Keep knowledgeable with free updates

Merely signal as much as the Media myFT Digest — delivered on to your inbox.

Springer Nature, one of many world’s largest educational publishers, has introduced plans for a long-delayed preliminary public providing, in a serious take a look at of urge for food for fundraising on Europe’s public markets.

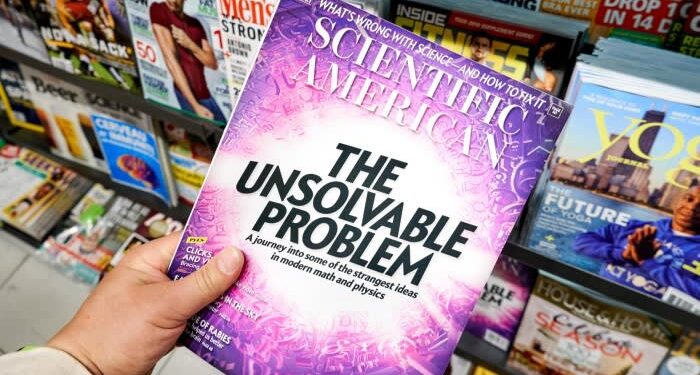

The Berlin-based firm, which is partly owned by non-public fairness group BC Companions and publishes journals together with Nature and Scientific American, mentioned on Thursday that it deliberate to boost €200mn in an inventory in Frankfurt earlier than the tip of the 12 months.

A flotation can be among the many largest in Europe this 12 months and will worth the writer at roughly €7bn, together with debt, in line with folks accustomed to the matter.

BC Companions first purchased into the writer in 2013 and now owns a 47 per cent stake. The itemizing would permit the group to promote shares.

Holtzbrinck Publishing Group, a privately owned firm that owns the remaining 53 per cent, doesn’t intend to promote shares.

Springer Nature final 12 months posted revenues of €1.9bn, up 5.2 per cent, and adjusted working revenue of €511mn, a rise of seven per cent.

The IPO, which might be accomplished within the second half of 2024, has been lengthy delayed; an preliminary try was halted in 2020 through the Covid-19 pandemic.

It will be Europe’s first large market debut for the second half of the 12 months. The continent noticed a number of IPOs undergo efficiently earlier in 2024, together with Swiss skincare company Galderma.

Earlier than this 12 months, Europe had been enduring a slowdown in IPOs as rising rates of interest and uneven markets deterred corporations from in search of listings given unsure investor urge for food.

Nevertheless, a stabilising financial outlook, decrease charges and a want by non-public fairness teams to money out from a few of their investments has led to extra offers this 12 months.

Whereas giant choices resembling Galderma and private equity group CVC have gained in buying and selling since their IPOs, others have fared much less properly.

The March itemizing of German perfume retailer Douglas flopped, whereas Spanish magnificence group Puig has also fallen since its Might debut.

Springer Nature, which competes with UK-listed rival Relx, estimated that the dimensions of the worldwide analysis publishing market in 2023 was €10.2bn. The group sees the usage of synthetic intelligence and different expertise as an enormous driver of future progress in its commerce publications and information.

Frank Vrancken Peeters, its chief government, mentioned: “Springer Nature is properly positioned to proceed to ship in a resilient and rising analysis market by using expertise to generate actual advantages for the tutorial neighborhood.”