The Hash Rate Momentum Score shows miners are still confident.

Bitcoin (BTC) briefly dropped near $102,000 before a quick recovery to $105,500 on Wednesday amid ongoing macroeconomic uncertainty. Turbulence aside, network fundamentals remain solid.

In fact, new analysis indicates that BTC’s miner activity continues to strengthen, with the crucial hash rate momentum metric trending upward.

No Signs of Miner Weakness, Yet

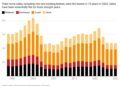

Alphractal founder Joao Wedson said the “Hash Rate Momentum Score,” a metric tracking Bitcoin miner activity, indicates continued network strength. The score combines the 7-day hash rate change, weighted at 30%, and the 30-day change, weighted at 70%, to assess whether network security is improving or weakening. It also includes a 90-day moving average to capture long-term trends.

Wedson explained that a downward slope in the moving average typically points to the onset of miner capitulation, while a move into negative territory suggests the phase has ended. He added that the indicator currently remains in positive territory, while the moving average trends upward, indicating stable network conditions and steady miner confidence.

The analyst added,

“But it’s definitely a metric to keep on your radar… because when this curve turns, it often foreshadows major shifts in the ecosystem”

BTC Price Action Under Watch

At the same time, institutional investment activity also showed signs of recovery. Bitcoin exchange-traded funds (ETFs) are seeing renewed investor interest after October’s devastating market crash. Data compiled by SoSoValue revealed that US spot Bitcoin ETFs recorded $524 million in cumulative net inflows on Tuesday, the highest daily total since October 7. The surge indicates improving sentiment and a return of risk appetite among investors.

BlackRock’s iShares Bitcoin Trust (IBIT) led the day with $224.2 million in inflows, followed by Fidelity’s FBTC with $165.8 million. Ark Invest and 21Shares’ joint ETF, ARKB, attracted more than $102 million, while Grayscale’s BTC and Bitwise’s BITB saw inflows of $24.1 million and $7.27 million, respectively.

You may also like:

With institutional demand returning, Glassnode reported that Bitcoin is currently positioned between the 0.85 and 0.75 cost-basis quantiles at $108,500 and $100,600. These levels have served as key support and resistance zones in previous instances. As such, a breakout in either direction is likely to determine BTC’s next trend.

Analysts are now also monitoring the 365-day moving average, a support level that has supported the price in past rallies. A break below could trigger a downtrend like mid-2022, when the crypto asset fell roughly 66%. As CryptoPotato had recently noted, the current cycle patterns point to a possible multi-year correction and a potential bottom near $38,000-$50,000 around October 2026.

Short- and long-term averages are close to forming a Death Cross, though similar signals previously resulted in recoveries. Strong resistance remains above the current price level.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).