spending, versus “QE for the wealthy,” which inflates asset costs with out contributing to actual financial exercise.

“QE for poor individuals stimulates financial progress. The Treasury handing out stimmies inspired the plebes to purchase vehicles. As a result of demand for items, Ford was capable of pay its staff and apply for a mortgage to extend manufacturing,” he elaborates.

Moreover, Hayes discusses potential regulatory adjustments, resembling exempting banks from the Supplemental Leverage Ratio (SLR), which might allow them to buy an infinite quantity of presidency debt with out extra capital necessities. He argues that this is able to pave the way in which for “infinite QE” directed at productive sectors of the financial system.

“If Treasuries, central financial institution reserves, and/or authorised company debt securities had been exempted from the SLR, a financial institution might buy an infinite amount of debt with out having to encumber themselves with any costly fairness,” he explains. “The Fed has the facility to grant an exemption. They did simply that from April 2020 to March 2021.”

How Bitcoin May Attain $1 Million

Hayes believes that the mixture of aggressive fiscal insurance policies and regulatory adjustments will end in an explosion of financial institution credit score, resulting in larger inflation and a weakening US greenback:

The mix of legislated industrial coverage and the SLR exemption will end in a gusher of financial institution credit score. I’ve already proven how the financial velocity of such insurance policies is way larger than that of conventional QE for wealthy individuals overseen by the Fed. Subsequently, we will count on that Bitcoin and crypto will carry out as nicely, if not higher, than they did from March 2020 till November 2021.

In such an atmosphere, he asserts that Bitcoin stands to learn essentially the most because of its shortage and decentralized nature. “That is how Bitcoin goes to $1 million, as a result of costs are set on the margin. Because the freely traded provide of Bitcoin dwindles, essentially the most fiat cash in historical past can be chasing a secure haven,” he predicts. Hayes backs this declare by referencing his customized index that tracks US financial institution credit score provide, demonstrating that Bitcoin has outperformed different property when adjusted for financial institution credit score progress.

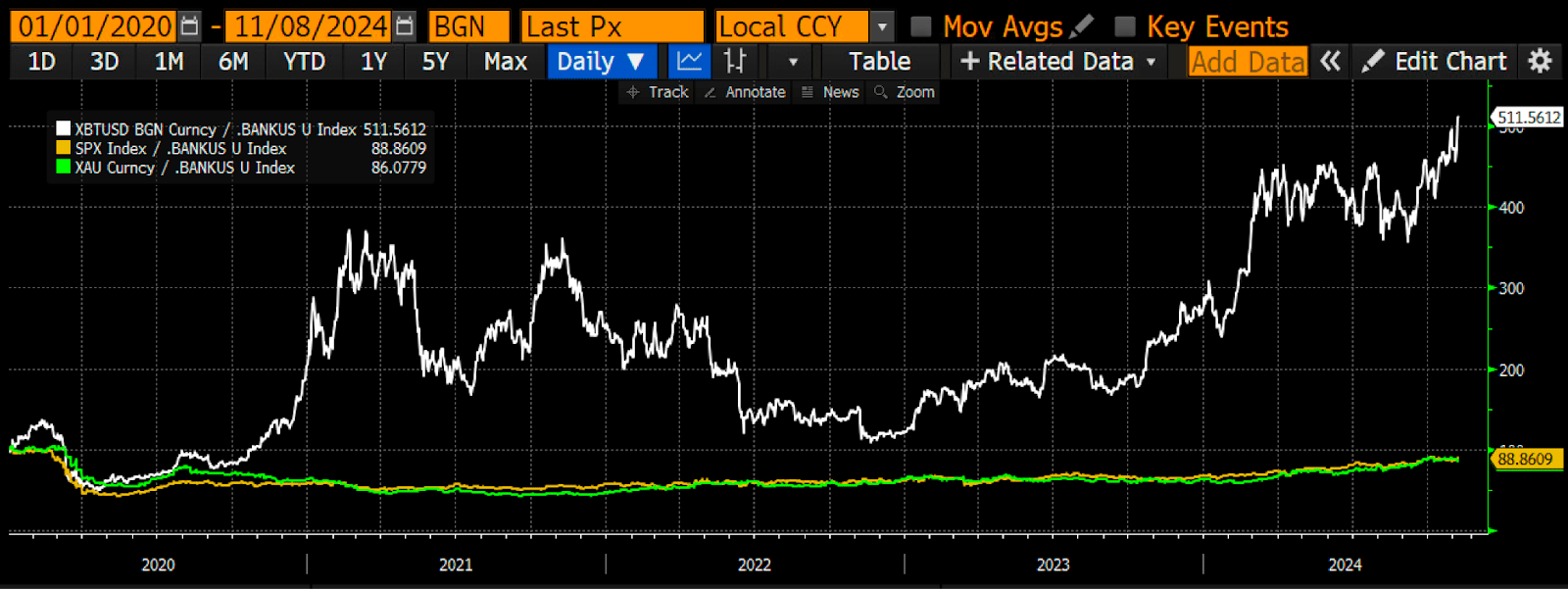

“What’s [..] essential is how an asset performs when deflated by the provision of financial institution credit score. Bitcoin (white), the S&P 500 Index (gold), and gold (inexperienced) have all been divided by my financial institution credit score index. The values are listed to 100, and as you may see, Bitcoin is the standout performer, rising over 400% since 2020. Should you can solely do one factor to counter the fiat debasement, it’s Bitcoin. You possibly can’t argue with the maths,” he asserts.

In concluding his essay, Hayes urges buyers to place themselves accordingly in anticipation of those macroeconomic shifts. “Get lengthy, and keep lengthy. Should you doubt my evaluation of the influence of QE for poor individuals, simply learn up on the Chinese language financial historical past of the previous thirty years, and you’ll perceive why I name the brand new financial system of Pax Americana, “American Capitalism with Chinese language Traits,” he advises.

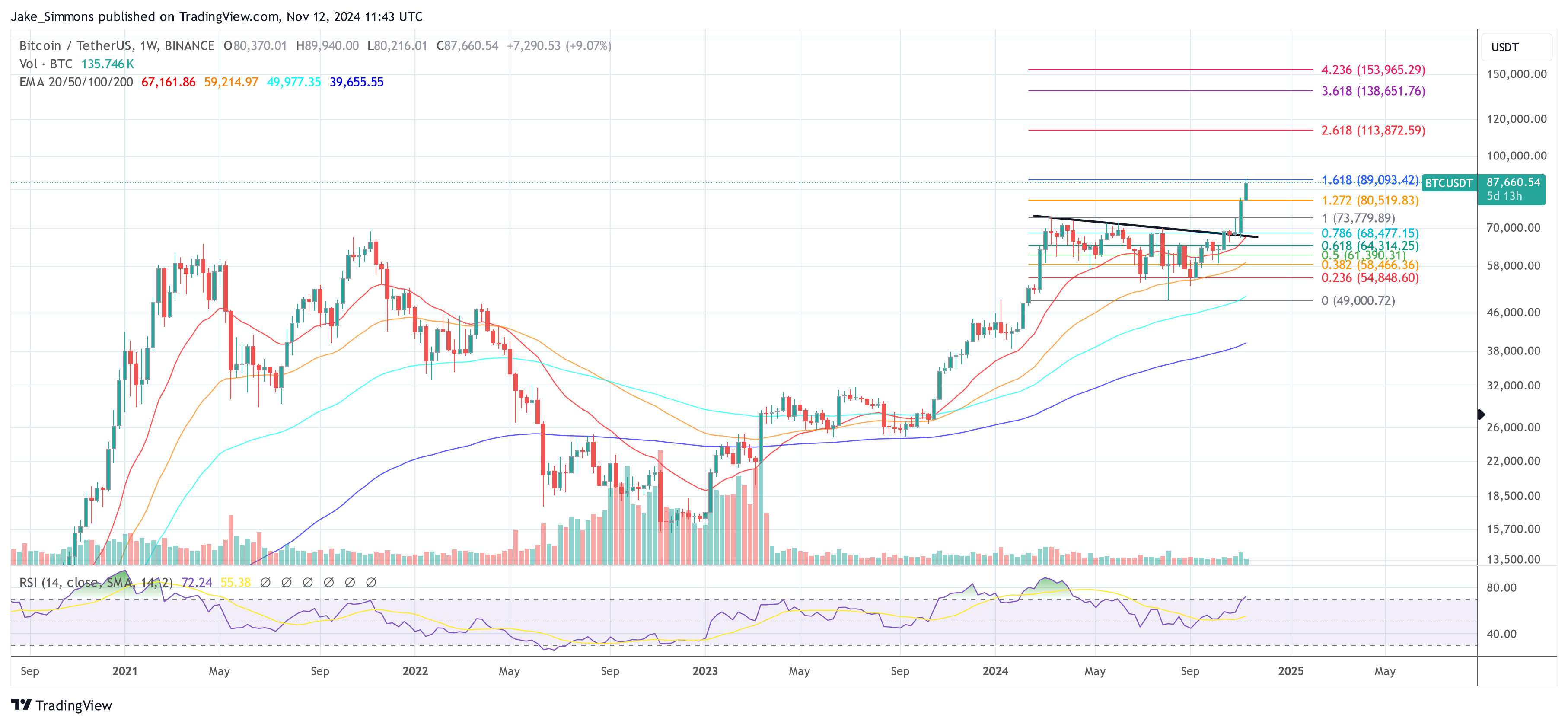

At press time, BTC traded at $87,660.

Featured picture from YouTube, chart from TradingView.com